Question: i need help with REQUIRED A and B Electronics Service Company pays salaries monthly on the last day of the month. The following information is

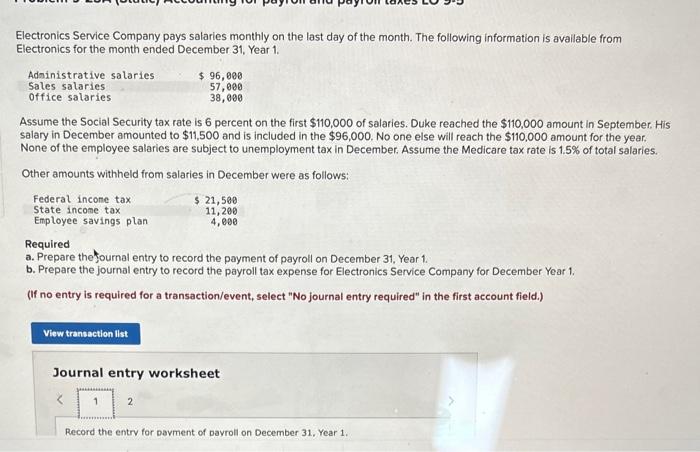

Electronics Service Company pays salaries monthly on the last day of the month. The following information is available from Electronics for the month ended December 31 , Year 1. Assume the Social Security tax rate is 6 percent on the first $110,000 of salaries. Duke reached the $110,000 amount in September. His salary in December amounted to $11,500 and is included in the $96,000. No one else will reach the $110,000 amount for the year. None of the employee salaries are subject to unemployment tax in December. Assume the Medicare tax rate is 1.5% of total salaries. Other amounts withheld from salaries in December were as follows: Required a. Prepare the fournal entry to record the payment of payroll on December 31 , Year 1 . b. Prepare the journal entry to record the payroll tax expense for Electronics Service Company for December Year 1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry for Davment of Dayrol on December 31 . Year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts