Question: I need help with questions 2 A-G. Please answer all the parts, thanks!! 2. On the graph below, reproduce the MC and ATC curves. a.

I need help with questions 2 A-G. Please answer all the parts, thanks!!

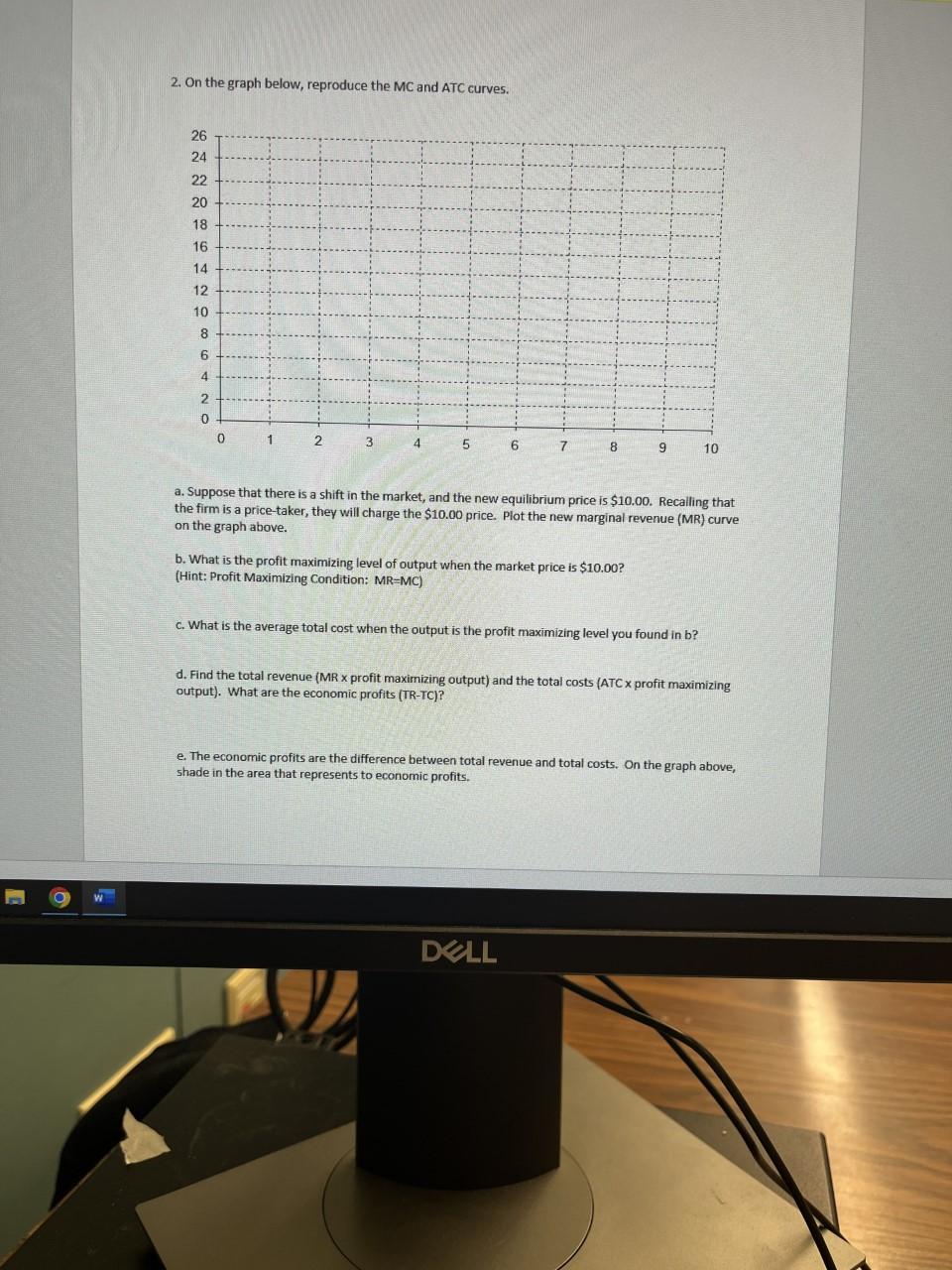

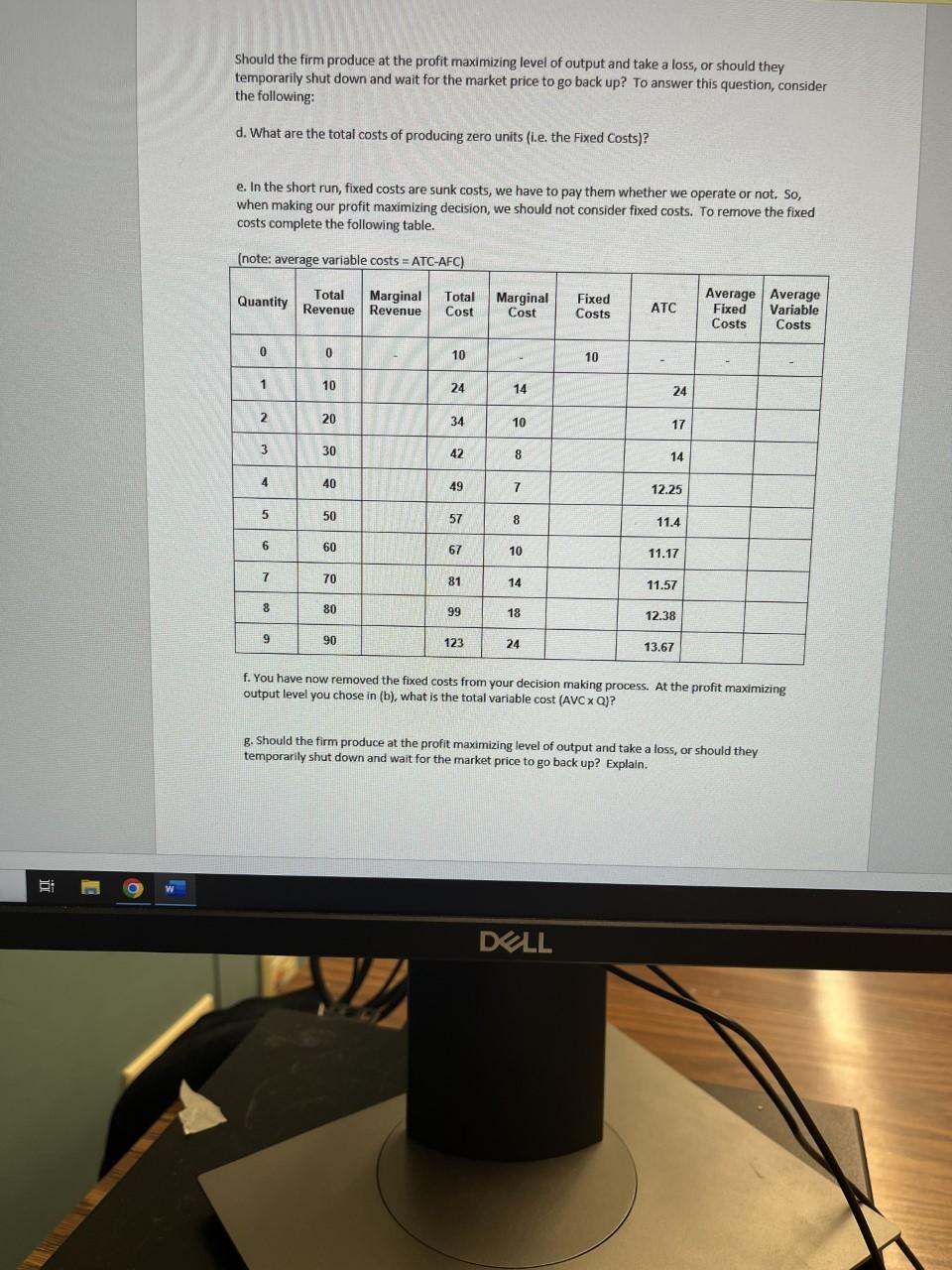

2. On the graph below, reproduce the MC and ATC curves. a. Suppose that there is a shift in the market, and the new equilibrium price is $10.00. Recalling that the firm is a price-taker, they will charge the $10.00 price. Plot the new marginal revenue (MR) curve on the graph above. b. What is the profit maximizing level of output when the market price is $10.00 ? (Hint: Profit Maximizing Condition: MR=MC) c. What is the average total cost when the output is the profit maximizing level you found in b? d. Find the total revenue (MR profit maximizing output) and the total costs (ATC profit maximizing output). What are the economic profits (TR-TC)? e. The economic profits are the difference between total revenue and total costs. On the graph above, shade in the area that represents to economic profits. Should the firm produce at the profit maximizing level of output and take a loss, or should they temporarily shut down and wait for the market price to go back up? To answer this question, consider the following: d. What are the total costs of producing zero units (i.e. the Fixed Costs)? e. In the short run, fixed costs are sunk costs, we have to pay them whether we operate or not. So, when making our profit maximizing decision, we should not consider fixed costs. To remove the fixed costs complete the following table. Inote: averade variahla metc = ATr_neri f. You have now removed the fixed costs from your decision making process. At the profit maximizing output level you chose in (b), what is the total variable cost (AVC Q)? g. Should the firm produce at the profit maximizing level of output and take a loss, or should they temporarily shut down and wait for the market price to go back up? Explain. 2. On the graph below, reproduce the MC and ATC curves. a. Suppose that there is a shift in the market, and the new equilibrium price is $10.00. Recalling that the firm is a price-taker, they will charge the $10.00 price. Plot the new marginal revenue (MR) curve on the graph above. b. What is the profit maximizing level of output when the market price is $10.00 ? (Hint: Profit Maximizing Condition: MR=MC) c. What is the average total cost when the output is the profit maximizing level you found in b? d. Find the total revenue (MR profit maximizing output) and the total costs (ATC profit maximizing output). What are the economic profits (TR-TC)? e. The economic profits are the difference between total revenue and total costs. On the graph above, shade in the area that represents to economic profits. Should the firm produce at the profit maximizing level of output and take a loss, or should they temporarily shut down and wait for the market price to go back up? To answer this question, consider the following: d. What are the total costs of producing zero units (i.e. the Fixed Costs)? e. In the short run, fixed costs are sunk costs, we have to pay them whether we operate or not. So, when making our profit maximizing decision, we should not consider fixed costs. To remove the fixed costs complete the following table. Inote: averade variahla metc = ATr_neri f. You have now removed the fixed costs from your decision making process. At the profit maximizing output level you chose in (b), what is the total variable cost (AVC Q)? g. Should the firm produce at the profit maximizing level of output and take a loss, or should they temporarily shut down and wait for the market price to go back up? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts