Question: I need help with requirment 4: complete the analysis... but any additonal help is greatly appreciated!! forgot to include the balance sheet! AMAZING COMPANY Adjusted

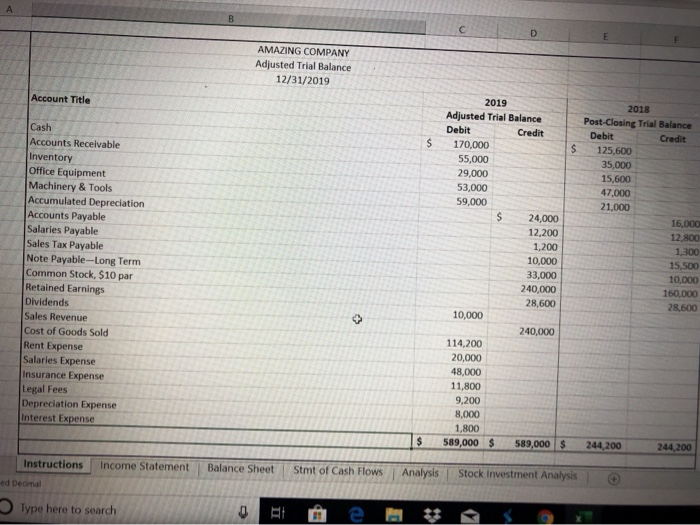

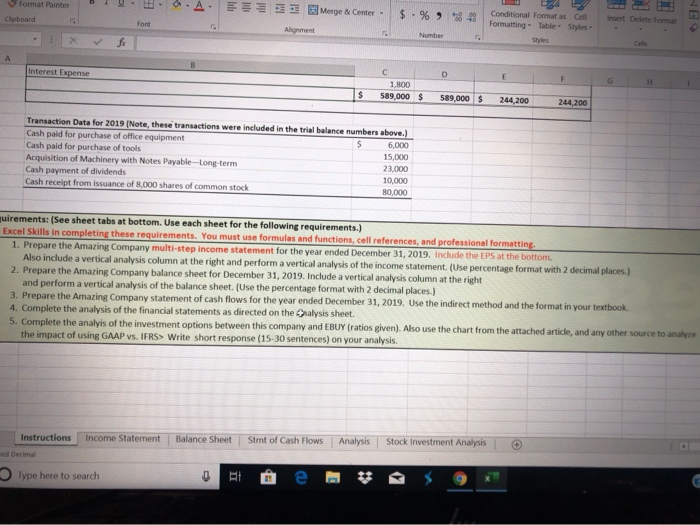

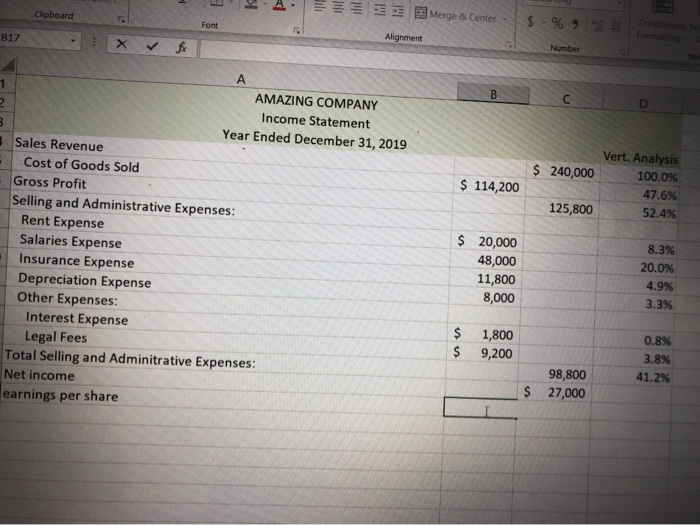

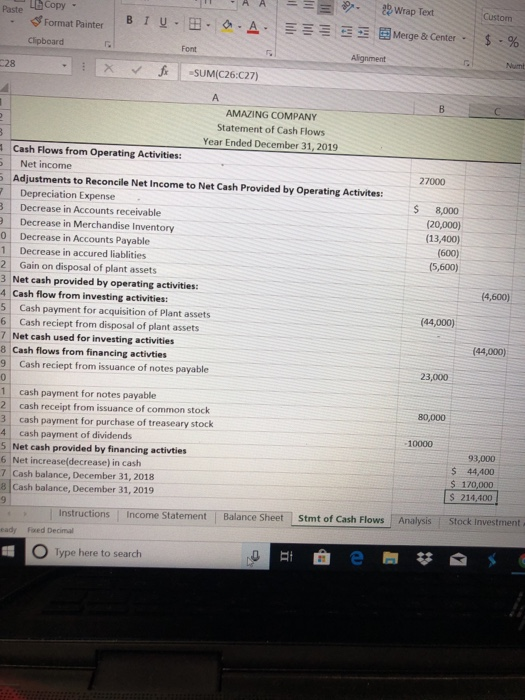

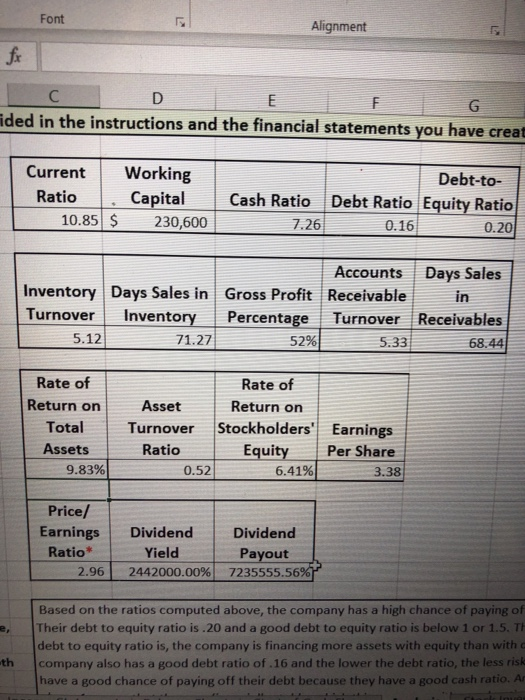

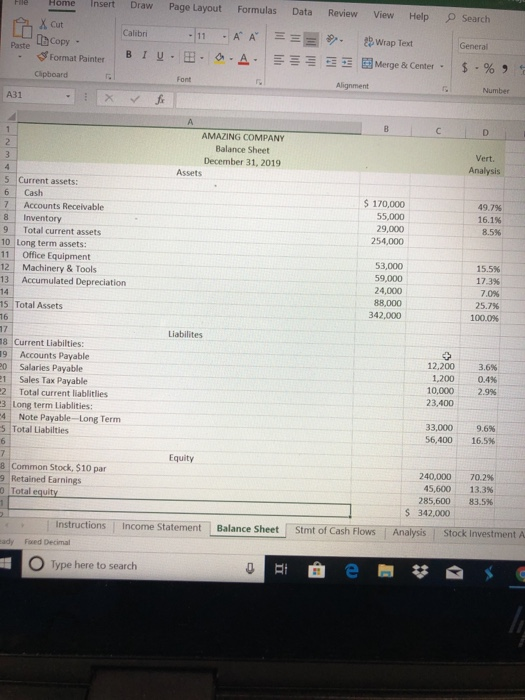

AMAZING COMPANY Adjusted Trial Balance 12/31/2019 Account Title Cash Accounts Receivable Inventory Office Equipment Machinery & Tools Accumulated Depreciation Accounts Payable Salaries Payable Sales Tax Payable Note Payable-Long Term Common Stock, $10 par Retained Earnings Dividends Sales Revenue Cost of Goods Sold Rent Expense Salaries Expense Insurance Expense Legal Fees Depreciation Expense Interest Expense 2019 Adjusted Trial Balance Debit Credit 170,000 55,000 29,000 53,000 59,000 24,000 12,200 1.200 10,000 33,000 240,000 28,600 10,000 240,000 114,200 20,000 48,000 11,800 9,200 8,000 1,800 589,000 $ 589,000 2018 Post-Closing Trial Balance Debit Credit 125,600 35,000 15,600 47,000 21,000 16,000 12.800 1,300 15,500 10,000 160,000 28,600 S 244,200 244,200 Income Statement Balance Sheet Stmt of Cash Flows Analysis Stock Investment Analysis Instructions d Dema Type here to search 0 Eles A. Clipboard 33 Merge & Center - - % B17 Alignment X for Number $ 240,000 $ 114,200 Vert. Analysis 100.0% 47.6% 52.4% 125,800 AMAZING COMPANY Income Statement Year Ended December 31, 2019 Sales Revenue Cost of Goods Sold Gross Profit Selling and Administrative Expenses: Rent Expense Salaries Expense Insurance Expense Depreciation Expense Other Expenses: Interest Expense Legal Fees Total Selling and Adminitrative Expenses: Net income earnings per share $ 20,000 48,000 11,800 8,000 8.3% 20.0% 4.9% 3.3% $ $ 1,800 9,200 0.8% 3.8% 41.2% $ 98,800 27,000 Puste 1 Copy - - A A - BI Format Painter Clipboard O . A 29 Wrap Text Merge & Center - Custom $ . % Font 28 Alignment X V fi =SUM(C26:027) 27000 AMAZING COMPANY Statement of Cash Flows Year Ended December 31, 2019 Cash Flows from Operating Activities: 6 Net income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activites: 7 Depreciation Expense 3 Decrease in Accounts receivable Decrease in Merchandise Inventory 0 Decrease in Accounts Payable 1 Decrease in accured liablities 2 Gain on disposal of plant assets 3 Net cash provided by operating activities: 4 Cash flow from investing activities: 5 Cash payment for acquisition of Plant assets 6 Cash reciept from disposal of plant assets 7 Net cash used for investing activities 8 Cash flows from financing activties 9 Cash reciept from issuance of notes payable 8,000 (20,000) (13,400) (600) (5,600) (4,600) (44,000) (44,000) 23,000 80,000 1 cash payment for notes payable 2 cash receipt from issuance of common stock 3 cash payment for purchase of treaseary stock 4 cash payment of dividends 5 Net cash provided by financing activties 6 Net increase(decrease) in cash 7 Cash balance, December 31, 2018 8 Cash balance, December 31, 2019 -10000 93,000 $ 44,400 $ 170,000 $ 214,400 Instructions Fored Decimal Income Statement Balance Sheet Stmt of Cash Flows Analysis Stock Investment eady Type here to search Font Alignment fr C D ded in the instructions and the financial statements you have creat Current Working Ratio . Capital 10.85 $ 230,600 Cash Ratio 7.26 Debt-to- Debt Ratio Equity Ratio 0.16 0.20 Accounts Days Sales Inventory Days Sales in Gross Profit Receivable in Turnover Inventory Percentage Turnover Receivables 5.12 71.27 52% 5.33 68.44 Rate of Return on Total Assets 9.83% Asset Turnover Ratio 0.52 Rate of Return on Stockholders' Earnings Equity Per Share 6 .41% 3.38 Pricel Earnings Ratio* 2.96 Dividend Yield 2442000.00% Dividend Payout 7235555.56% Based on the ratios computed above, the company has a high chance of paying o Their debt to equity ratio is .20 and a good debt to equity ratio is below 1 or 1.5. T debt to equity ratio is, the company is financing more assets with equity than with company also has a good debt ratio of 16 and the lower the debt ratio, the less ris have a good chance of paying off their debt because they have a good cash ratio. A th HII Insert Home X Cut Search Draw Page Layout Formulas Data Calibri -11 A == B IU. 0.A. Review . Paste Copy View Help Wrap Text Merge & Center - General Format Painter Clipboard $ - % 9 % Font Alignment Number AMAZING COMPANY Balance Sheet December 31, 2019 Assets Vert. Analysis 5 Current assets: 6 Cash 7 Accounts Receivable 8 Inventory 9 Total current assets 10 Long term assets: 11 Office Equipment 12 Machinery & Tools 13 Accumulated Depreciation $ 170,000 55,000 29,000 254,000 49.796 16.1% 8.5% 53,000 59,000 24,000 88.000 342,000 15.5% 17.3% 7.0% 25.796 100.0% 15 Total Assets Liabilites 18 Current Liabilties: 19 Accounts Payable 20 Salaries Payable 21 Sales Tax Payable 2 Total current liabilities 3 Long term Liablities: 4 Note Payable---Long Term 5 Total Liabilties 12,200 1,200 10,000 23,400 2.996 33.000 56,400 9.6% 16.5% Equity 8 Common Stock, $10 par 9 Retained Earnings Total equity 240,000 70.2% 45,600 13.3% 285,600 83.5% $ 342,000 Analysis Stock Investment Instructions Ford Decimal Income Statement Balance Sheet Stmt of Cash Flows sady Type here to search AMAZING COMPANY Adjusted Trial Balance 12/31/2019 Account Title Cash Accounts Receivable Inventory Office Equipment Machinery & Tools Accumulated Depreciation Accounts Payable Salaries Payable Sales Tax Payable Note Payable-Long Term Common Stock, $10 par Retained Earnings Dividends Sales Revenue Cost of Goods Sold Rent Expense Salaries Expense Insurance Expense Legal Fees Depreciation Expense Interest Expense 2019 Adjusted Trial Balance Debit Credit 170,000 55,000 29,000 53,000 59,000 24,000 12,200 1.200 10,000 33,000 240,000 28,600 10,000 240,000 114,200 20,000 48,000 11,800 9,200 8,000 1,800 589,000 $ 589,000 2018 Post-Closing Trial Balance Debit Credit 125,600 35,000 15,600 47,000 21,000 16,000 12.800 1,300 15,500 10,000 160,000 28,600 S 244,200 244,200 Income Statement Balance Sheet Stmt of Cash Flows Analysis Stock Investment Analysis Instructions d Dema Type here to search 0 Eles A. Clipboard 33 Merge & Center - - % B17 Alignment X for Number $ 240,000 $ 114,200 Vert. Analysis 100.0% 47.6% 52.4% 125,800 AMAZING COMPANY Income Statement Year Ended December 31, 2019 Sales Revenue Cost of Goods Sold Gross Profit Selling and Administrative Expenses: Rent Expense Salaries Expense Insurance Expense Depreciation Expense Other Expenses: Interest Expense Legal Fees Total Selling and Adminitrative Expenses: Net income earnings per share $ 20,000 48,000 11,800 8,000 8.3% 20.0% 4.9% 3.3% $ $ 1,800 9,200 0.8% 3.8% 41.2% $ 98,800 27,000 Puste 1 Copy - - A A - BI Format Painter Clipboard O . A 29 Wrap Text Merge & Center - Custom $ . % Font 28 Alignment X V fi =SUM(C26:027) 27000 AMAZING COMPANY Statement of Cash Flows Year Ended December 31, 2019 Cash Flows from Operating Activities: 6 Net income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activites: 7 Depreciation Expense 3 Decrease in Accounts receivable Decrease in Merchandise Inventory 0 Decrease in Accounts Payable 1 Decrease in accured liablities 2 Gain on disposal of plant assets 3 Net cash provided by operating activities: 4 Cash flow from investing activities: 5 Cash payment for acquisition of Plant assets 6 Cash reciept from disposal of plant assets 7 Net cash used for investing activities 8 Cash flows from financing activties 9 Cash reciept from issuance of notes payable 8,000 (20,000) (13,400) (600) (5,600) (4,600) (44,000) (44,000) 23,000 80,000 1 cash payment for notes payable 2 cash receipt from issuance of common stock 3 cash payment for purchase of treaseary stock 4 cash payment of dividends 5 Net cash provided by financing activties 6 Net increase(decrease) in cash 7 Cash balance, December 31, 2018 8 Cash balance, December 31, 2019 -10000 93,000 $ 44,400 $ 170,000 $ 214,400 Instructions Fored Decimal Income Statement Balance Sheet Stmt of Cash Flows Analysis Stock Investment eady Type here to search Font Alignment fr C D ded in the instructions and the financial statements you have creat Current Working Ratio . Capital 10.85 $ 230,600 Cash Ratio 7.26 Debt-to- Debt Ratio Equity Ratio 0.16 0.20 Accounts Days Sales Inventory Days Sales in Gross Profit Receivable in Turnover Inventory Percentage Turnover Receivables 5.12 71.27 52% 5.33 68.44 Rate of Return on Total Assets 9.83% Asset Turnover Ratio 0.52 Rate of Return on Stockholders' Earnings Equity Per Share 6 .41% 3.38 Pricel Earnings Ratio* 2.96 Dividend Yield 2442000.00% Dividend Payout 7235555.56% Based on the ratios computed above, the company has a high chance of paying o Their debt to equity ratio is .20 and a good debt to equity ratio is below 1 or 1.5. T debt to equity ratio is, the company is financing more assets with equity than with company also has a good debt ratio of 16 and the lower the debt ratio, the less ris have a good chance of paying off their debt because they have a good cash ratio. A th HII Insert Home X Cut Search Draw Page Layout Formulas Data Calibri -11 A == B IU. 0.A. Review . Paste Copy View Help Wrap Text Merge & Center - General Format Painter Clipboard $ - % 9 % Font Alignment Number AMAZING COMPANY Balance Sheet December 31, 2019 Assets Vert. Analysis 5 Current assets: 6 Cash 7 Accounts Receivable 8 Inventory 9 Total current assets 10 Long term assets: 11 Office Equipment 12 Machinery & Tools 13 Accumulated Depreciation $ 170,000 55,000 29,000 254,000 49.796 16.1% 8.5% 53,000 59,000 24,000 88.000 342,000 15.5% 17.3% 7.0% 25.796 100.0% 15 Total Assets Liabilites 18 Current Liabilties: 19 Accounts Payable 20 Salaries Payable 21 Sales Tax Payable 2 Total current liabilities 3 Long term Liablities: 4 Note Payable---Long Term 5 Total Liabilties 12,200 1,200 10,000 23,400 2.996 33.000 56,400 9.6% 16.5% Equity 8 Common Stock, $10 par 9 Retained Earnings Total equity 240,000 70.2% 45,600 13.3% 285,600 83.5% $ 342,000 Analysis Stock Investment Instructions Ford Decimal Income Statement Balance Sheet Stmt of Cash Flows sady Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts