Question: I need help with questions 1,4,6,7, 10-15 Question 1 1p Which of the following statement is correct? The most important investors in corporate bonds are

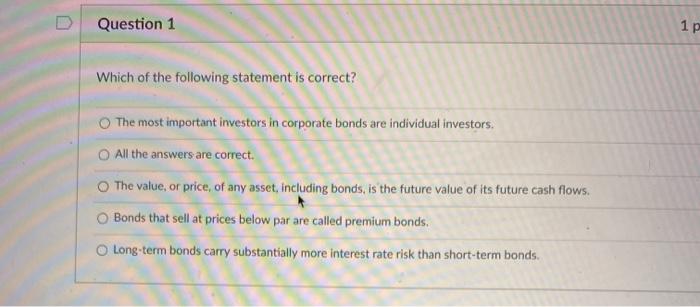

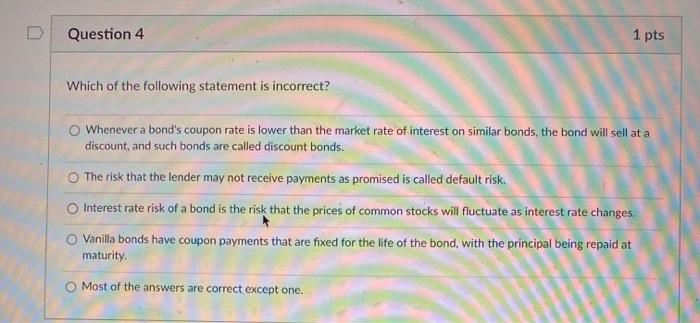

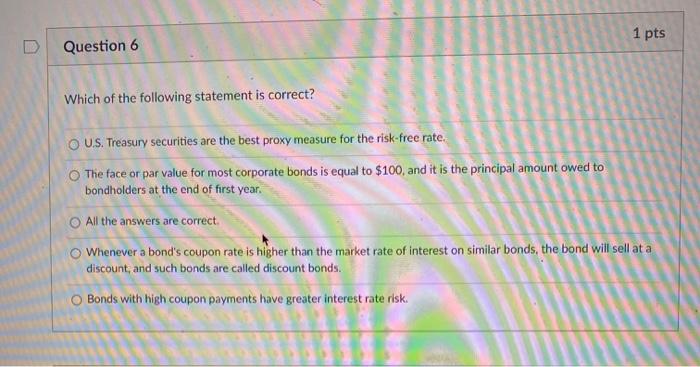

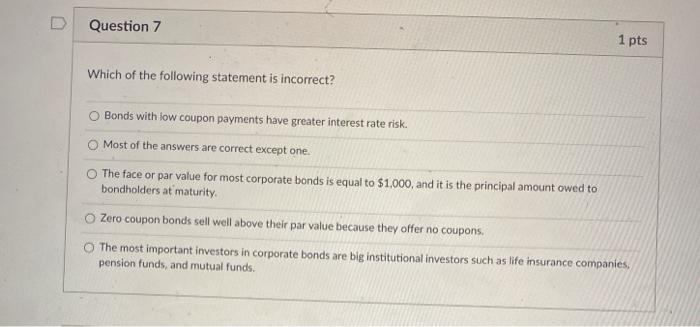

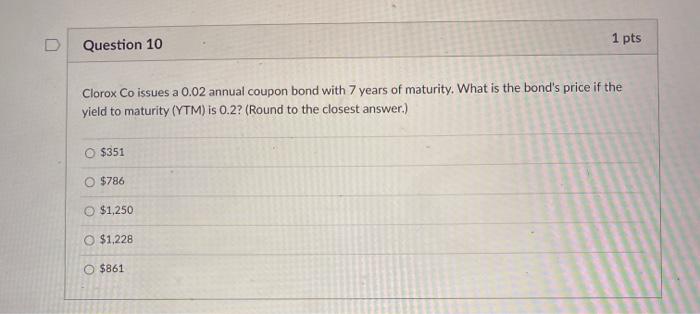

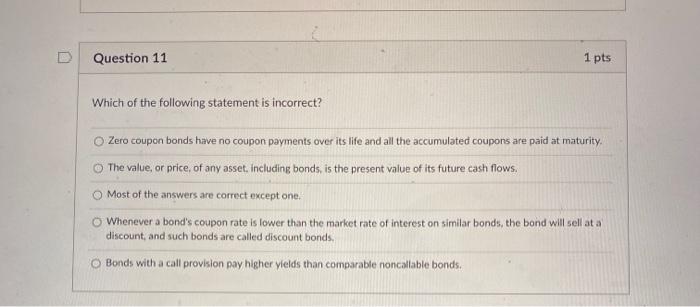

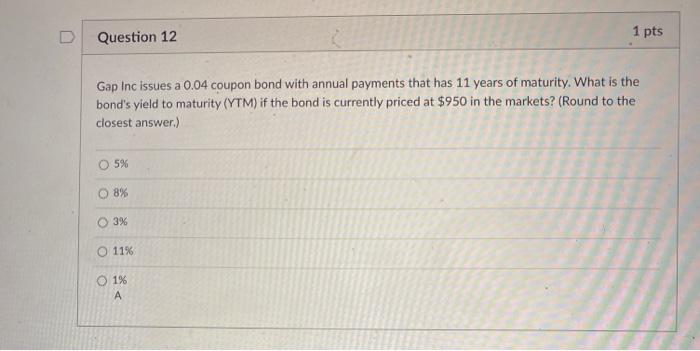

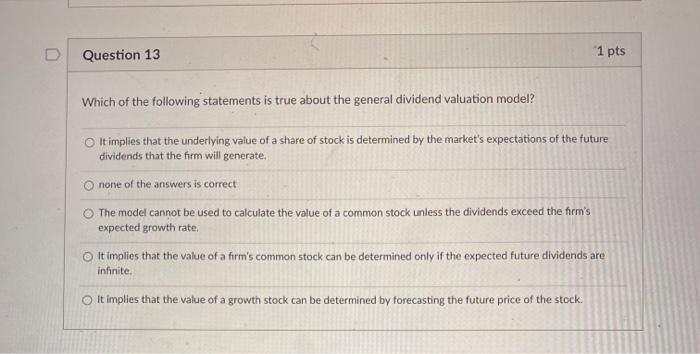

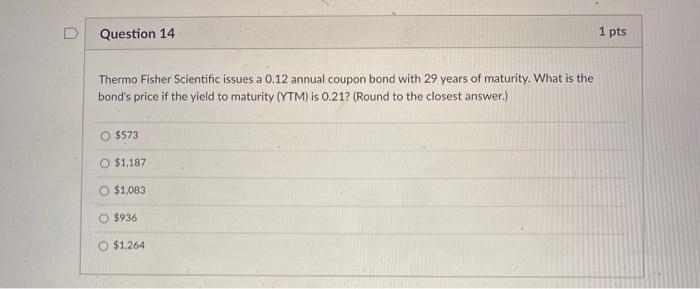

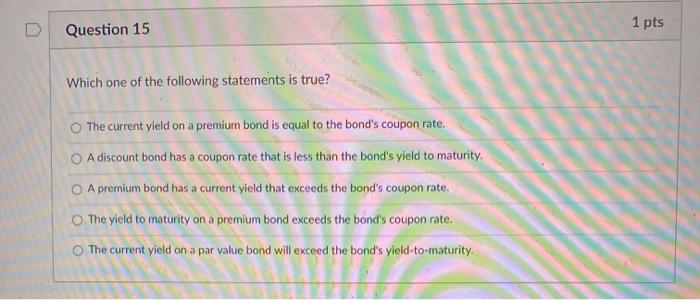

Question 1 1p Which of the following statement is correct? The most important investors in corporate bonds are individual investors. All the answers are correct. The value, or price of any asset, including bonds, is the future value of its future cash flows. O Bonds that sell at prices below par are called premium bonds. Long-term bonds carry substantially more interest rate risk than short-term bonds. Question 4 1 pts Which of the following statement is incorrect? Whenever a bond's coupon rate is lower than the market rate of interest on similar bonds, the bond will sell at a discount, and such bonds are called discount bonds. The risk that the lender may not receive payments as promised is called default risk. Interest rate risk of a bond is the risk that the prices of common stocks will fluctuate as interest rate changes. Vanilla bonds have coupon payments that are fixed for the life of the bond, with the principal being repaid at maturity Most of the answers are correct except one. 1 pts Question 6 Which of the following statement is correct? O U.S. Treasury securities are the best proxy measure for the risk-free rate The face or par value for most corporate bonds is equal to $100, and it is the principal amount owed to bondholders at the end of first year. O All the answers are correct. Whenever a bond's coupon rate is higher than the market rate of interest on similar bonds, the bond will sell at a discount, and such bonds are called discount bonds. O Bonds with high coupon payments have greater interest rate risk Question 7 1 pts Which of the following statement is incorrect? Bonds with low coupon payments have greater interest rate risk. Most of the answers are correct except one. The face or par value for most corporate bonds is equal to $1.000, and it is the principal amount owed to bondholders at maturity Zero coupon bonds sell well above their par value because they offer no coupons. The most important investors in corporate bonds are big institutional investors such as life insurance companies, pension funds, and mutual funds. D 1 pts Question 10 Clorox Co issues a 0.02 annual coupon bond with 7 years of maturity. What is the bond's price if the yield to maturity (YTM) is 0.2? (Round to the closest answer.) $351 O $786 $1,250 $1.228 $861 Question 11 1 pts Which of the following statement is incorrect? Zero coupon bonds have no coupon payments over its life and all the accumulated coupons are paid at maturity, The value, or price of any asset, including bonds, is the present value of its future cash flows. Most of the answers are correct except one. Whenever a bond's coupon rate is lower than the market rate of interest on similar bonds, the bond will sell at a discount, and such bonds are called discount bonds, O Bonds with a call provision pay higher yields than comparable noncallable bonds. Question 12 1 pts Gap Inc issues a 0.04 coupon bond with annual payments that has 11 years of maturity. What is the bond's yield to maturity (YTM) if the bond is currently priced at $950 in the markets? (Round to the closest answer.) 5% O 8% O 3% 11% 1% A Question 13 1 pts Which of the following statements is true about the general dividend valuation model? It implies that the underlying value of a share of stock is determined by the market's expectations of the future dividends that the firm will generate. none of the answers is correct The model cannot be used to calculate the value of a common stock unless the dividends exceed the firm's expected growth rate It implies that the value of a firm's common stock can be determined only if the expected future dividends are Infinite. It implies that the value of a growth stock can be determined by forecasting the future price of the stock Question 14 1 pts Thermo Fisher Scientific issues a 0.12 annual coupon bond with 29 years of maturity. What is the bond's price if the yield to maturity (YTM) is 0.21? (Round to the closest answer.) O $573 O $1.187 O $1,083 $936 $1,264 Question 15 1 pts Which one of the following statements is true? The current yield on a premium bond is equal to the bond's coupon rate. A discount bond has a coupon rate that is less than the bond's yield to maturity O A premium bond has a current yield that exceeds the bond's coupon rate. The yield to maturity on a premium bond exceeds the bond's coupon rate. The current yield on a par value bond will exceed the bond's yield-to-maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts