Question: i need help with question 5 and 6 Coupon rate Coupon frequency 6% semiannual 10% Semiannual a) Calculate the current values of the bonds. b)

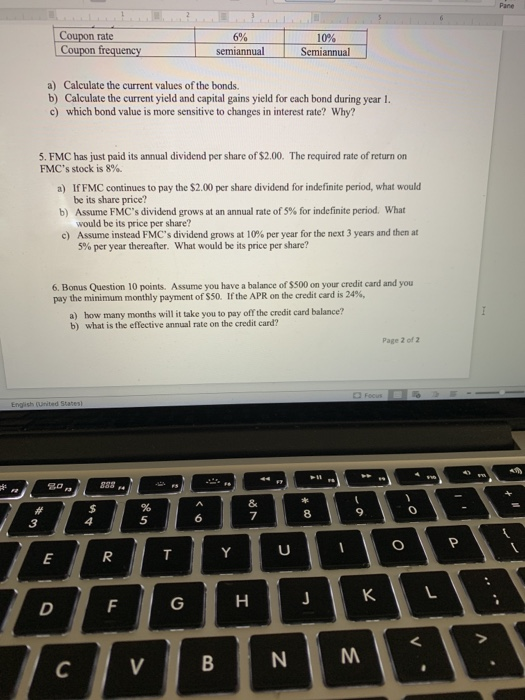

Coupon rate Coupon frequency 6% semiannual 10% Semiannual a) Calculate the current values of the bonds. b) Calculate the current yield and capital gains yield for each bond during year 1. c) which bond value is more sensitive to changes in interest rate? Why? 5. FMC has just paid its annual dividend per share of $2.00. The required rate of return on FMC's stock is 8%. a) If FMC continues to pay the $2.00 per share dividend for indefinite period, what would be its share price? b) Assume FMC's dividend grows at an annual rate of 5% for indefinite period. What would be its price per share? c) Assume instead FMC's dividend grows at 10% per year for the next 3 years and then at 5% per year thereafter. What would be its price per share? 6. Bonus Question 10 points. Assume you have a balance of $500 on your credit card and you pay the minimum monthly payment of $50. If the APR on the credit card is 24% a) how many months will it take you to pay of the credit card balance? b) what is the effective annual rate on the credit card? Page 2 of 2 Focus E English (United States R ullole

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts