Question: I need help with question 9 please. 9. Rio National Corp. is a U.S.-based condpany and the largest competitor in its industry. Tables 18F through

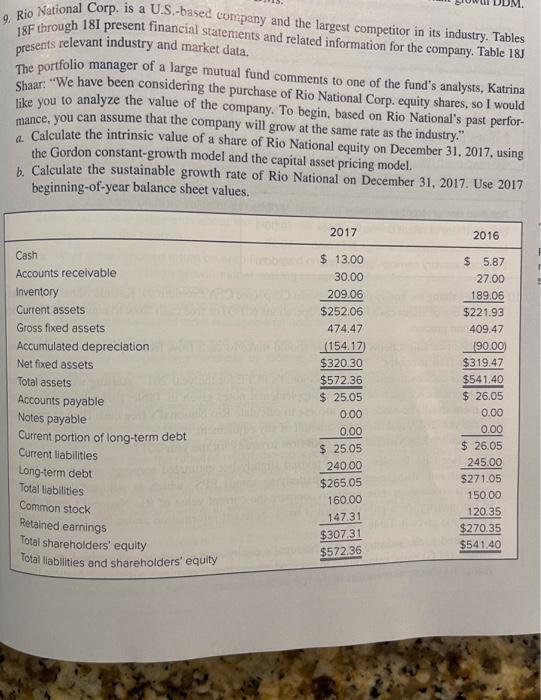

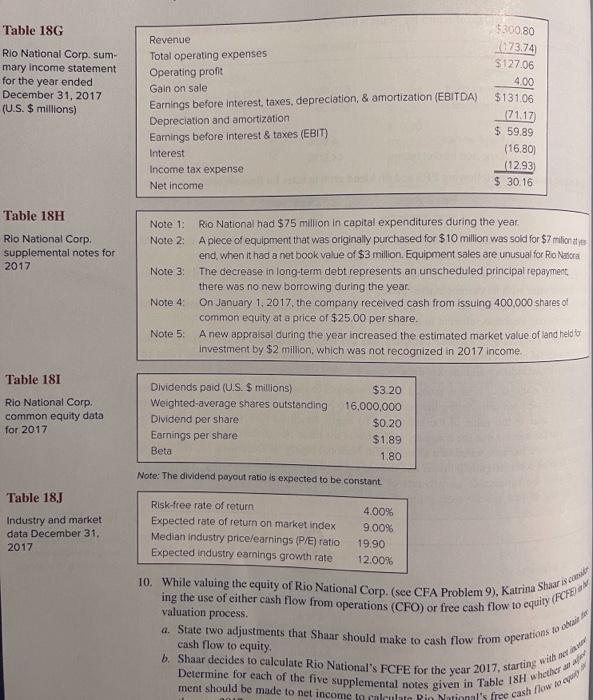

9. Rio National Corp. is a U.S.-based condpany and the largest competitor in its industry. Tables 18F through 181 present financial statements and related information for the company. Table 18J presents relevant industry and market data. The portfolio manager of a large mutual fund comments to one of the fund's analysts, Katrina Shaar: "We have been considering the purchase of Rio National Corp. equity shares, so I would like you to analyze the value of the company. To begin, based on Rio National's past perfor- mance, you can assume that the company will grow at the same rate as the industry." a. Calculate the intrinsic value of a share of Rio National equity on December 31, 2017, using the Gordon constant-growth model and the capital asset pricing model. b. Calculate the sustainable growth rate of Rio National on December 31, 2017. Use 2017 beginning-of-year balance sheet values. 2017 2016 Cash Accounts receivable Inventory Current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Accounts payable Notes payable Current portion of long-term debt Current liabilities Long-term debt Total liabilities Common stock Retained earnings Total shareholders' equity Total abilities and shareholders' equity $ 13.00 30.00 209.06 $252.06 474.47 (154.17 $320.30 $572.36 $ 25.05 0.00 0.00 $ 25.05 240.00 $265.05 160.00 147.31 $307.31 $572.36 $ 5.87 27.00 189.06 $221.93 409,47 (90.00 $319.47 $541.40 $ 26.05 0.00 0.00 $ 26.05 245.00 $271.05 150.00 120.35 $270.35 $541.40 Table 18G Rio National Corp. sum- mary income statement for the year ended December 31, 2017 (U.S. $ millions) Revenue Total operating expenses Operating profit Gain on sale Earnings before interest, taxes, depreciation, & amortization (EBITDA) Depreciation and amortization Earnings before interest & taxes (EBIT) Interest Income tax expense Net income $300.80 173.74 $127.06 4.00 $131.06 (71.17 $ 59.89 (16.80) (12.93 $ 30.16 Table 18H Note 1: Note 2: Rio National Corp. Supplemental notes for 2017 Note 3 Rio National had $75 million in capital expenditures during the year A plece of equipment that was originally purchased for $10 million was sold for $7 milionaty end when it had a net book value of $3 million. Equipment sales are unusual for Ro Nacra The decrease in long-term debt represents an unscheduled principal repayment there was no new borrowing during the year. On January 1, 2017, the company received cash from issuing 400,000 shares of common equity at a price of $25.00 per share. A new appraisal during the year increased the estimated market value of land held to investment by $2 million, which was not recognized in 2017 income. Note 4 Note 5 Table 181 Rio National Corp. common equity data for 2017 Dividends paid (US. $ millions) Weighted average shares outstanding Dividend per share Earnings per share Beta $3.20 16,000,000 $0.20 $1.89 1.80 Note: The dividend payout ratio is expected to be constant Table 18J Industry and market data December 31, 2017 Risk-free rate of return 4.00% Expected rate of return on market index 9.00% Median industry pricelearnings (P/E) ratio 19.90 Expected industry earnings growth rate 12.00% 10. While valuing the equity of Rio National Corp. (See CFA Problem 9), Katrina Shuur is om ing the use of either cash flow from operations (CFO) or free cash flow to equity (FCE valuation process. 4. State two adjustments that Shaar should make to cash flow from operations cash flow to equity. b. Shaar decides to calculate Rio National's FCFE for the year 2017, starting with Determine for each of the five supplemental notes given in Table 18H whether ment should be made to net income to calculato Pin National's free cash flow to lo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts