Question: I need help with requirements c and d. I've also provided the dropdown options On May 1, 2022, Lark's Heavy Equipment sold a piece of

I need help with requirements c and d. I've also provided the dropdown options

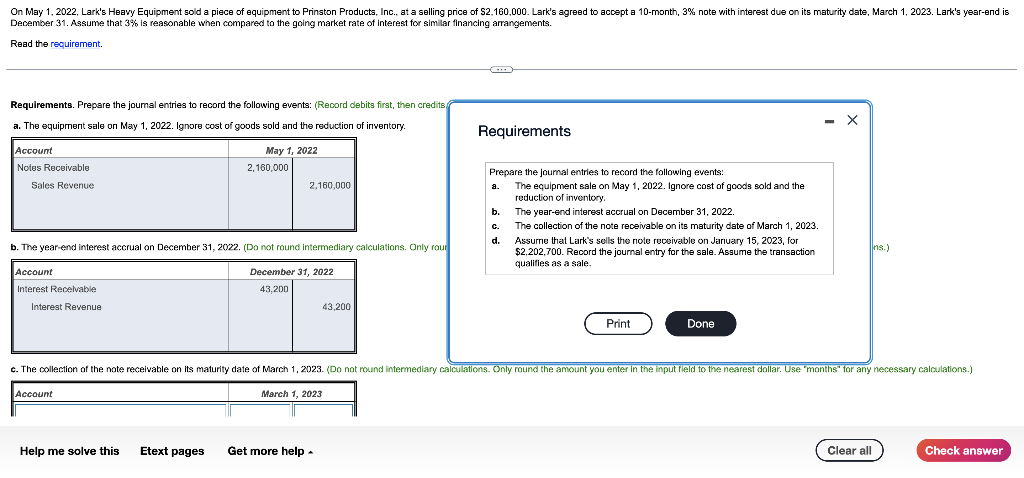

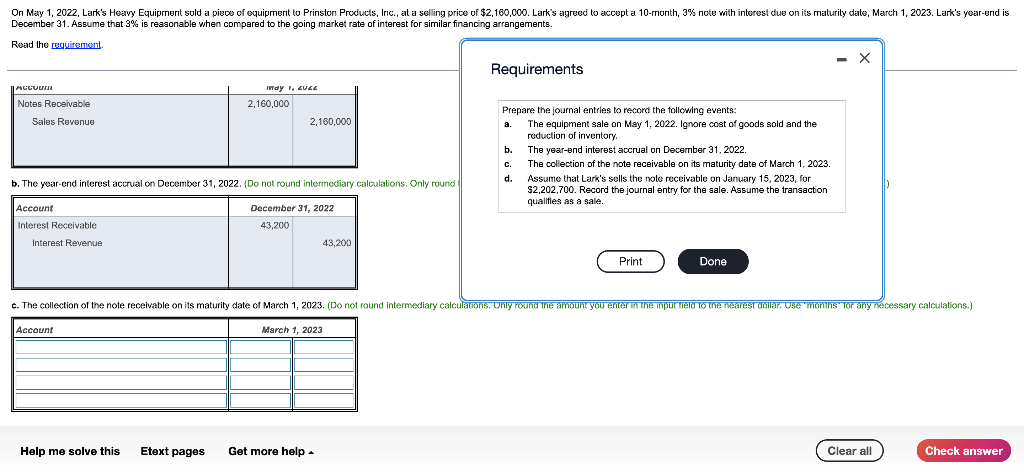

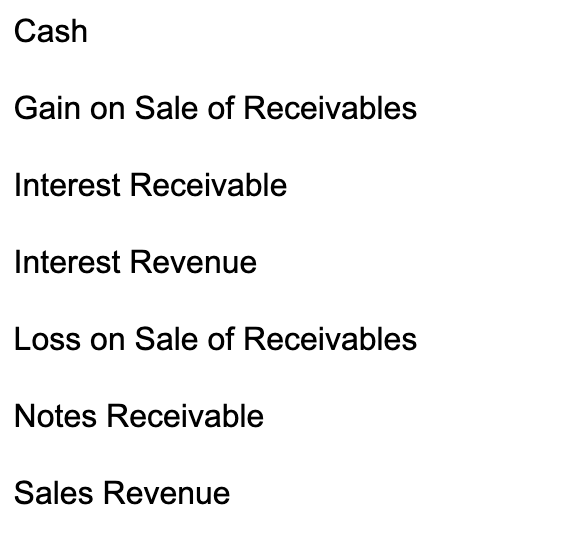

On May 1, 2022, Lark's Heavy Equipment sold a piece of equipment to Prinston Products, Inc., at a selling price of S2,160,000. Lark's agreed to accept a 10-month, 3% note with interest due on its maturity date, March 1, 2023. Lark's year-end is December 31. Assume that 3% is reasonable when compared to the going market rate of interest for similar financing arrangements. Read the requirement. Requirements. Prepare the journal entries to record the following events: (Record debits first, then credits a. The equipment sale on May 1, 2022. Ignore cost of goods sold and the reduction of inventory. - X Requirements Account Notes Receivable May 1, 2022 2,160,000 2,160,000 Sales Revenue Prepare the journal entries to record the following events: The equipment sale on May 1, 2022. Ignore cost of goods sold and the reduction of inventory. b. The year-end interest accrual on December 31, 2022 The collection of the note receivable on its maturity date of March 1, 2023. d. Assume that Lark's sells the note receivable on January 15, 2023, for $2.202,700. Record the journal entry for the sale. Assume the transaction qualifies as a sale. b. The year-end interest accrual on December 31, 2022. (Do not round intermediary calculations. Only rour lins.) Account Interest Receivable Interest Revenue December 31, 2022 43,200 43,200 Print Done c. The collection of the note receivable on its maturity date of March 1, 2023. (Do not round intermediary calculations. Only round the amount you enter in the input field to the nearest dollar. Use "months" for any necessary calculations.) Account March 1, 2023 Help me solve this Etext pages Get more help Clear all Check answer On May 1, 2022, Lark's Heavy Equipment sold a piece of equipment to Prinston Products, Inc., at a selling price of $2,160,000. Lark's agreed to accept a 10-month, 3% note with interest due on its maturity date, March 1, 2023. Lark's year-end is December 31. Assume that 3% is reasonable when compared to the going market rate of interest for similar financing arrangements. Read the requirement X Requirements may ca ALUVUN Notes Receivable Sales Revenue 2,160,000 2,160,000 Prepare the journal entries to record the following events: The equipment sale on May 1, 2022. Ignore cost of goods sold and the reduction of inventory. b The year-end interest accrual on December 31, 2022 The collection of the note receivable on its maturity date of March 1, 2023 d. Assume that Lark's sells the note receivable on January 15, 2023, for $2,202,700. Record the journal entry for the sale. Assume the transaction qualifies as a sale. c. b. The year-end interest accrual on December 31, 2022. (Do not round intermediary calculations. Only round Account Interest Receivable Interest Revenue December 31, 2022 43,200 43,200 Print Done c. The collection of the note receivable on its maturity date of March 1, 2023. (Do not round intermediary calculations. Only round the amount you enter the input ned to the nearest dollar. Use "mons Tor any necessary calculations.) Account March 1, 2023 Help me solve this Etext pages Get more help. Clear all Check answer Cash Gain on Sale of Receivables Interest Receivable Interest Revenue Loss on Sale of Receivables Notes Receivable Sales Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts