Question: I NEED HELP WITH THE BLANKS PLEASE. ALL INFORMATION NEEDED ARE ON THE FIRST 3 PAGES THANK YOU. Instructions Comprehensive Problem 8-1 Trish Himple owns

I NEED HELP WITH THE BLANKS PLEASE. """ALL INFORMATION NEEDED ARE ON THE FIRST 3 PAGES""""

THANK YOU.

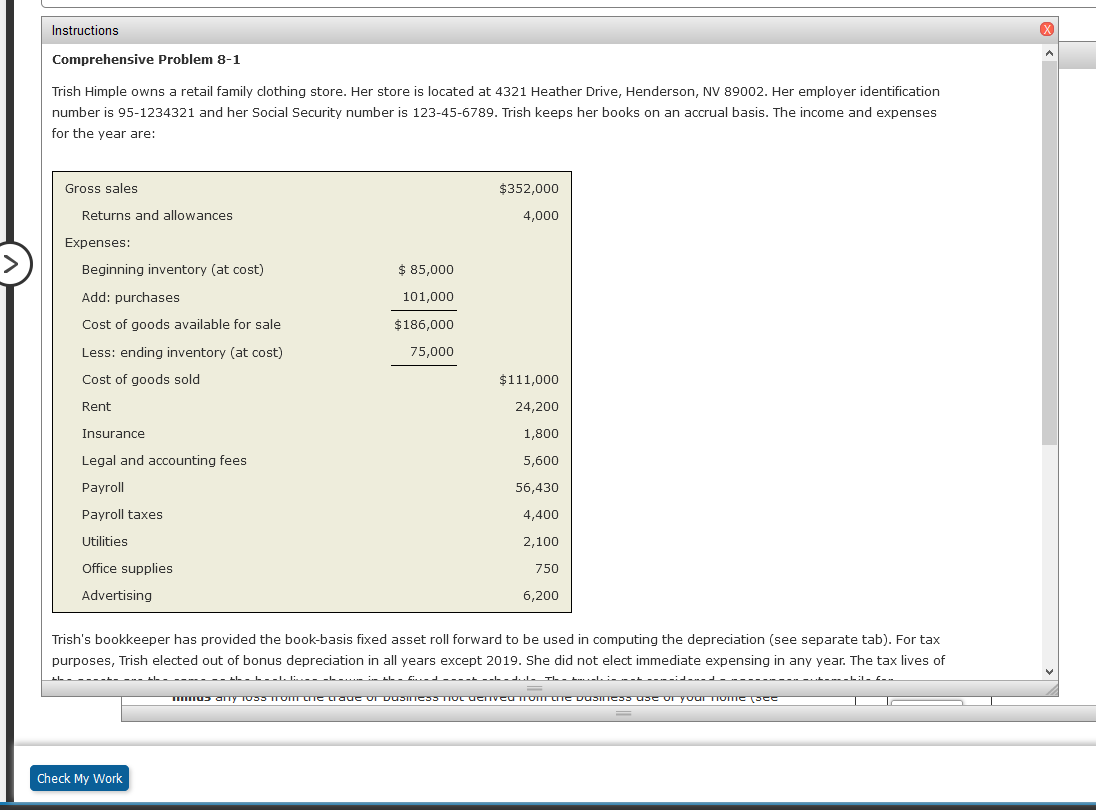

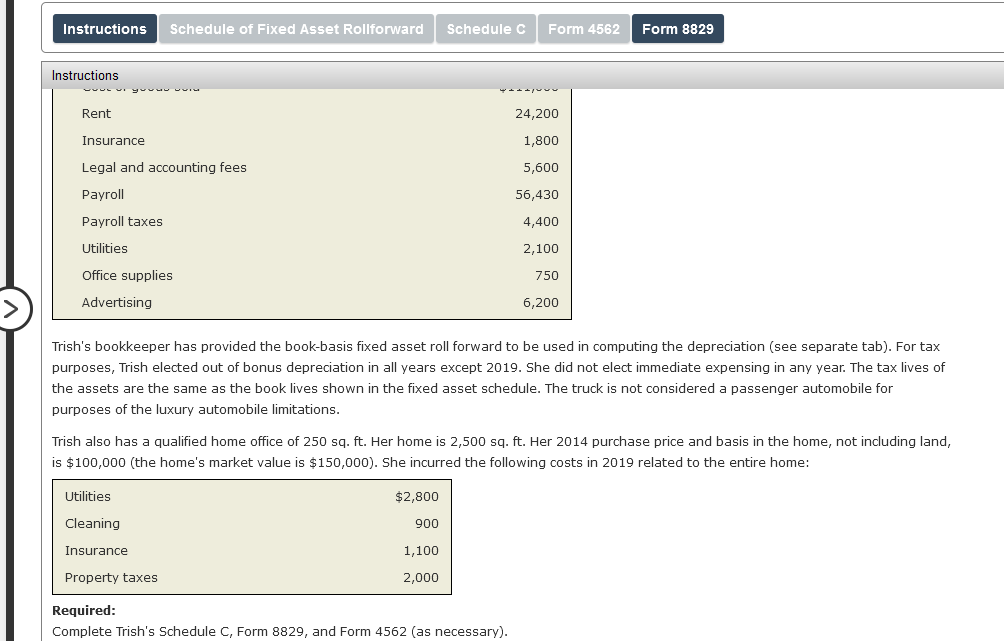

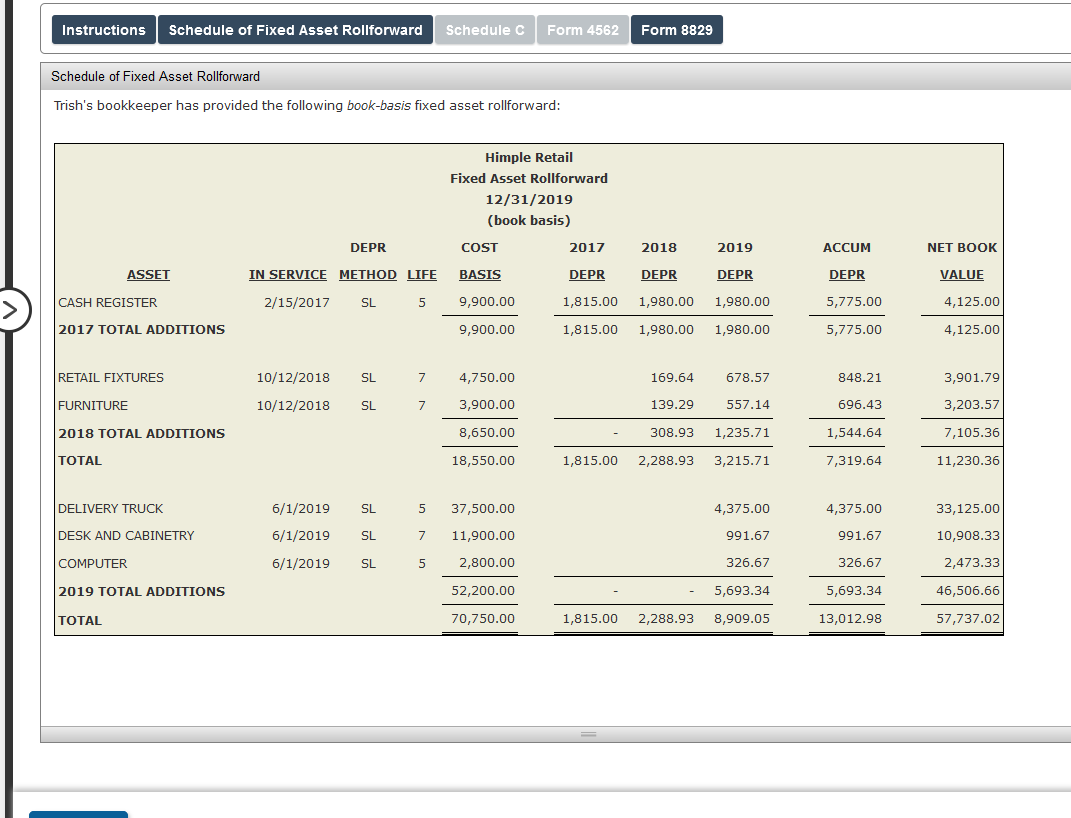

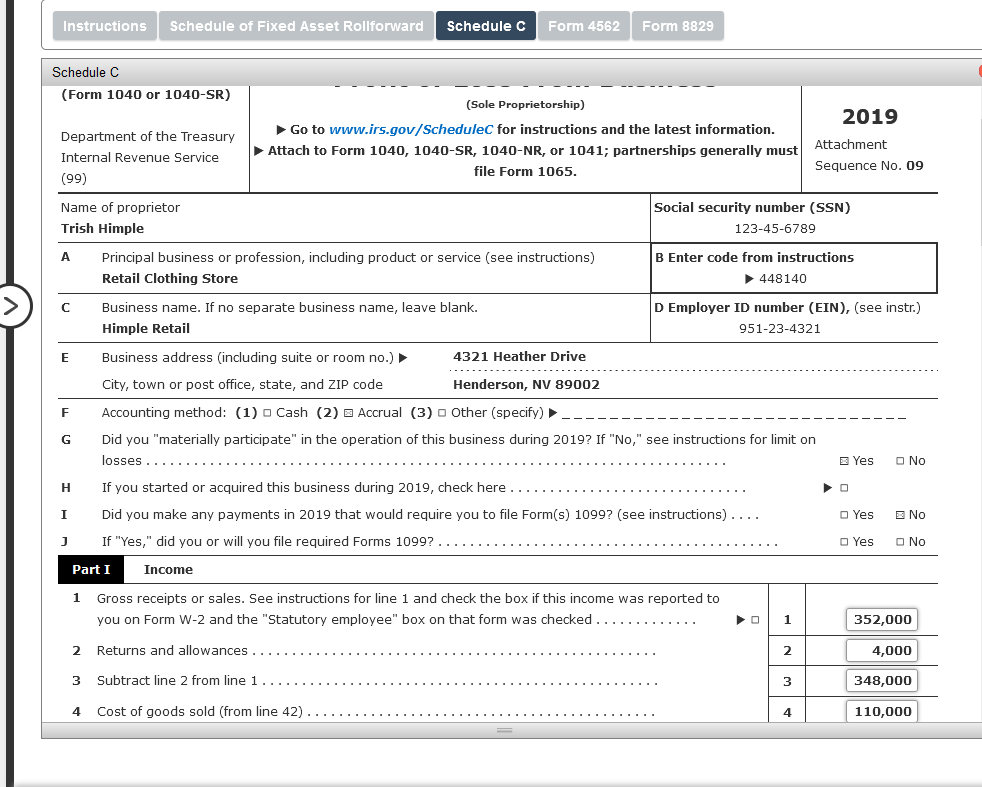

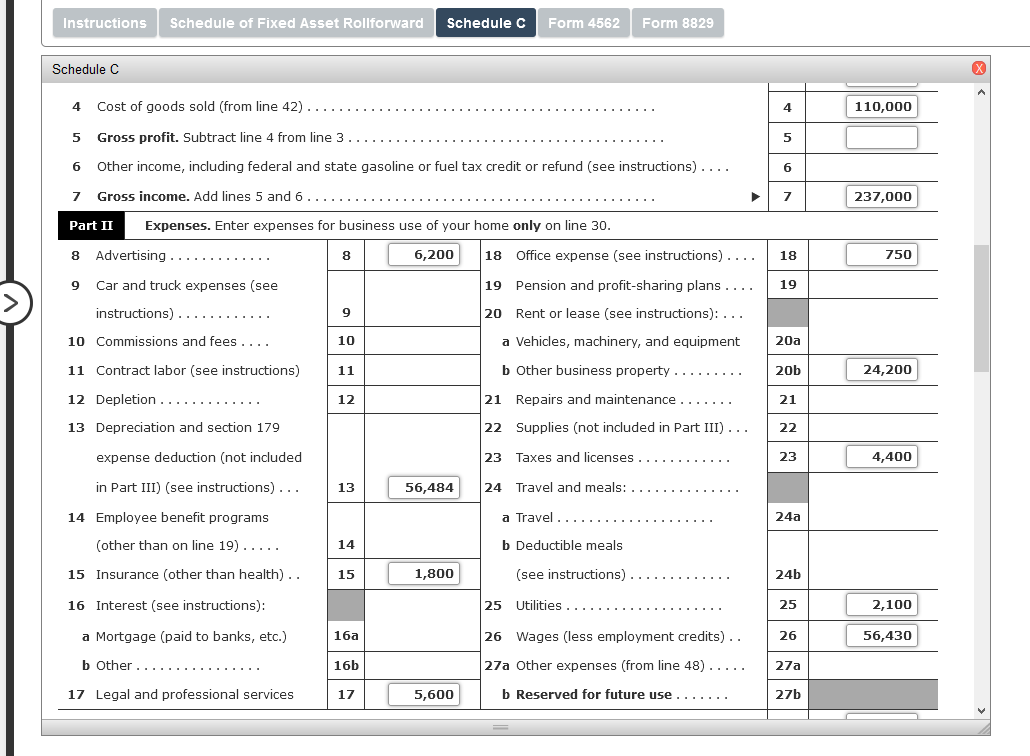

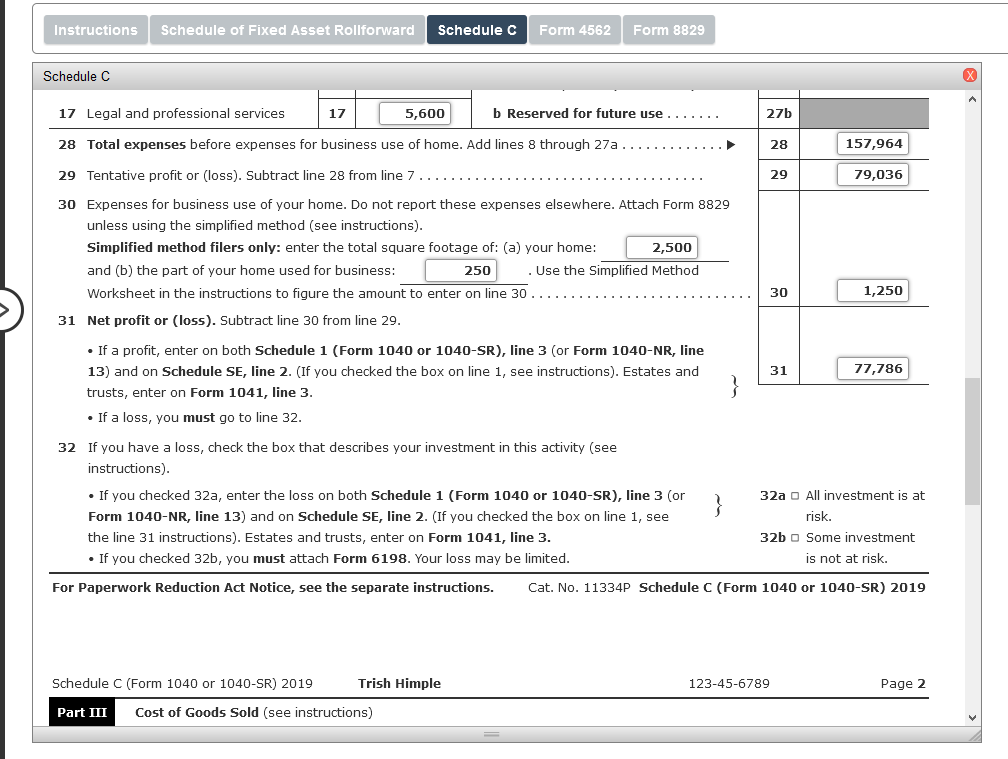

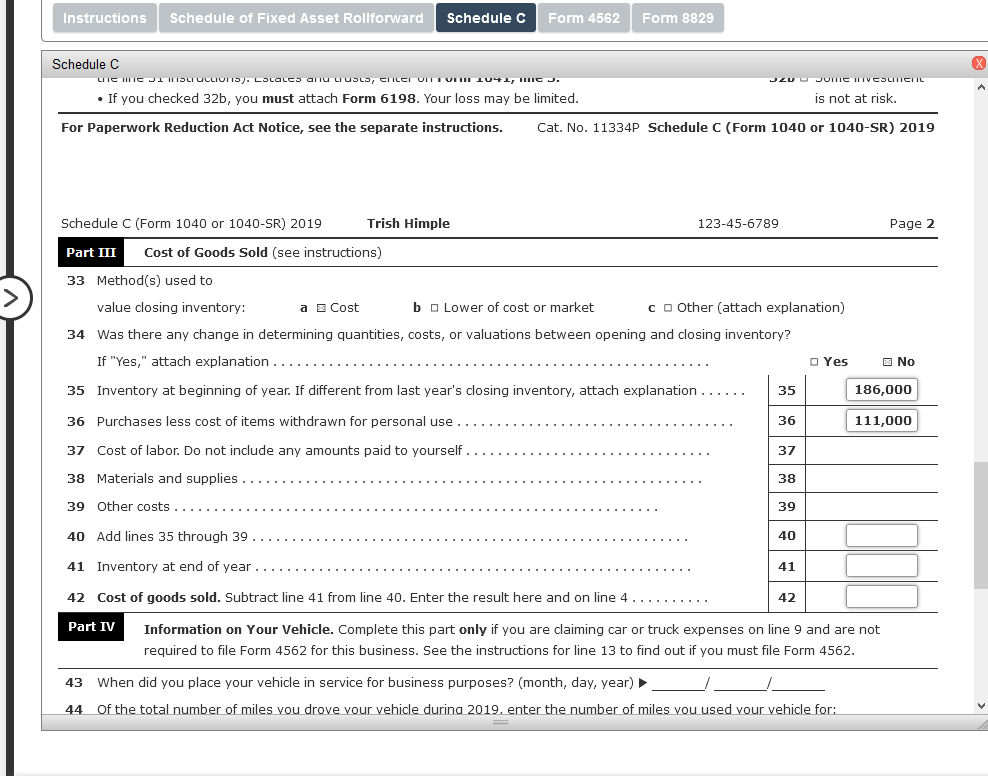

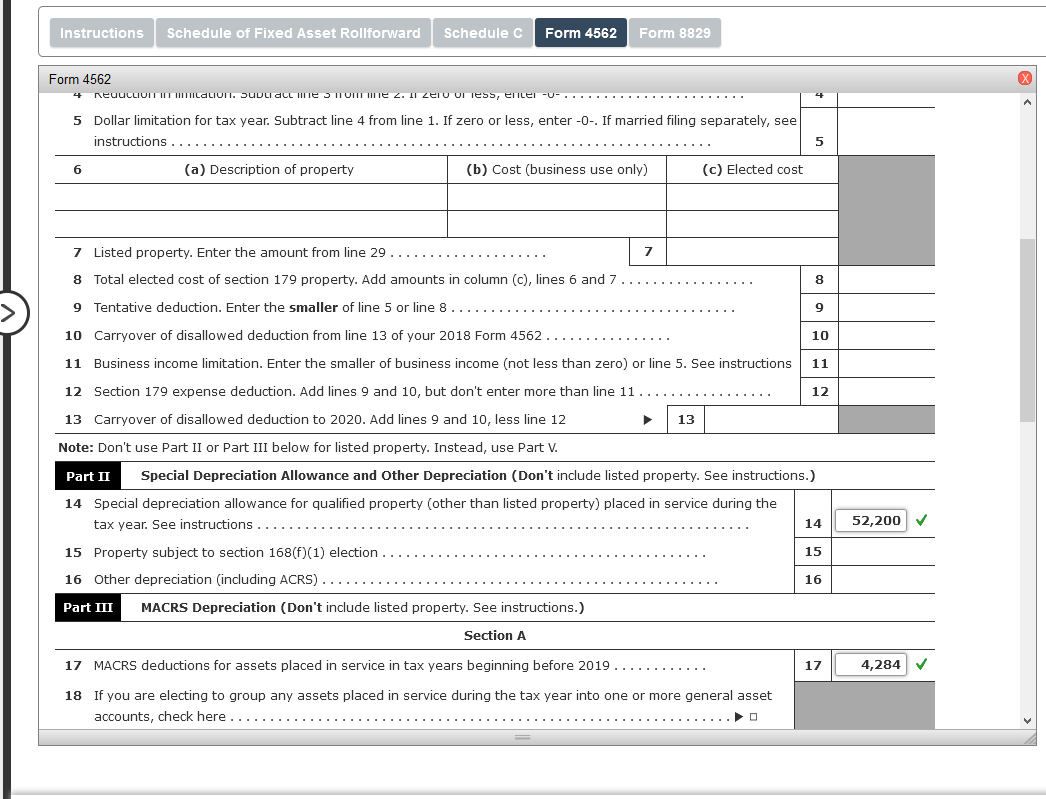

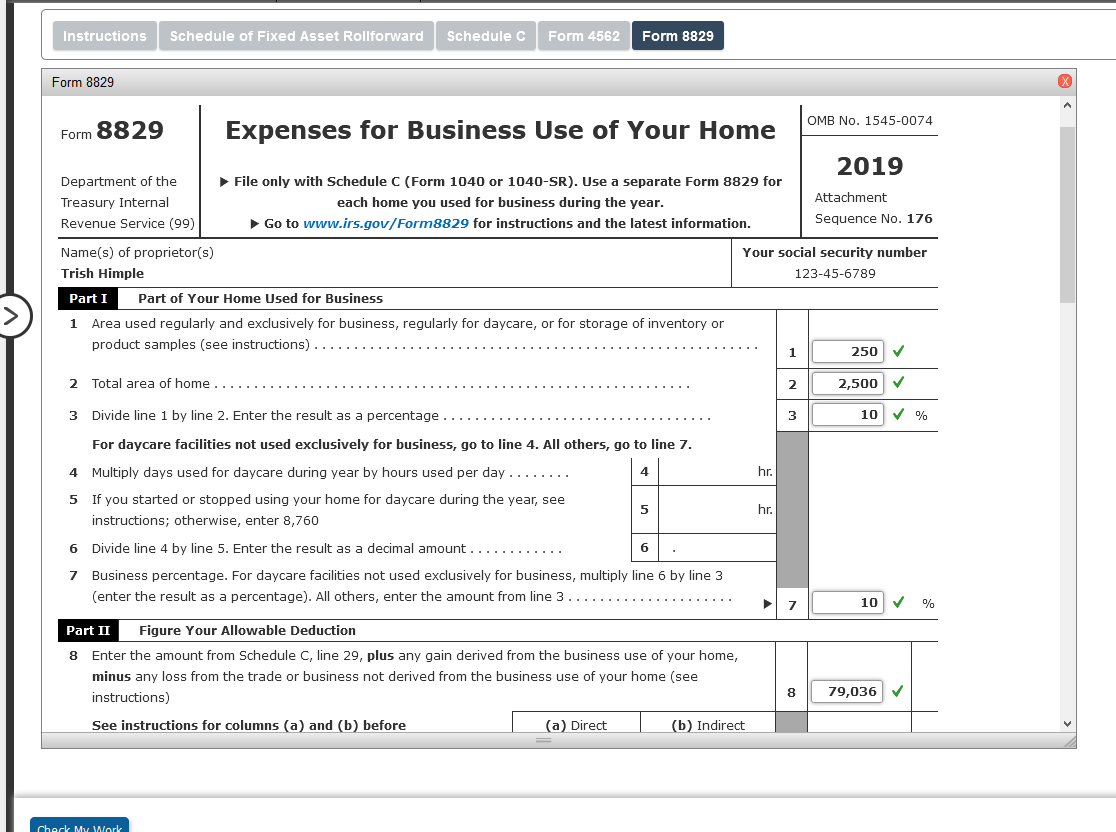

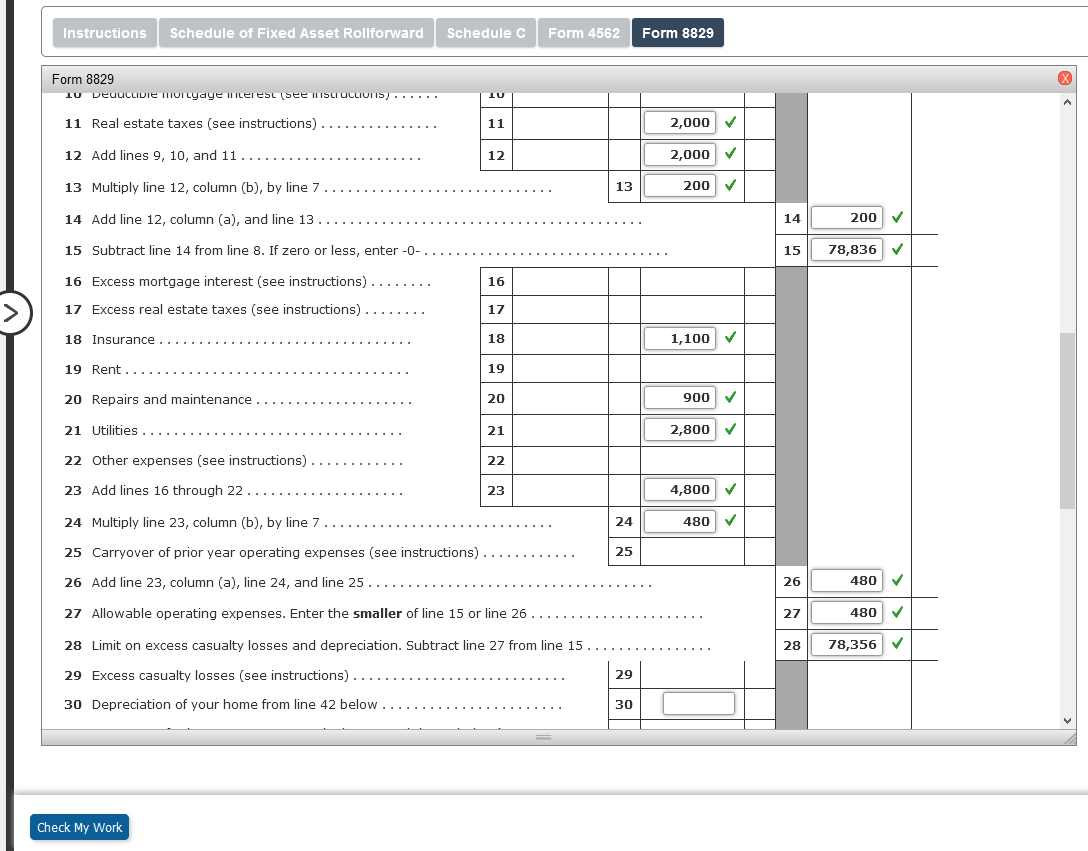

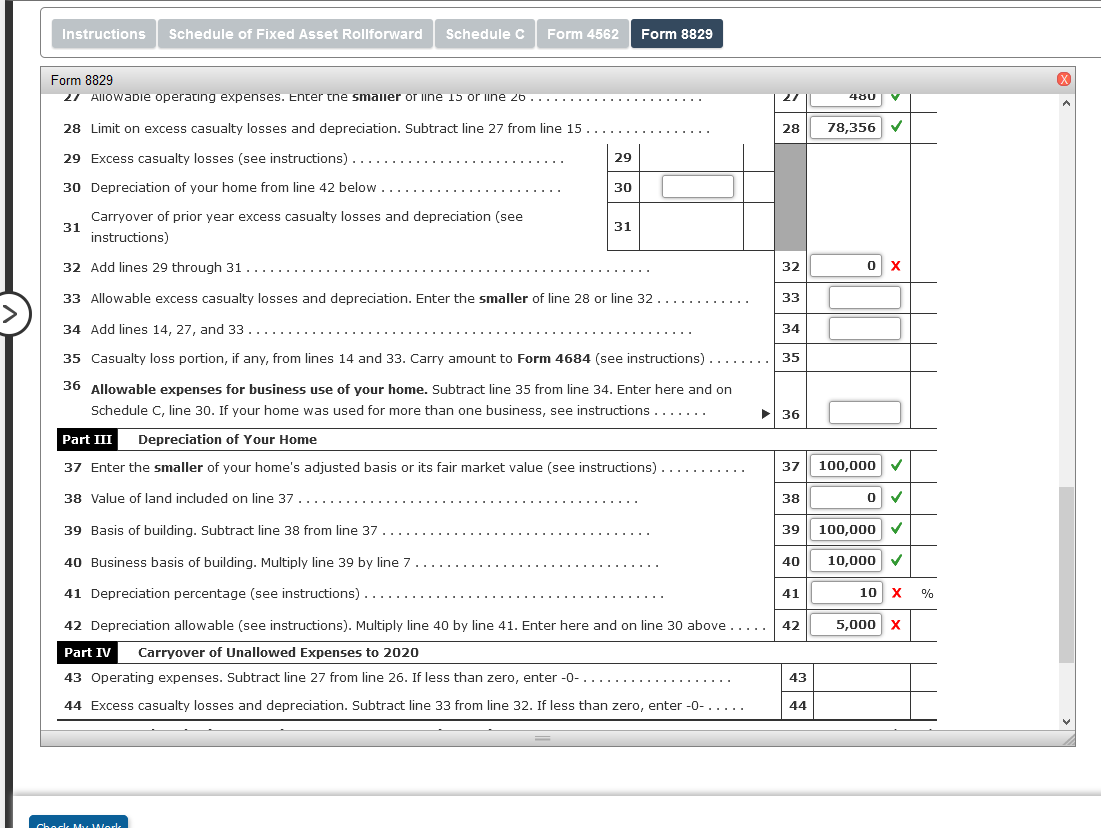

Instructions Comprehensive Problem 8-1 Trish Himple owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95-1234321 and her Social Security number is 123-45-6789. Trish keeps her books on an accrual basis. The income and expenses for the year are: Gross sales $352,000 4,000 Returns and allowances Expenses: Beginning inventory (at cost) $ 85,000 Add: purchases 101,000 Cost of goods available for sale $186,000 75,000 Less: ending inventory (at cost) Cost of goods sold $111,000 Rent 24,200 Insurance 1,800 5,600 Legal and accounting fees Payroll 56,430 Payroll taxes 4,400 Utilities 2,100 750 Office supplies Advertising 6,200 Trish's bookkeeper has provided the book-basis fixed asset roll forward to be used in computing the depreciation (see separate tab). For tax purposes, Trish elected out of bonus depreciation in all years except 2019. She did not elect immediate expensing in any year. The tax lives of ---LLLLLLLLL LL LLLLLLLL TITUS CITY TUOS TOM HIC LIGUE OI DUSTICSSTOL UCHTVCU TOTI CHE DUSTICOS use or your TOMIC SCC Check My Work Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Instructions Rent 24,200 Insurance 1,800 5,600 Legal and accounting fees Payroll Payroll taxes 56,430 4,400 Utilities 2,100 Office supplies 750 Advertising 6,200 Trish's bookkeeper has provided the book-basis fixed asset roll forward to be used in computing the depreciation (see separate tab). For tax purposes, Trish elected out of bonus depreciation in all years except 2019. She did not elect immediate expensing in any year. The tax lives of the assets are the same as the book lives shown in the fixed asset schedule. The truck is not considered a passenger automobile for purposes of the luxury automobile limitations. Trish also has a qualified home office of 250 sq. ft. Her home is 2,500 sq. ft. Her 2014 purchase price and basis in the home, not including land, is $100,000 (the home's market value is $150,000). She incurred the following costs related to the entire Utilities $2,800 Cleaning 900 Insurance 1,100 Property taxes 2,000 Required: Complete Trish's Schedule C, Form 8829, and Form 4562 (as necessary). Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Schedule of Fixed Asset Rollforward Trish's bookkeeper has provided the following book-basis fixed asset rollforward: Himple Retail Fixed Asset Rollforward 12/31/2019 (book basis) DEPR COST 2017 2018 2019 ACCUM NET BOOK ASSET BASIS DEPR DEPR DEPR DEPR VALUE IN SERVICE METHOD LIFE 2/15/2017 SL 5 CASH REGISTER 9,900.00 1,815.00 1,980.00 1,980.00 5,775.00 4,125.00 2017 TOTAL ADDITIONS 9,900.00 1,815.00 1,980.00 1,980.00 5,775.00 4,125.00 10/12/2018 SL 7 4,750.00 169.64 678.57 848.21 3,901.79 10/12/2018 SL 7 3,900.00 139.29 557.14 696.43 3,203.57 RETAIL FIXTURES FURNITURE 2018 TOTAL ADDITIONS TOTAL 8,650.00 308.93 1,235.71 1,544.64 7,105.36 18,550.00 1,815.00 2,288.93 3,215.71 7,319.64 11,230.36 DELIVERY TRUCK 6/1/2019 SL 5 37,500.00 4,375.00 33,125.00 4,375.00 991.67 DESK AND CABINETRY 6/1/2019 SL 7 11,900.00 991.67 10,908.33 COMPUTER 6/1/2019 SL 5 2,800.00 326.67 326.67 2,473.33 2019 TOTAL ADDITIONS 52,200.00 5,693.34 5,693.34 46,506.66 TOTAL 70,750.00 1,815.00 2,288.93 8,909.05 13,012.98 57,737.02 Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Schedule C (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service (99) (Sole Proprietorship) Go to www.irs.gov/Schedule for instructions and the latest information. Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships generally must file Form 1065. 2019 Attachment Sequence No. 09 Name of proprietor Trish Himple Social security number (SSN) 123-45-6789 A Principal business or profession, including product or service (see instructions) Retail Clothing Store B Enter code from instructions 448140 Business name. If no separate business name, leave blank. Himple Retail D Employer ID number (EIN), (see instr.) 951-23-4321 E .......... F Business address (including suite or room no.) 4321 Heather Drive City, town or post office, state, and ZIP code Henderson, NV 89002 Accounting method: (1) O Cash (2) Accrual (3) Other (specify) Did you "materially participate" in the operation of this business during 2019? If "No," see instructions for limit on losses G Yes No H I If you started or acquired this business during 2019, check here Did you make any payments in 2019 that would require you to file Form(s) 1099? (see instructions) .... If "Yes," did you or will you file required Forms 1099? Yes E No J Yes No Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. 1 352,000 2 Returns and allowances 2 4,000 3 Subtract line 2 from line 1 3 348,000 4 Cost of goods sold (from line 42) 4 4 110,000 Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Schedule C 4 Cost of goods sold (from line 42). 4 110,000 5 Gross profit. Subtract line 4 from line 3.... 5 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions).... 6 7 237,000 7 Gross income. Add lines 5 and 6 Part II Expenses. Enter expenses for business use of your home only on line 30. Advertising 8 6,200 18 Office expense (see instructions).... 8 18 750 9 Car and truck expenses (see 19 Pension and profit-sharing plans .... 19 instructions).. 9 20 Rent or lease (see instructions): ... 10 Commissions and fees .... 10 a Vehicles, machinery, and equipment 20a 11 Contract labor (see instructions) 11 b Other business property 20b 24,200 12 Depletion .. 12 21 Repairs and maintenance 21 13 Depreciation and section 179 22 Supplies (not included in Part III) ... 22 expense deduction (not included 23 Taxes and licenses.. 23 4,400 in Part III) (see instructions)... 13 56,484 24 Travel and meals: 14 Employee benefit programs a Travel .. 24a (other than on line 19)..... 14 b Deductible meals 15 Insurance (other than health).. 15 1,800 (see instructions) 24b 16 Interest (see instructions): 25 Utilities 25 2,100 a Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits).. 26 56,430 b Other ....... 16b 27a Other expenses (from line 48)..... 27a 17 Legal and professional services 17 5,600 b Reserved for future use....... 27b Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Schedule C 17 Legal and professional services 17 5,600 b Reserved for future use 27b 28 Total expenses before expenses for business use of home. Add lines 8 through 27a 28 157,964 29 79,036 29 Tentative profit or loss). Subtract line 28 from line 7 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only: enter the total square footage of: (a) your home: 2,500 and (b) the part of your home used for business: 250 Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 31 Net profit or (loss). Subtract line 30 from line 29. 30 1,250 31 77,786 If a profit, enter on both Schedule 1 (Form 1040 or 1040-SR), line 3 (or Form 1040-NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. If a loss, you must go to line 32. 32 If you have a loss, check the box that describes your investment in this activity (see instructions). . If you checked 32a, enter the loss on both Schedule 1 (Form 1040 or 1040-SR), line 3 (or Form 1040-NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on Form 1041, line 3. If you checked 32b, you must attach Form 6198. Your loss may be limited. 32a All investment is at risk. 32b O Some investment is not at risk. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040 or 1040-SR) 2019 Schedule C (Form 1040 or 1040-SR) 2019 Trish Himple 123-45-6789 Page 2 Part III Cost of Goods Sold (see instructions) Instructions Schedule of Fixed Asset Rollforward Schedule Form 4562 Form 8829 x Schedule C LIICHIC DISLI ULLIONS). LOLaLCS anu u USLS, CHILCI OH TUIHI 1041, HIC J. If you checked 32b, you must attach Form 6198. Your loss may be limited. JUU JUMICHIVCLITICII is not at risk. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040 or 1040-SR) 2019 Schedule C (Form 1040 or 1040-SR) 2019 Trish Himple 123-45-6789 Page 2 Part III Cost of Goods Sold (see instructions) 33 Method(s) used to value closing inventory: a Cost b Lower of cost or market CoOther (attach explanation) 34 Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If "Yes," attach explanation .. 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation Yes No 35 186,000 36 Purchases less cost of items withdrawn for personal use. 36 111,000 37 Cost of labor. Do not include any amounts paid to yourself. 37 38 Materials and supplies 38 39 Other costs 39 40 Add lines 35 through 39 40 41 Inventory at end of year .. 41 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4...... 42 Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. 43 When did you place your vehicle in service for business purposes? (month, day, year) 44 Of the total number of miles vou drove your vehicle durina 2019, enter the number of miles you used vour vehicle for: Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 4 Form 4562 neuuLLIUI IR ITTILALUIT. DUDL ALL HITETTONITE Z. II Zeru viess, encei-u- 5 Dollar limitation for tax year. Subtract line from line 1. If zero or less, enter-O-. If married filing separately, see instructions 5 6 (a) Description of property (b) Cost (business use only) (c) Elected cost 7 7 Listed property. Enter the amount from line 29 8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 9 Tentative deduction. Enter the smaller of line 5 or line 8 8 9 10 10 Carryover of disallowed deduction from line 13 of your 2018 Form 4562.. 11 Business income limitation. Enter the smaller of business income (not less than zero) or line 5. See instructions 11 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 12 13 Carryover of disallowed deduction to 2020. Add lines 9 and 10, less line 12 13 52,200 Note: Don't use Part II or Part III below for listed property. Instead, use Part V. Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year. See instructions.. 14 15 Property subject to section 168(f)(1) election 15 16 Other depreciation (including ACRS) 16 Part III MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2019.... 17 4,284 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Form 8829 OMB No. 1545-0074 Form 8829 Expenses for Business Use of Your Home 2019 Department of the File only with Schedule C (Form 1040 or 1040-SR). Use a separate Form 8829 for Treasury Internal each home you used for business during the year. Attachment Revenue Service (99) Go to www.irs.gov/Form8829 for instructions and the latest information. Sequence No. 176 Name(s) of proprietor(s) Your social security number Trish Himple 123-45-6789 Part I Part of Your Home Used for Business Area used regularly and exclusively for business, regularly for daycare, or for storage of inventory or product samples (see instructions) 1 250 1 2 Total area of home. 2 2,500 3 Divide line 1 by line 2. Enter the result as a percentage 3 10 % hr. For daycare facilities not used exclusively for business, go to line 4. All others, go to line 7. 4 Multiply days used for daycare during year by hours used per day..... 4 5 If you started or stopped using your home for daycare during the year, see 5 instructions; otherwise, enter 8,760 hr. 6 Divide line 4 by line 5. Enter the result as a decimal amount ... 6 7 Business percentage. For daycare facilities not used exclusively for business, multiply line 6 by line 3 (enter the result as a percentage). All others, enter the amount from line 3 7 10 % Part II Figure Your Allowable Deduction 8 Enter the amount from Schedule C, line 29, plus any gain derived from the business use of your home, minus any loss from the trade or business not derived from the business use of your home (see instructions) See instructions for columns (a) and (b) before (a) Direct (b) Indirect 8 79,036 Check My Work Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Form 8829 IU Deuuclide MILYaye lilerest (See IISLI UCLIOTIS) IU 11 Real estate taxes (see instructions) 11 2,000 12 Add lines 9, 10, and 11.. 12 2,000 13 Multiply line 12, column (b), by line 7 13 200 14 Add line 12, column (a), and line 13.. 14 200 15 Subtract line 14 from line 8. If zero or less, enter-O- 15 78,836 16 16 Excess mortgage interest (see instructions) 17 Excess real estate taxes (see instructions) 17 18 Insurance 18 1,100 19 Rent 19 20 Repairs and maintenance 20 900 21 Utilities 21 2,800 22 Other expenses (see instructions) 22 23 Add lines 16 through 22 23 4,800 24 Multiply line 23, column (b), by line 7 24 480 25 Carryover of prior year operating expenses (see instructions) 25 26 Add line 23, column (a), line 24, and line 25.. 26 480 27 Allowable operating expenses. Enter the smaller of line 15 or line 26. 27 480 28 Limit on excess casualty losses and depreciation. Subtract line 27 from line 15 28 78,356 29 Excess casualty losses (see instructions). 29 30 Depreciation of your home from line 42 below 30 Check My Work Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 x Form 8829 21 Allowanie operating expenses. Enter the smaller or ine 15 or ine 26 27 430 28 Limit on excess casualty losses and depreciation. Subtract line 27 from line 15 28 78,356 29 Excess casualty losses (see instructions) 29 30 Depreciation of your home from line 42 below ... 30 31 Carryover of prior year excess casualty losses and depreciation (see instructions) 31 32 Add lines 29 through 31 ... 32 0 x 33 Allowable excess casualty losses and depreciation. Enter the smaller of line 28 or line 32 33 34 Add lines 14, 27, and 33... 34 35 Casualty loss portion, if any, from lines 14 and 33. Carry amount to Form 4684 (see instructions). 35 36 36 Allowable expenses for business use of your home. Subtract line 35 from line 34. Enter here and on Schedule C, line 30. If your home was used for more than one business, see instructions ....... Part III Depreciation of Your Home 37 Enter the smaller of your home's adjusted basis or its fair market value (see instructions). 37 100,000 38 Value of land included on line 37. 38 0 39 Basis of building. Subtract line 38 from line 37 39 100,000 40 Business basis of building. Multiply line 39 by line 7 40 10,000 41 Depreciation percentage (see instructions). 41 10 X % 5,000 X 42 Depreciation allowable (see instructions). Multiply line 40 by line 41. Enter here and on line 30 above..... 42 Part IV Carryover of Unallowed Expenses to 2020 43 Operating expenses. Subtract line 27 from line 26. If less than zero, enter-O-. 43 44 Excess casualty losses and depreciation. Subtract line 33 from line 32. If less than zero, enter-0-..... 44 chock Marl Instructions Comprehensive Problem 8-1 Trish Himple owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95-1234321 and her Social Security number is 123-45-6789. Trish keeps her books on an accrual basis. The income and expenses for the year are: Gross sales $352,000 4,000 Returns and allowances Expenses: Beginning inventory (at cost) $ 85,000 Add: purchases 101,000 Cost of goods available for sale $186,000 75,000 Less: ending inventory (at cost) Cost of goods sold $111,000 Rent 24,200 Insurance 1,800 5,600 Legal and accounting fees Payroll 56,430 Payroll taxes 4,400 Utilities 2,100 750 Office supplies Advertising 6,200 Trish's bookkeeper has provided the book-basis fixed asset roll forward to be used in computing the depreciation (see separate tab). For tax purposes, Trish elected out of bonus depreciation in all years except 2019. She did not elect immediate expensing in any year. The tax lives of ---LLLLLLLLL LL LLLLLLLL TITUS CITY TUOS TOM HIC LIGUE OI DUSTICSSTOL UCHTVCU TOTI CHE DUSTICOS use or your TOMIC SCC Check My Work Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Instructions Rent 24,200 Insurance 1,800 5,600 Legal and accounting fees Payroll Payroll taxes 56,430 4,400 Utilities 2,100 Office supplies 750 Advertising 6,200 Trish's bookkeeper has provided the book-basis fixed asset roll forward to be used in computing the depreciation (see separate tab). For tax purposes, Trish elected out of bonus depreciation in all years except 2019. She did not elect immediate expensing in any year. The tax lives of the assets are the same as the book lives shown in the fixed asset schedule. The truck is not considered a passenger automobile for purposes of the luxury automobile limitations. Trish also has a qualified home office of 250 sq. ft. Her home is 2,500 sq. ft. Her 2014 purchase price and basis in the home, not including land, is $100,000 (the home's market value is $150,000). She incurred the following costs related to the entire Utilities $2,800 Cleaning 900 Insurance 1,100 Property taxes 2,000 Required: Complete Trish's Schedule C, Form 8829, and Form 4562 (as necessary). Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Schedule of Fixed Asset Rollforward Trish's bookkeeper has provided the following book-basis fixed asset rollforward: Himple Retail Fixed Asset Rollforward 12/31/2019 (book basis) DEPR COST 2017 2018 2019 ACCUM NET BOOK ASSET BASIS DEPR DEPR DEPR DEPR VALUE IN SERVICE METHOD LIFE 2/15/2017 SL 5 CASH REGISTER 9,900.00 1,815.00 1,980.00 1,980.00 5,775.00 4,125.00 2017 TOTAL ADDITIONS 9,900.00 1,815.00 1,980.00 1,980.00 5,775.00 4,125.00 10/12/2018 SL 7 4,750.00 169.64 678.57 848.21 3,901.79 10/12/2018 SL 7 3,900.00 139.29 557.14 696.43 3,203.57 RETAIL FIXTURES FURNITURE 2018 TOTAL ADDITIONS TOTAL 8,650.00 308.93 1,235.71 1,544.64 7,105.36 18,550.00 1,815.00 2,288.93 3,215.71 7,319.64 11,230.36 DELIVERY TRUCK 6/1/2019 SL 5 37,500.00 4,375.00 33,125.00 4,375.00 991.67 DESK AND CABINETRY 6/1/2019 SL 7 11,900.00 991.67 10,908.33 COMPUTER 6/1/2019 SL 5 2,800.00 326.67 326.67 2,473.33 2019 TOTAL ADDITIONS 52,200.00 5,693.34 5,693.34 46,506.66 TOTAL 70,750.00 1,815.00 2,288.93 8,909.05 13,012.98 57,737.02 Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Schedule C (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service (99) (Sole Proprietorship) Go to www.irs.gov/Schedule for instructions and the latest information. Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships generally must file Form 1065. 2019 Attachment Sequence No. 09 Name of proprietor Trish Himple Social security number (SSN) 123-45-6789 A Principal business or profession, including product or service (see instructions) Retail Clothing Store B Enter code from instructions 448140 Business name. If no separate business name, leave blank. Himple Retail D Employer ID number (EIN), (see instr.) 951-23-4321 E .......... F Business address (including suite or room no.) 4321 Heather Drive City, town or post office, state, and ZIP code Henderson, NV 89002 Accounting method: (1) O Cash (2) Accrual (3) Other (specify) Did you "materially participate" in the operation of this business during 2019? If "No," see instructions for limit on losses G Yes No H I If you started or acquired this business during 2019, check here Did you make any payments in 2019 that would require you to file Form(s) 1099? (see instructions) .... If "Yes," did you or will you file required Forms 1099? Yes E No J Yes No Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. 1 352,000 2 Returns and allowances 2 4,000 3 Subtract line 2 from line 1 3 348,000 4 Cost of goods sold (from line 42) 4 4 110,000 Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Schedule C 4 Cost of goods sold (from line 42). 4 110,000 5 Gross profit. Subtract line 4 from line 3.... 5 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions).... 6 7 237,000 7 Gross income. Add lines 5 and 6 Part II Expenses. Enter expenses for business use of your home only on line 30. Advertising 8 6,200 18 Office expense (see instructions).... 8 18 750 9 Car and truck expenses (see 19 Pension and profit-sharing plans .... 19 instructions).. 9 20 Rent or lease (see instructions): ... 10 Commissions and fees .... 10 a Vehicles, machinery, and equipment 20a 11 Contract labor (see instructions) 11 b Other business property 20b 24,200 12 Depletion .. 12 21 Repairs and maintenance 21 13 Depreciation and section 179 22 Supplies (not included in Part III) ... 22 expense deduction (not included 23 Taxes and licenses.. 23 4,400 in Part III) (see instructions)... 13 56,484 24 Travel and meals: 14 Employee benefit programs a Travel .. 24a (other than on line 19)..... 14 b Deductible meals 15 Insurance (other than health).. 15 1,800 (see instructions) 24b 16 Interest (see instructions): 25 Utilities 25 2,100 a Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits).. 26 56,430 b Other ....... 16b 27a Other expenses (from line 48)..... 27a 17 Legal and professional services 17 5,600 b Reserved for future use....... 27b Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Schedule C 17 Legal and professional services 17 5,600 b Reserved for future use 27b 28 Total expenses before expenses for business use of home. Add lines 8 through 27a 28 157,964 29 79,036 29 Tentative profit or loss). Subtract line 28 from line 7 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only: enter the total square footage of: (a) your home: 2,500 and (b) the part of your home used for business: 250 Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 31 Net profit or (loss). Subtract line 30 from line 29. 30 1,250 31 77,786 If a profit, enter on both Schedule 1 (Form 1040 or 1040-SR), line 3 (or Form 1040-NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. If a loss, you must go to line 32. 32 If you have a loss, check the box that describes your investment in this activity (see instructions). . If you checked 32a, enter the loss on both Schedule 1 (Form 1040 or 1040-SR), line 3 (or Form 1040-NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on Form 1041, line 3. If you checked 32b, you must attach Form 6198. Your loss may be limited. 32a All investment is at risk. 32b O Some investment is not at risk. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040 or 1040-SR) 2019 Schedule C (Form 1040 or 1040-SR) 2019 Trish Himple 123-45-6789 Page 2 Part III Cost of Goods Sold (see instructions) Instructions Schedule of Fixed Asset Rollforward Schedule Form 4562 Form 8829 x Schedule C LIICHIC DISLI ULLIONS). LOLaLCS anu u USLS, CHILCI OH TUIHI 1041, HIC J. If you checked 32b, you must attach Form 6198. Your loss may be limited. JUU JUMICHIVCLITICII is not at risk. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040 or 1040-SR) 2019 Schedule C (Form 1040 or 1040-SR) 2019 Trish Himple 123-45-6789 Page 2 Part III Cost of Goods Sold (see instructions) 33 Method(s) used to value closing inventory: a Cost b Lower of cost or market CoOther (attach explanation) 34 Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If "Yes," attach explanation .. 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation Yes No 35 186,000 36 Purchases less cost of items withdrawn for personal use. 36 111,000 37 Cost of labor. Do not include any amounts paid to yourself. 37 38 Materials and supplies 38 39 Other costs 39 40 Add lines 35 through 39 40 41 Inventory at end of year .. 41 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4...... 42 Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. 43 When did you place your vehicle in service for business purposes? (month, day, year) 44 Of the total number of miles vou drove your vehicle durina 2019, enter the number of miles you used vour vehicle for: Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 4 Form 4562 neuuLLIUI IR ITTILALUIT. DUDL ALL HITETTONITE Z. II Zeru viess, encei-u- 5 Dollar limitation for tax year. Subtract line from line 1. If zero or less, enter-O-. If married filing separately, see instructions 5 6 (a) Description of property (b) Cost (business use only) (c) Elected cost 7 7 Listed property. Enter the amount from line 29 8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 9 Tentative deduction. Enter the smaller of line 5 or line 8 8 9 10 10 Carryover of disallowed deduction from line 13 of your 2018 Form 4562.. 11 Business income limitation. Enter the smaller of business income (not less than zero) or line 5. See instructions 11 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 12 13 Carryover of disallowed deduction to 2020. Add lines 9 and 10, less line 12 13 52,200 Note: Don't use Part II or Part III below for listed property. Instead, use Part V. Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year. See instructions.. 14 15 Property subject to section 168(f)(1) election 15 16 Other depreciation (including ACRS) 16 Part III MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2019.... 17 4,284 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Form 8829 OMB No. 1545-0074 Form 8829 Expenses for Business Use of Your Home 2019 Department of the File only with Schedule C (Form 1040 or 1040-SR). Use a separate Form 8829 for Treasury Internal each home you used for business during the year. Attachment Revenue Service (99) Go to www.irs.gov/Form8829 for instructions and the latest information. Sequence No. 176 Name(s) of proprietor(s) Your social security number Trish Himple 123-45-6789 Part I Part of Your Home Used for Business Area used regularly and exclusively for business, regularly for daycare, or for storage of inventory or product samples (see instructions) 1 250 1 2 Total area of home. 2 2,500 3 Divide line 1 by line 2. Enter the result as a percentage 3 10 % hr. For daycare facilities not used exclusively for business, go to line 4. All others, go to line 7. 4 Multiply days used for daycare during year by hours used per day..... 4 5 If you started or stopped using your home for daycare during the year, see 5 instructions; otherwise, enter 8,760 hr. 6 Divide line 4 by line 5. Enter the result as a decimal amount ... 6 7 Business percentage. For daycare facilities not used exclusively for business, multiply line 6 by line 3 (enter the result as a percentage). All others, enter the amount from line 3 7 10 % Part II Figure Your Allowable Deduction 8 Enter the amount from Schedule C, line 29, plus any gain derived from the business use of your home, minus any loss from the trade or business not derived from the business use of your home (see instructions) See instructions for columns (a) and (b) before (a) Direct (b) Indirect 8 79,036 Check My Work Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 Form 8829 IU Deuuclide MILYaye lilerest (See IISLI UCLIOTIS) IU 11 Real estate taxes (see instructions) 11 2,000 12 Add lines 9, 10, and 11.. 12 2,000 13 Multiply line 12, column (b), by line 7 13 200 14 Add line 12, column (a), and line 13.. 14 200 15 Subtract line 14 from line 8. If zero or less, enter-O- 15 78,836 16 16 Excess mortgage interest (see instructions) 17 Excess real estate taxes (see instructions) 17 18 Insurance 18 1,100 19 Rent 19 20 Repairs and maintenance 20 900 21 Utilities 21 2,800 22 Other expenses (see instructions) 22 23 Add lines 16 through 22 23 4,800 24 Multiply line 23, column (b), by line 7 24 480 25 Carryover of prior year operating expenses (see instructions) 25 26 Add line 23, column (a), line 24, and line 25.. 26 480 27 Allowable operating expenses. Enter the smaller of line 15 or line 26. 27 480 28 Limit on excess casualty losses and depreciation. Subtract line 27 from line 15 28 78,356 29 Excess casualty losses (see instructions). 29 30 Depreciation of your home from line 42 below 30 Check My Work Instructions Schedule of Fixed Asset Rollforward Schedule C Form 4562 Form 8829 x Form 8829 21 Allowanie operating expenses. Enter the smaller or ine 15 or ine 26 27 430 28 Limit on excess casualty losses and depreciation. Subtract line 27 from line 15 28 78,356 29 Excess casualty losses (see instructions) 29 30 Depreciation of your home from line 42 below ... 30 31 Carryover of prior year excess casualty losses and depreciation (see instructions) 31 32 Add lines 29 through 31 ... 32 0 x 33 Allowable excess casualty losses and depreciation. Enter the smaller of line 28 or line 32 33 34 Add lines 14, 27, and 33... 34 35 Casualty loss portion, if any, from lines 14 and 33. Carry amount to Form 4684 (see instructions). 35 36 36 Allowable expenses for business use of your home. Subtract line 35 from line 34. Enter here and on Schedule C, line 30. If your home was used for more than one business, see instructions ....... Part III Depreciation of Your Home 37 Enter the smaller of your home's adjusted basis or its fair market value (see instructions). 37 100,000 38 Value of land included on line 37. 38 0 39 Basis of building. Subtract line 38 from line 37 39 100,000 40 Business basis of building. Multiply line 39 by line 7 40 10,000 41 Depreciation percentage (see instructions). 41 10 X % 5,000 X 42 Depreciation allowable (see instructions). Multiply line 40 by line 41. Enter here and on line 30 above..... 42 Part IV Carryover of Unallowed Expenses to 2020 43 Operating expenses. Subtract line 27 from line 26. If less than zero, enter-O-. 43 44 Excess casualty losses and depreciation. Subtract line 33 from line 32. If less than zero, enter-0-..... 44 chock Marl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts