Question: i need help with questions 1-15 :) Question 1 1 pts (TRUE or FALSE?) The yield to maturity of a bond is the discount rate

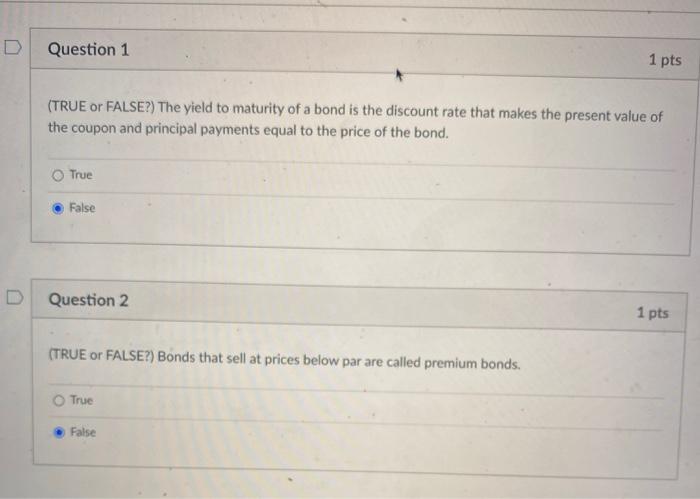

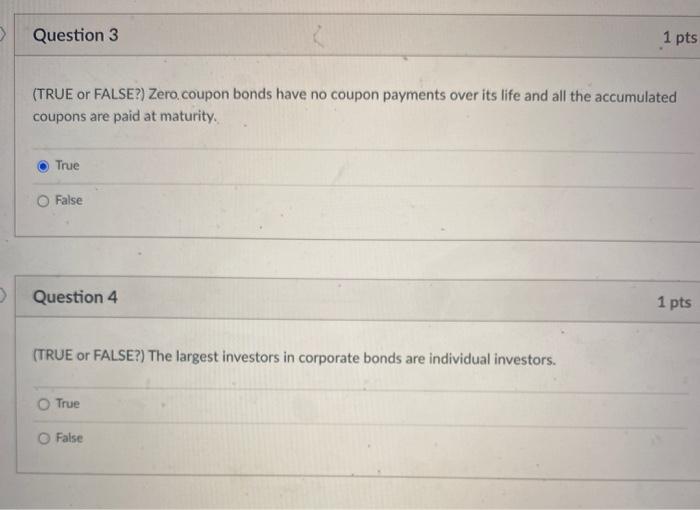

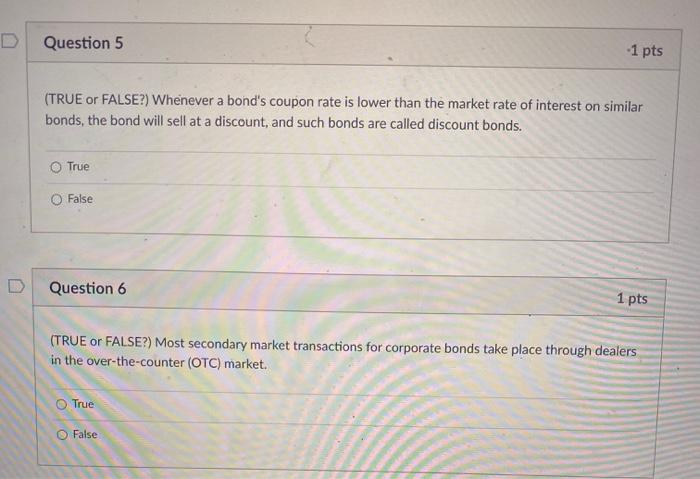

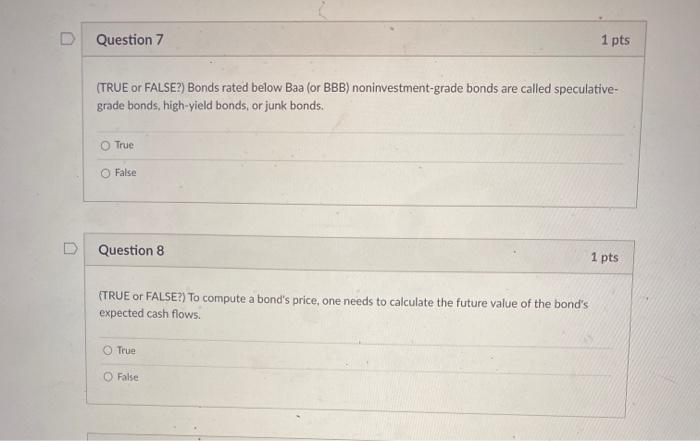

Question 1 1 pts (TRUE or FALSE?) The yield to maturity of a bond is the discount rate that makes the present value of the coupon and principal payments equal to the price of the bond. True False Question 2 1 pts (TRUE or FALSE?) Bonds that sell at prices below par are called premium bonds. True False Question 3 1 pts (TRUE or FALSE?) Zero, coupon bonds have no coupon payments over its life and all the accumulated coupons are paid at maturity True False Question 4 1 pts (TRUE or FALSE?) The largest investors in corporate bonds are individual investors. True False Question 7 1 pts (TRUE or FALSE?) Bonds rated below Baa (or BBB) noninvestment-grade bonds are called speculative- grade bonds, high-yield bonds, or junk bonds. True False Question 8 1 pts (TRUE or FALSE?) To compute a bond's price, one needs to calculate the future value of the bond's expected cash flows. True False Question 9 1 pts (TRUE or FALSE?) The real rate of interest varies with the business cycle, with the highest rates seen at the end of a period of business recession and the lowest at the bottom of a expansion True False D Question 10 1 pts (TRUE or FALSE?) Investors buying callable bonds require the higher yields because call provisions work to the benefit of the borrower and the detriment of the investor. True False Question 11 1 pts (TRUE OR FALSE?) There is a negative relation between changes in the level of interest rates and changes in the price of a bond. True False D Question 12 1 pts (TRUE or FALSE?) Whenever a bond's coupon rate is higher than the market rate of interest on similar bonds, the bond will sell at a discount, and such bonds are called discount bonds. True False Question 13 1 pts (TRUE or FALSE?) Whenever a bond's coupon rate is higher than the market rate of interest, the bond will sell at a premium. True False Question 14 1 pts (TRUE or FALSE?) Investors buying callable bonds require the lower yields because call provisions work to the benefit of the bond investors and the detriment of the bond issuers. O True O False Question 15 1 pts (TRUE or FALSE?) The face or par value for most corporate bonds is equal to $1,000, and it is the principal amount owed to bondholders at maturity. O True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts