Question: I need help with the 5 treasury spread...I would also appreciate a bit of explanation ..thank you For the Surfaces Division, MDFA only has one

I need help with the 5 treasury spread...I would also appreciate a bit of explanation ..thank you

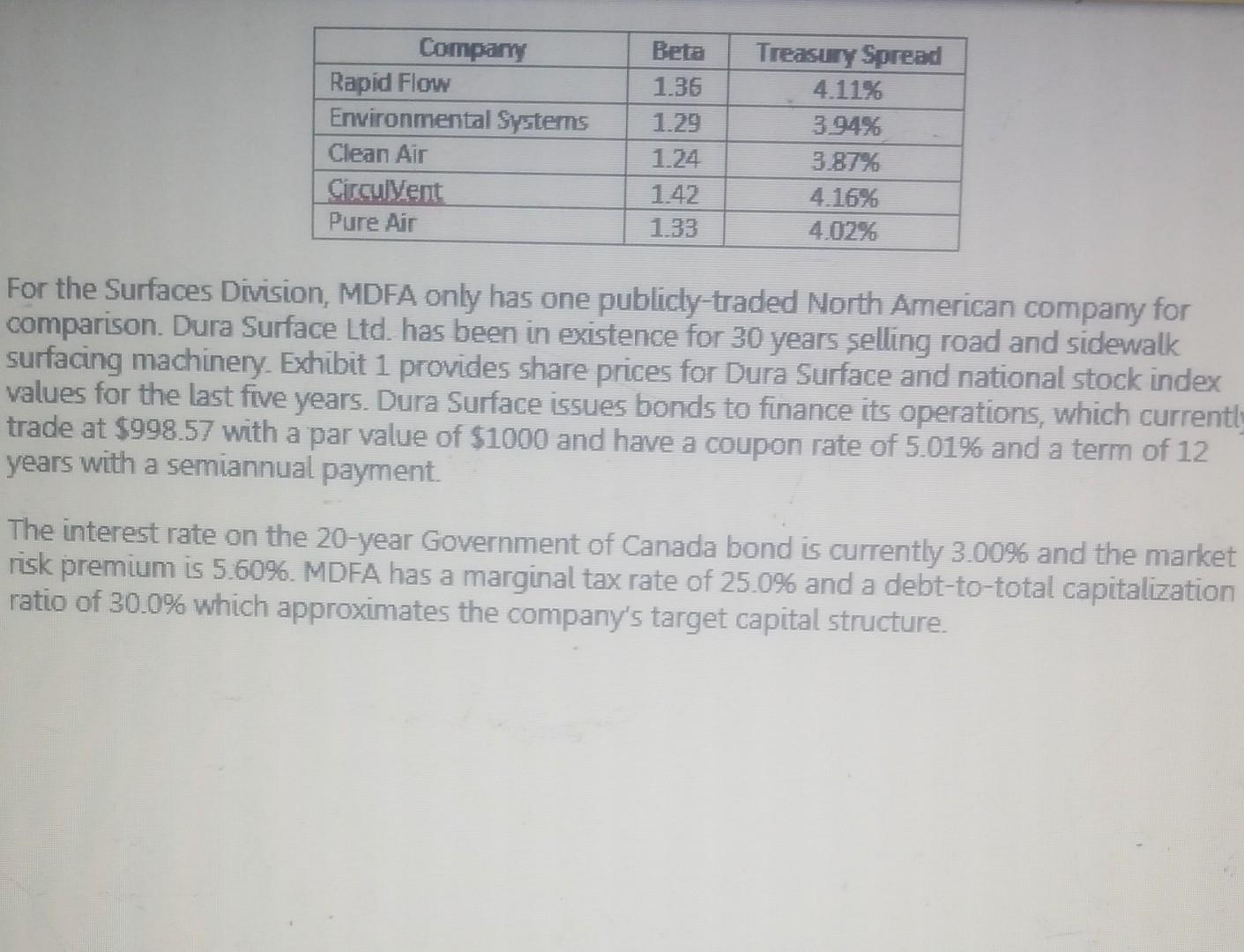

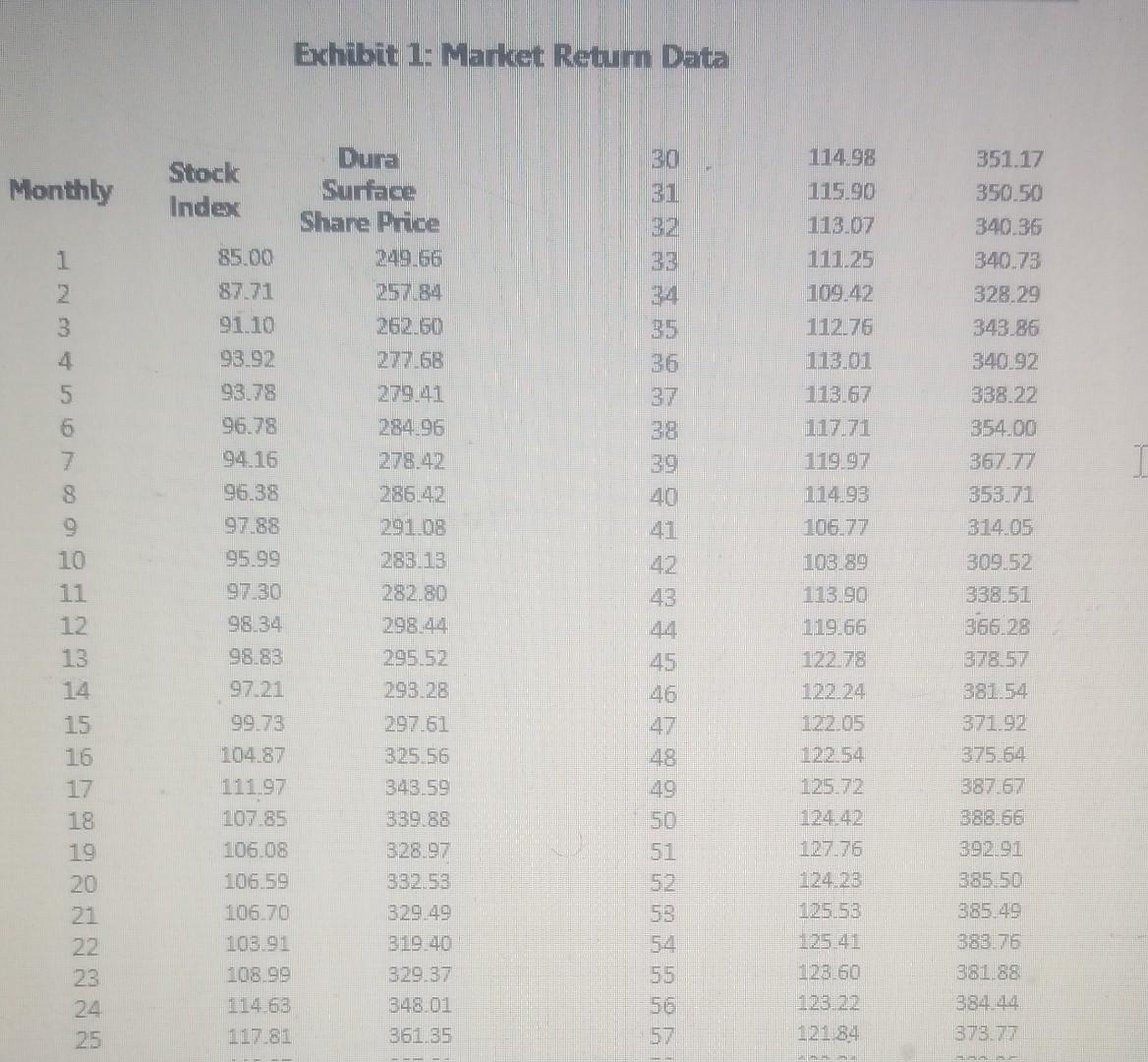

For the Surfaces Division, MDFA only has one publicly-traded Morth American company for comparison. Dura Surface Ltd. has been in existence for 30 years selling road and sidewalk surfacing machinery. Exhibit 1 provides share prices for Dura Surface and national stock index values for the last five years. Dura Surface issues bonds to finance its operations, which currentl trade at $998.57 with a par value of $1000 and have a coupon rate of 5.01% and a term of 12 years with a semiannual payment. The interest rate on the 20-year Government of Canada bond is currently 3.00% and the market risk premium is 5.60\%. MDFA has a marginal tax rate of 25.0% and a debt-to-total capitalization ratio of 30.0% which approximates the company's target capital structure. Exhibit 1: Market Reburn Data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts