Question: i need help with question number two. Information for problem two is found in problem number one. 1. The Board of Directors of Collins Entertainment,

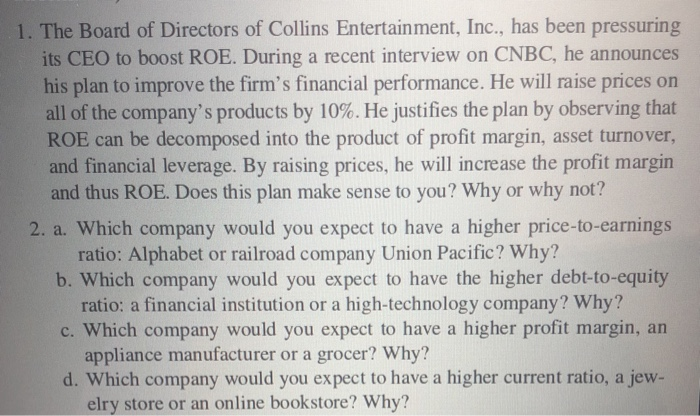

1. The Board of Directors of Collins Entertainment, Inc., has been pressuring its CEO to boost ROE. During a recent interview on CNBC, he announces his plan to improve the firm's financial performance. He will raise prices on all of the company's products by 10%. He justifies the plan by observing that ROE can be decomposed into the product of profit margin, asset turnover, and financial leverage. By raising prices, he will increase the profit margin and thus ROE. Does this plan make sense to you? Why or why not? 2. a. Which company would you expect to have a higher price-to-earnings ratio: Alphabet or railroad company Union Pacific? Why? b. Which company would you expect to have the higher debt-to-equity ratio: a financial institution or a high-technology company? Why? c. Which company would you expect to have a higher profit margin, an appliance manufacturer or a grocer? Why? d. Which company would you expect to have a higher current ratio, a jew- elry store or an online bookstore? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts