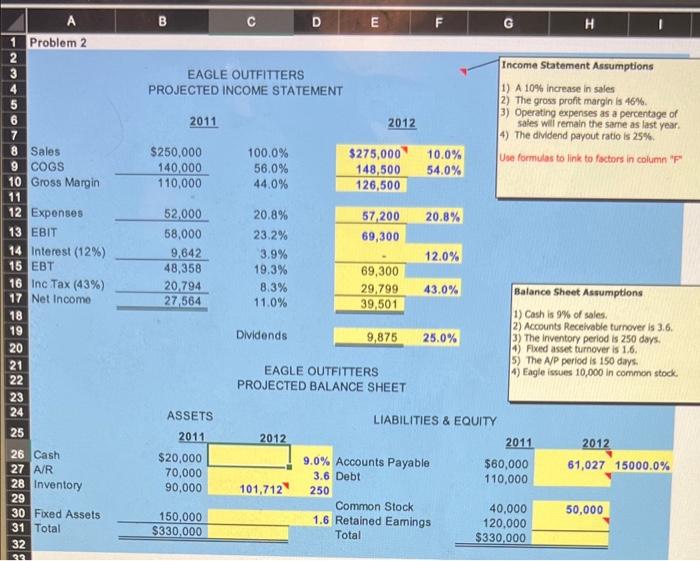

Question: I need help with the assets and Liabilities & Equity section. with excel references 1 Problem 2 2 3 4 8 Sales 9 COGS 10

1 Problem 2 2 3 4 8 Sales 9 COGS 10 Gross Margin 11 12 Expenses 13 EBIT 14 Interest (12%) 15 EBT 16 Inc Tax (43%) 17 Net Income 18 19 20 21 22 23 24 25 26 Cash 27 A/R 28 Inventory 29 30 Fixed Assets 31 Total 32 DE B EAGLE OUTFITTERS PROJECTED INCOME STATEMENT 2011 $250,000 100.0% $275,000 140,000 56.0% 148,500 110,000 44.0% 126,500 52,000 20.8% 57,200 58,000 23.2% 69,300 9,642 3.9% 48,358 19.3% 69,300 20,794 8.3% 29,799 27,564 11.0% 39,501 Dividends 9,875 EAGLE OUTFITTERS PROJECTED BALANCE SHEET ASSETS 2011 2012 $20,000 70,000 90,000 101,712 150,000 $330,000 2012 F 9.0% Accounts Payable 3.6 Debt 250 Common Stock 1.6 Retained Eamings Total G H Income Statement Assumptions 1) A 10% increase in sales 2) The gross profit margin is 46%. 3) Operating expenses as a percentage of sales will remain the same as last year. 4) The dividend payout ratio is 25%. Use formulas to link to factors in column "P" Balance Sheet Assumptions 1) Cash is 9% of sales. 2) Accounts Receivable turnover is 3.6. 3) The inventory period is 250 days. 4) Fixed asset turnover is 1.6. 5) The A/P period is 150 days. 4) Eagle issues 10,000 in common stock. 2011 2012 $60,000 61,027 15000.0% 110,000 40,000 50,000 120,000 $330,000 10.0% 54.0% 20.8% 12.0% 43.0% 25.0% LIABILITIES & EQUITY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts