Question: I NEED HELP WITH SITUATION 4, I HAVE TRIED MULTIPLE NUMBERS AND STILL CANNOT FIGURE IT OUT. ALSO FOR 1. LEASE PAYMENTS I HAVE ALSO

I NEED HELP WITH SITUATION 4, I HAVE TRIED MULTIPLE NUMBERS AND STILL CANNOT FIGURE IT OUT. ALSO FOR 1. LEASE PAYMENTS I HAVE ALSO TRIED 1,200,000 AND THAT IS NOT IT!

I NEED HELP WITH SITUATION 4, I HAVE TRIED MULTIPLE NUMBERS AND STILL CANNOT FIGURE IT OUT. ALSO FOR 1. LEASE PAYMENTS I HAVE ALSO TRIED 1,200,000 AND THAT IS NOT IT!

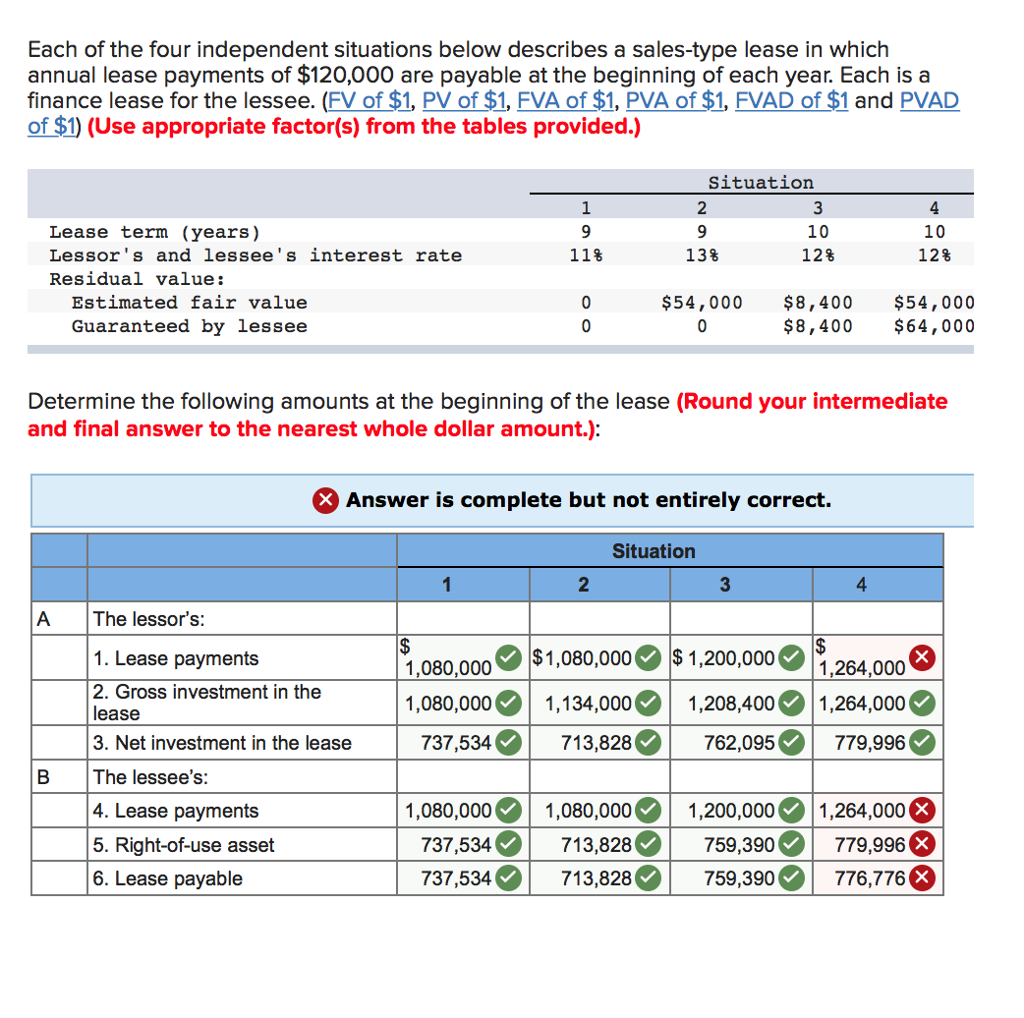

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $120,000 are payable at the beginning of each year. Each is a finance lease for the lessee. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Situation Lease term (years) Lessor's and lessee' s interest rate Residual value: 10 12% 10 12% 11% 13% Estimated fair value Guaranteed by lessee $54,000 $8,400 $54,000 $8,400 $64, 000 Determine the following amounts at the beginning of the lease (Round your intermediate and final answer to the nearest whole dollar amount.) Answer is complete but not entirely correct. Situation 1 2 3 4 A The lessor's: 1. Lease payments 2. Gross investment in the lease 3. Net investment in the lease $ 1,080,000 $ 1,200,000 ,264,000 1,208,400 1,264,000 | 737,5340| 713,8280| 762,095 779,996 1,080,000 1,080,000 1,134,000 B The lessee's: 1,200,0001,264,000 737,534 | 713,828 759,390 | 779,996 776,776 1,080,000 4. Lease payments 5. Right-of-use asset 6. Lease payable 1,080,000 737,534 713,828 759,390

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts