Question: I need help with question 4, specifically preparing journal entry needed to adjust the investment to fair value I Tanner-UNF Corporation acquired as a long-term

I need help with question 4, specifically preparing journal entry needed to adjust the investment to fair value

I

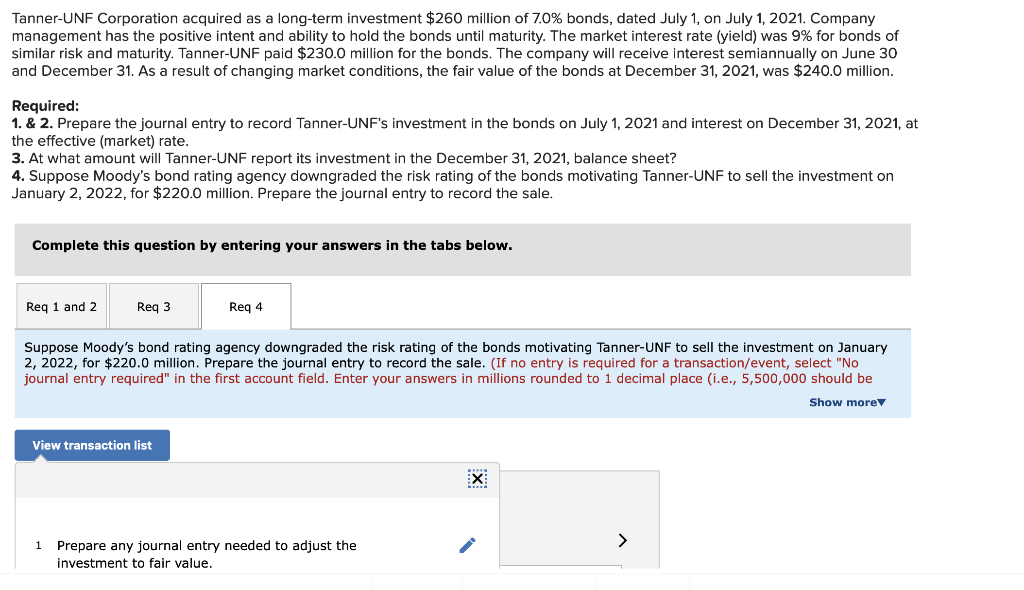

Tanner-UNF Corporation acquired as a long-term investment $260 million of 7.0% bonds, dated July 1, on July 1, 2021. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 9% for bonds of similar risk and maturity. Tanner-UNF paid $230.0 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $240.0 million. Required: 1. & 2. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2021 and interest on December 31, 2021, at the effective (market) rate. 3. At what amount will Tanner-UNF report its investment in the December 31, 2021, balance sheet? 4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2022, for $220.0 million. Prepare the journal entry to record the sale. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req3 Reg 4 Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2022, for $220.0 million. Prepare the journal entry to record the sale. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be Show more View transaction list X > 1 Prepare any journal entry needed to adjust the investment to fair value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts