Question: I need help with question (g) to question (i) please! I need help with question (g) to question (i) please! Question 4 (35 marks) An

I need help with question (g) to question (i) please!

I need help with question (g) to question (i) please!

I need help with question (g) to question (i) please!

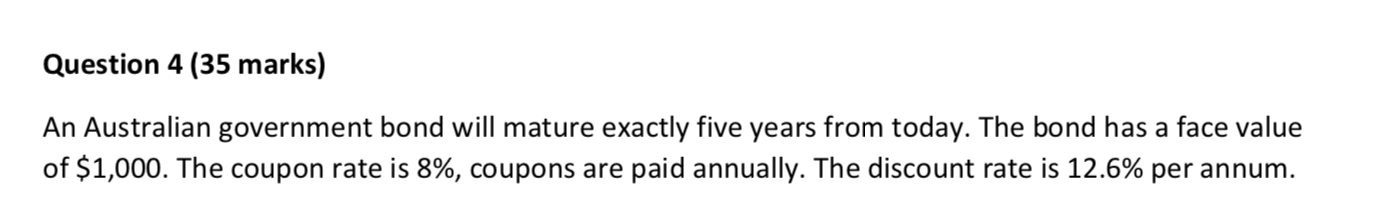

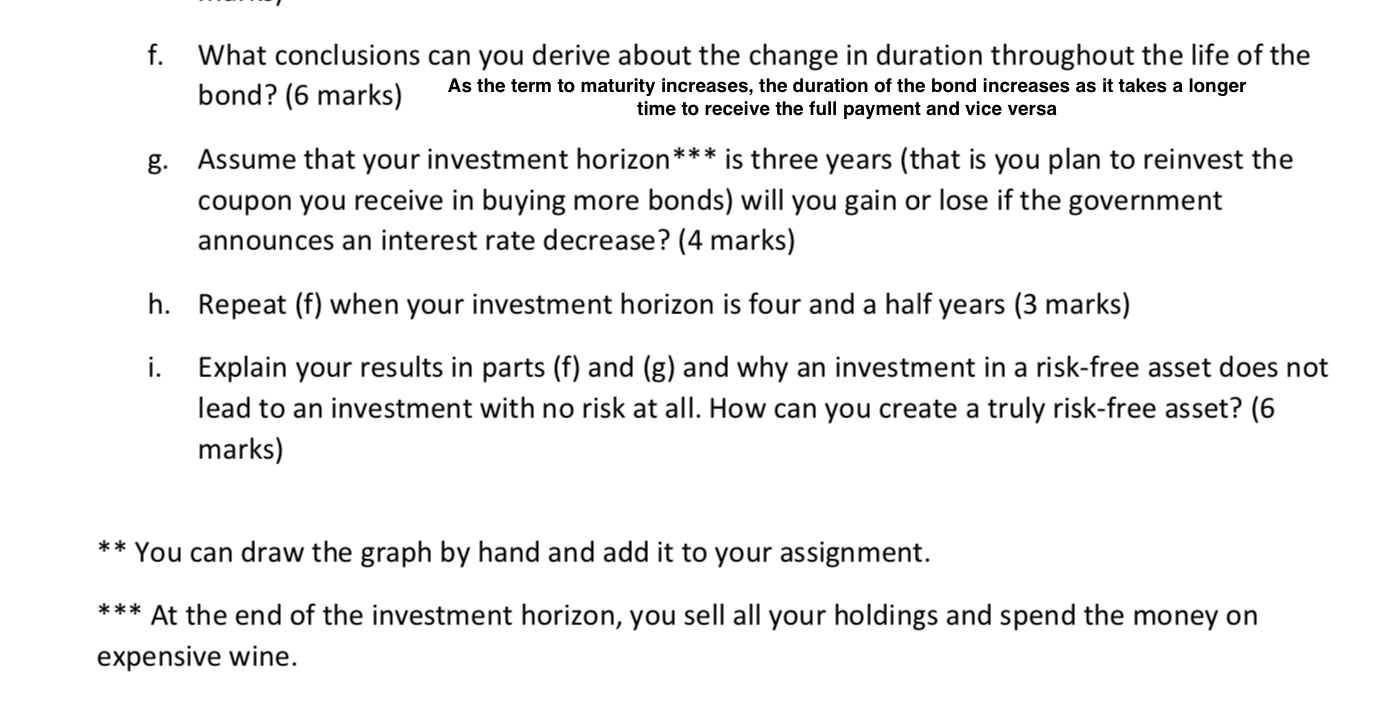

Question 4 (35 marks) An Australian government bond will mature exactly five years from today. The bond has a face value of $1,000. The coupon rate is 8%, coupons are paid annually. The discount rate is 12.6% per annum. f. What conclusions can you derive about the change in duration throughout the life of the bond? (6 marks) As the term to maturity increases, the duration of the bond increases as it takes a longer time to receive the full payment and vice versa *** Assume that your investment horizon* is three years (that is you plan to reinvest the coupon you receive in buying more bonds) will you gain or lose if the government announces an interest rate decrease? (4 marks) h. Repeat (f) when your investment horizon is four and a half years (3 marks) i. Explain your results in parts (f) and (g) and why an investment in a risk-free asset does not lead to an investment with no risk at all. How can you create a truly risk-free asset? (6 marks) ** You can draw the graph by hand and add it to your assignment. *** At the end of the investment horizon, you sell all your holdings and spend the money on expensive wine. Question 4 (35 marks) An Australian government bond will mature exactly five years from today. The bond has a face value of $1,000. The coupon rate is 8%, coupons are paid annually. The discount rate is 12.6% per annum. f. What conclusions can you derive about the change in duration throughout the life of the bond? (6 marks) As the term to maturity increases, the duration of the bond increases as it takes a longer time to receive the full payment and vice versa *** Assume that your investment horizon* is three years (that is you plan to reinvest the coupon you receive in buying more bonds) will you gain or lose if the government announces an interest rate decrease? (4 marks) h. Repeat (f) when your investment horizon is four and a half years (3 marks) i. Explain your results in parts (f) and (g) and why an investment in a risk-free asset does not lead to an investment with no risk at all. How can you create a truly risk-free asset? (6 marks) ** You can draw the graph by hand and add it to your assignment. *** At the end of the investment horizon, you sell all your holdings and spend the money on expensive wine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts