Question: I need help with Question H and I please! Assume that there is an economy populated by a continuum (0, 1) of households living in

I need help with Question H and I please!

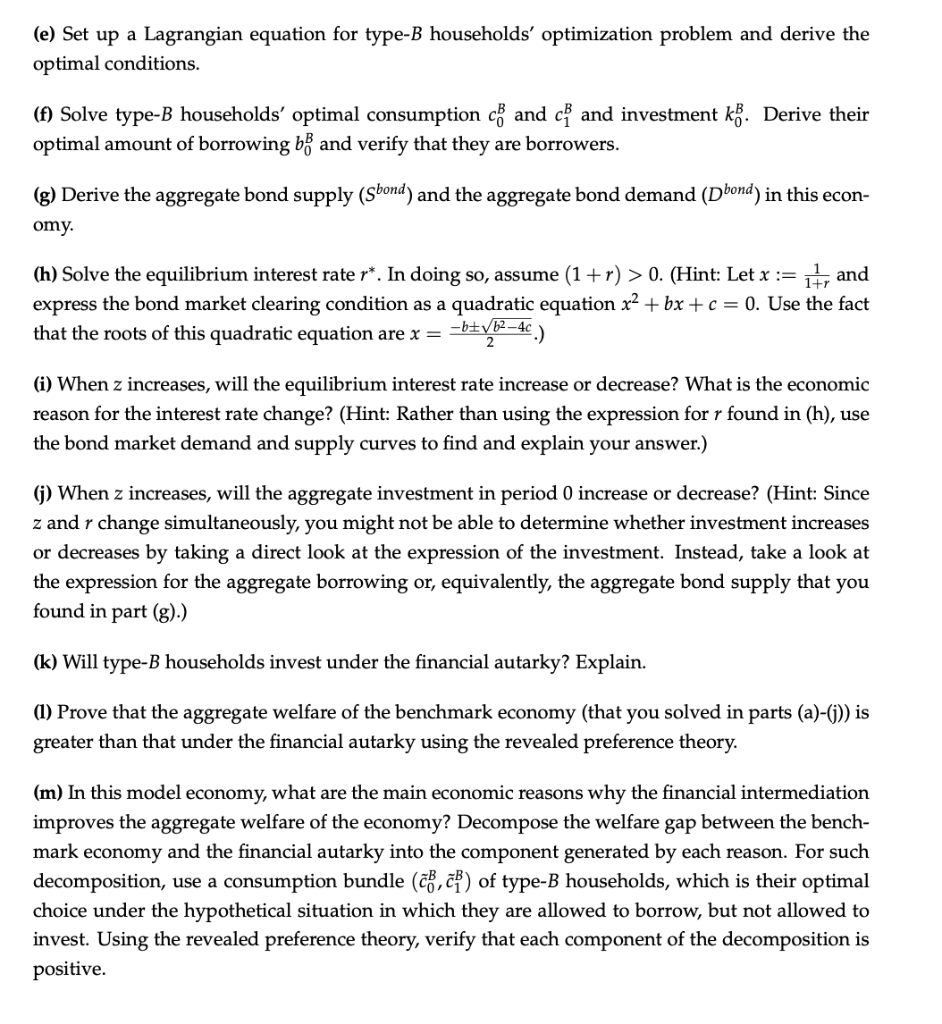

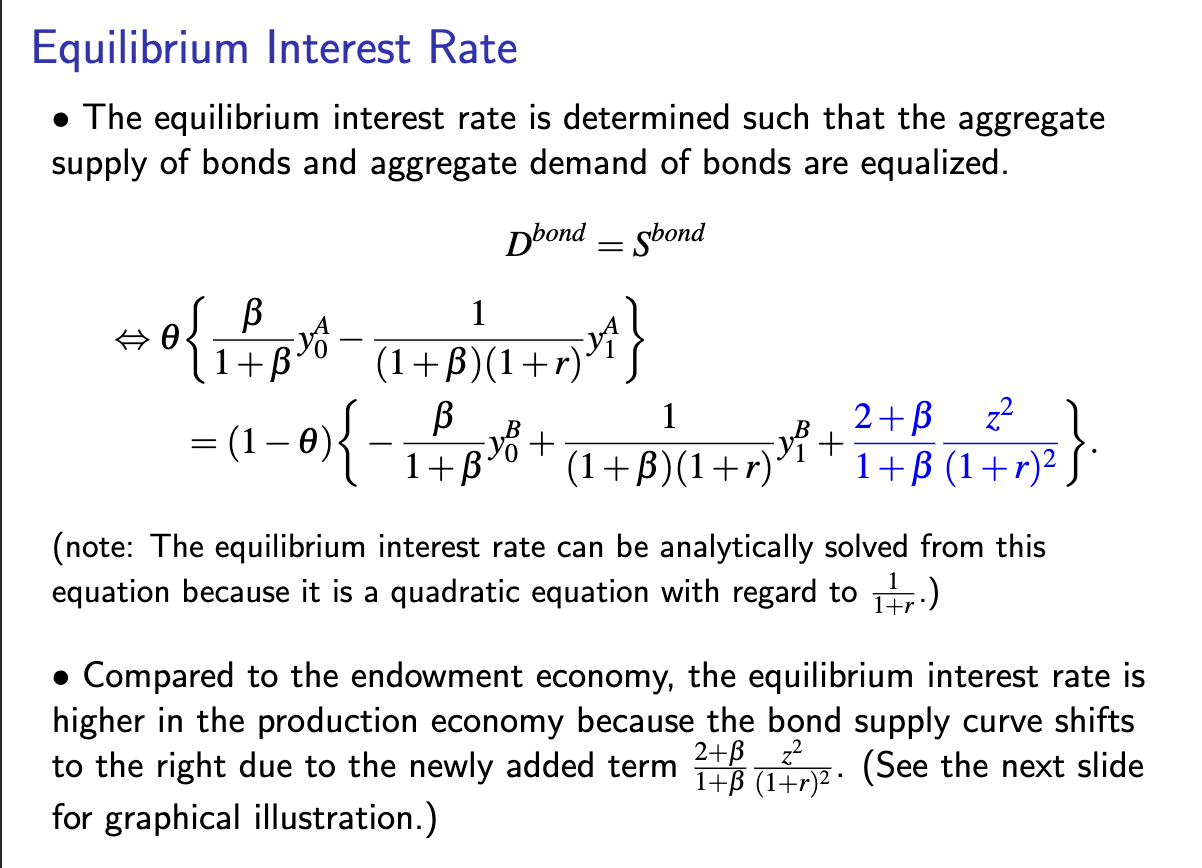

Assume that there is an economy populated by a continuum (0, 1) of households living in two periods, 0 and 1. There are two types of households, A and B, who are different in both endowed income streams and production technology. First, any household i in the interval (0,0) is a type- A household. Type-A households are endowed with y and y in period 0 and 1, respectively, where y >> yf. They have no production technology. Second, any household i in the interval [0,1] is a type-B household. Type-B households are endowed with y and y in period 0 and 1, respectively, where y k for some positive number k, which is greater than y. (In other words, the technology begins to produce positive output only when the invested capital is greater than a certain cutoff, k.) Both types of households have utility function u(co) + Bu(ci) in which co and c are household consumption in period 0 and 1. For simplicity, assume u(c) = log c. Households can borrow or lend in period 0, and the repayment takes place in period 1. Moreover, assume that z is large enough such that in the equilibrium of the production economy, type-B households choose ko > k and produce positive output. (a) Write down type-A households' optimization problem using the intertemporal budget con- straint. (Denote type-A households' consumption in periods 0 and 1 by c and c, respectively.) (b) Set up a Lagrangian equation for type-A households' optimization problem and derive the optimal conditions. (c) Solve type-A households' optimal consumption c and c^. Derive their optimal amount of saving s and verify that they are savers. (d) Write down type-B households' optimization problem using the intertemporal budget con- straint. In doing so, use the assumption that z is large enough such that in the equilibrium of the production economy, type-B households choose ko > k and produce positive output. (Denote type-B households' consumption in periods 0 and 1 by c and cp, respectively.) (e) Set up a Lagrangian equation for type-B households' optimization problem and derive the optimal conditions. (f) Solve type-B households' optimal consumption c and c and investment kb. Derive their optimal amount of borrowing b and verify that they are borrowers. (g) Derive the aggregate bond supply (sbond) and the aggregate bond demand (Dbond) in this econ- omy. (h) Solve the equilibrium interest rate r*. In doing so, assume (1+r) > 0. (Hint: Let x := it, and express the bond market clearing condition as a quadratic equation x2 + bx + c = 0. Use the fact that the roots of this quadratic equation are x = 6=yb2-4c.) (i) When z increases, will the equilibrium interest rate increase or decrease? What is the economic reason for the interest rate change? (Hint: Rather than using the expression for r found in (h), use the bond market demand and supply curves to find and explain your answer.) (j) When z increases, will the aggregate investment in period 0 increase or decrease? (Hint: Since z and r change simultaneously, you might not be able to determine whether investment increases or decreases by taking a direct look at the expression of the investment. Instead, take a look at the expression for the aggregate borrowing or, equivalently, the aggregate bond supply that you found in part (g).) (k) Will type-B households invest under the financial autarky? Explain. (1) Prove that the aggregate welfare of the benchmark economy (that you solved in parts (a)-(j)) is greater than that under the financial autarky using the revealed preference theory. (m) In this model economy, what are the main economic reasons why the financial intermediation improves the aggregate welfare of the economy? Decompose the welfare gap between the bench- mark economy and the financial autarky into the component generated by each reason. For such decomposition, use a consumption bundle (75, CP) of type-B households, which is their optimal choice under the hypothetical situation in which they are allowed to borrow, but not allowed to invest. Using the revealed preference theory, verify that each component of the decomposition is positive. Equilibrium Interest Rate The equilibrium interest rate is determined such that the aggregate supply of bonds and aggregate demand of bonds are equalized. Dbond = sbond - + so{148*- 1+BX+r11 -(1-04 13x + 1 +93 +m***#$(} (1+B)(1+r) B 1 + + (1)(1r) 2+B 22 B z2 yi+ (note: The equilibrium interest rate can be analytically solved from this equation because it is a quadratic equation with regard to 1tr.) 1+ Compared to the endowment economy, the equilibrium interest rate is higher in the production economy because the bond supply curve shifts to the right due to the newly added term AB 1+B (1+r)2 - (See the next slide for graphical illustration.) Assume that there is an economy populated by a continuum (0, 1) of households living in two periods, 0 and 1. There are two types of households, A and B, who are different in both endowed income streams and production technology. First, any household i in the interval (0,0) is a type- A household. Type-A households are endowed with y and y in period 0 and 1, respectively, where y >> yf. They have no production technology. Second, any household i in the interval [0,1] is a type-B household. Type-B households are endowed with y and y in period 0 and 1, respectively, where y k for some positive number k, which is greater than y. (In other words, the technology begins to produce positive output only when the invested capital is greater than a certain cutoff, k.) Both types of households have utility function u(co) + Bu(ci) in which co and c are household consumption in period 0 and 1. For simplicity, assume u(c) = log c. Households can borrow or lend in period 0, and the repayment takes place in period 1. Moreover, assume that z is large enough such that in the equilibrium of the production economy, type-B households choose ko > k and produce positive output. (a) Write down type-A households' optimization problem using the intertemporal budget con- straint. (Denote type-A households' consumption in periods 0 and 1 by c and c, respectively.) (b) Set up a Lagrangian equation for type-A households' optimization problem and derive the optimal conditions. (c) Solve type-A households' optimal consumption c and c^. Derive their optimal amount of saving s and verify that they are savers. (d) Write down type-B households' optimization problem using the intertemporal budget con- straint. In doing so, use the assumption that z is large enough such that in the equilibrium of the production economy, type-B households choose ko > k and produce positive output. (Denote type-B households' consumption in periods 0 and 1 by c and cp, respectively.) (e) Set up a Lagrangian equation for type-B households' optimization problem and derive the optimal conditions. (f) Solve type-B households' optimal consumption c and c and investment kb. Derive their optimal amount of borrowing b and verify that they are borrowers. (g) Derive the aggregate bond supply (sbond) and the aggregate bond demand (Dbond) in this econ- omy. (h) Solve the equilibrium interest rate r*. In doing so, assume (1+r) > 0. (Hint: Let x := it, and express the bond market clearing condition as a quadratic equation x2 + bx + c = 0. Use the fact that the roots of this quadratic equation are x = 6=yb2-4c.) (i) When z increases, will the equilibrium interest rate increase or decrease? What is the economic reason for the interest rate change? (Hint: Rather than using the expression for r found in (h), use the bond market demand and supply curves to find and explain your answer.) (j) When z increases, will the aggregate investment in period 0 increase or decrease? (Hint: Since z and r change simultaneously, you might not be able to determine whether investment increases or decreases by taking a direct look at the expression of the investment. Instead, take a look at the expression for the aggregate borrowing or, equivalently, the aggregate bond supply that you found in part (g).) (k) Will type-B households invest under the financial autarky? Explain. (1) Prove that the aggregate welfare of the benchmark economy (that you solved in parts (a)-(j)) is greater than that under the financial autarky using the revealed preference theory. (m) In this model economy, what are the main economic reasons why the financial intermediation improves the aggregate welfare of the economy? Decompose the welfare gap between the bench- mark economy and the financial autarky into the component generated by each reason. For such decomposition, use a consumption bundle (75, CP) of type-B households, which is their optimal choice under the hypothetical situation in which they are allowed to borrow, but not allowed to invest. Using the revealed preference theory, verify that each component of the decomposition is positive. Equilibrium Interest Rate The equilibrium interest rate is determined such that the aggregate supply of bonds and aggregate demand of bonds are equalized. Dbond = sbond - + so{148*- 1+BX+r11 -(1-04 13x + 1 +93 +m***#$(} (1+B)(1+r) B 1 + + (1)(1r) 2+B 22 B z2 yi+ (note: The equilibrium interest rate can be analytically solved from this equation because it is a quadratic equation with regard to 1tr.) 1+ Compared to the endowment economy, the equilibrium interest rate is higher in the production economy because the bond supply curve shifts to the right due to the newly added term AB 1+B (1+r)2 - (See the next slide for graphical illustration.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts