Question: I need help with the amounts in the balance sheet accounts and comprehensive income statement At December 31, 2017, the available-for-sale debt portfolio for Sheffield

I need help with the amounts in the balance sheet accounts and comprehensive income statement

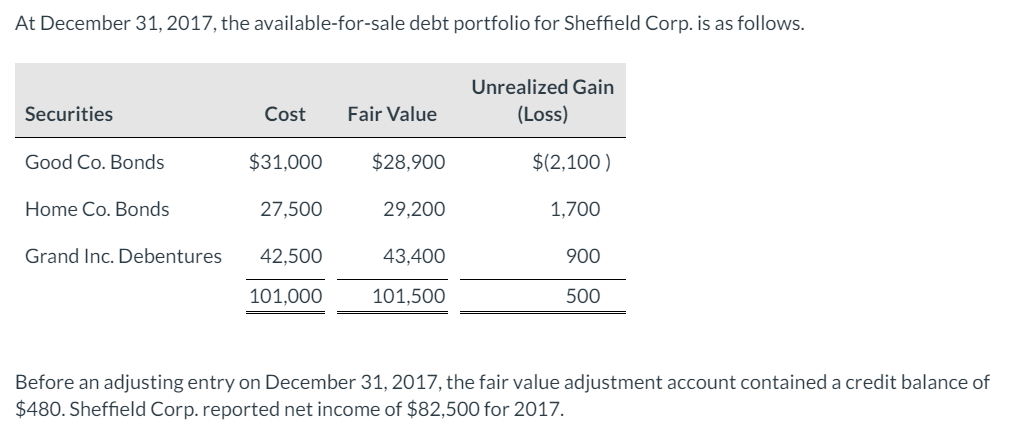

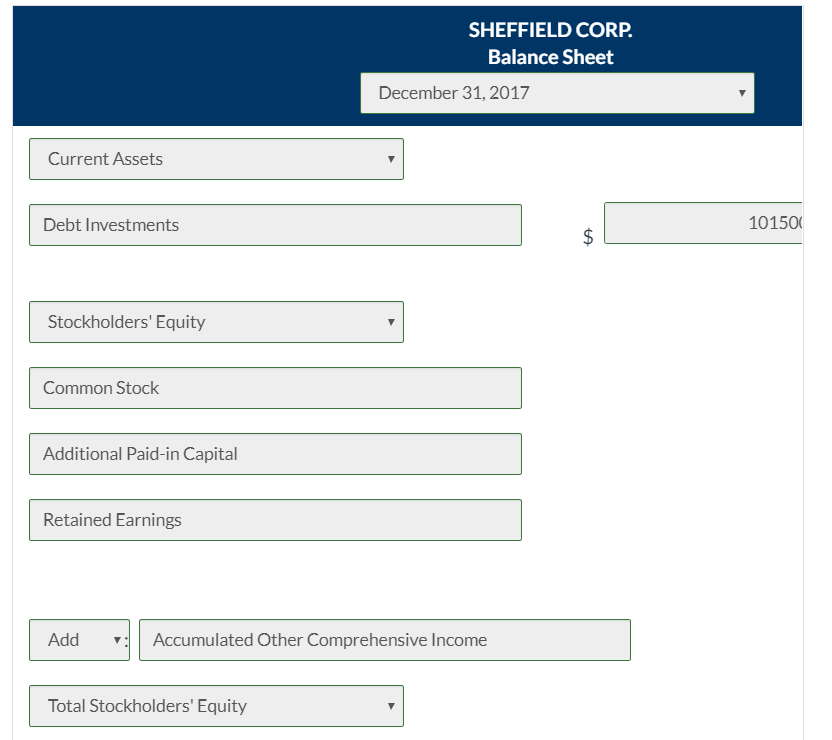

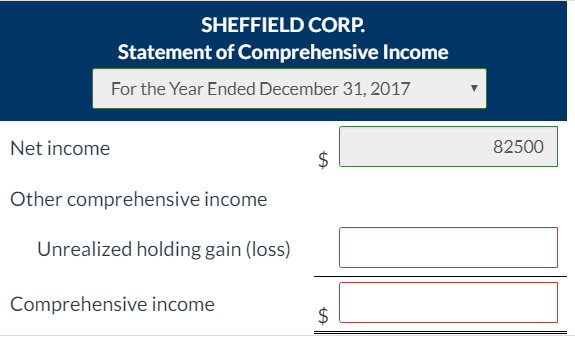

At December 31, 2017, the available-for-sale debt portfolio for Sheffield Corp. is as follows. Unrealized Gain (Loss) Securities Cost Fair Value Good Co. Bonds $31,000 $28,900 $(2,100) Home Co. Bonds 27,500 29,200 1,700 Grand Inc. Debentures 42,500 900 43,400 101,500 101,000 500 Before an adjusting entry on December 31, 2017, the fair value adjustment account contained a credit balance of $480. Sheffield Corp.reported net income of $82,500 for 2017. SHEFFIELD CORP. Balance Sheet December 31, 2017 Current Assets Debt Investments 101500 Stockholders' Equity Common Stock Additional Paid-in Capital Retained Earnings Add : Accumulated Other Comprehensive Income Total Stockholders' Equity SHEFFIELD CORP. Statement of Comprehensive Income For the Year Ended December 31, 2017 Net income 82500 Other comprehensive income Unrealized holding gain (loss) Comprehensive income At December 31, 2017, the available-for-sale debt portfolio for Sheffield Corp. is as follows. Unrealized Gain (Loss) Securities Cost Fair Value Good Co. Bonds $31,000 $28,900 $(2,100) Home Co. Bonds 27,500 29,200 1,700 Grand Inc. Debentures 42,500 900 43,400 101,500 101,000 500 Before an adjusting entry on December 31, 2017, the fair value adjustment account contained a credit balance of $480. Sheffield Corp.reported net income of $82,500 for 2017. SHEFFIELD CORP. Balance Sheet December 31, 2017 Current Assets Debt Investments 101500 Stockholders' Equity Common Stock Additional Paid-in Capital Retained Earnings Add : Accumulated Other Comprehensive Income Total Stockholders' Equity SHEFFIELD CORP. Statement of Comprehensive Income For the Year Ended December 31, 2017 Net income 82500 Other comprehensive income Unrealized holding gain (loss) Comprehensive income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts