Question: I need help with the declining balance in part c. here's my work Millco Inc. acquired a machine that cost $1,200,000 early in 2019. The

I need help with the declining balance in part c. here's my work

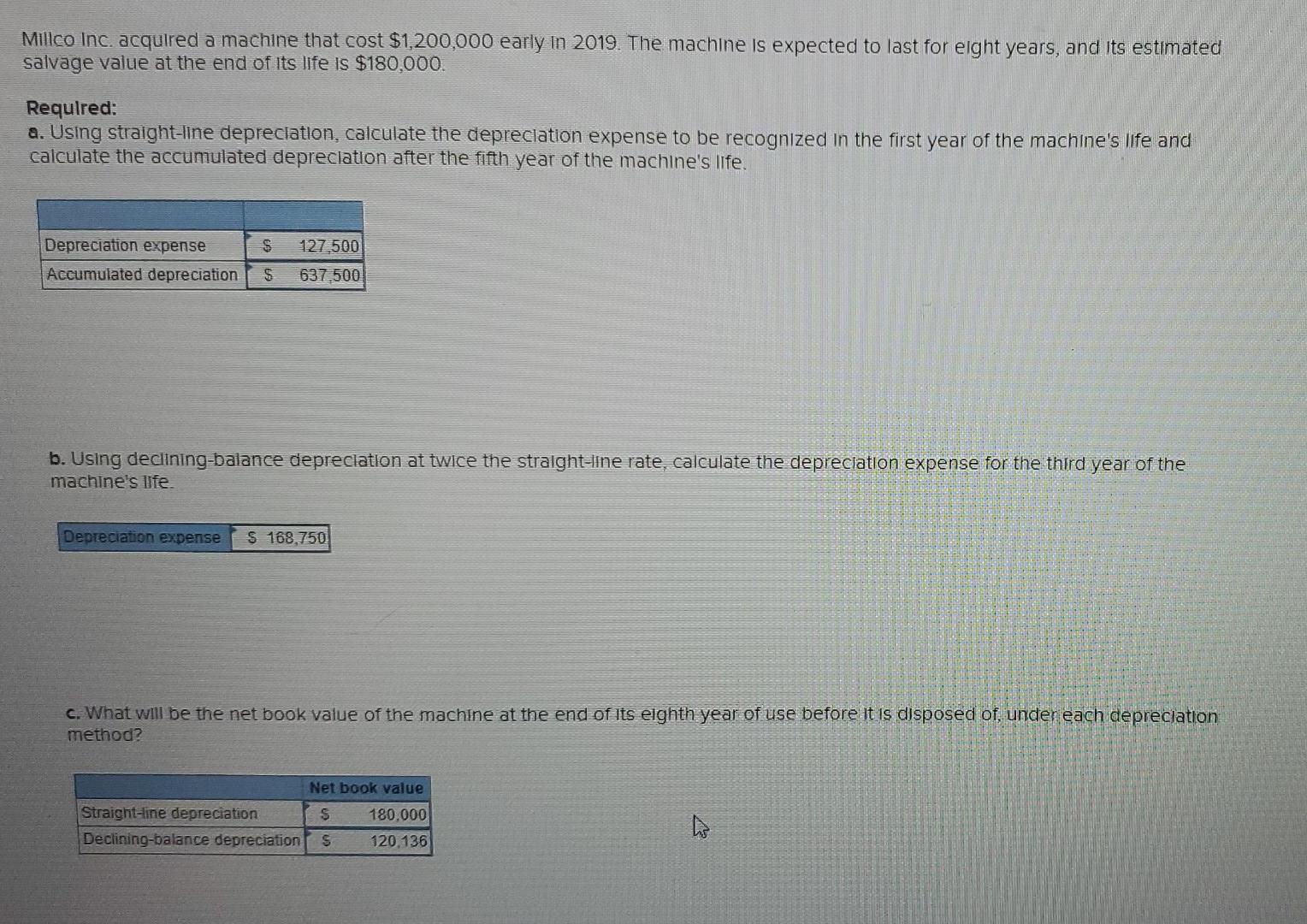

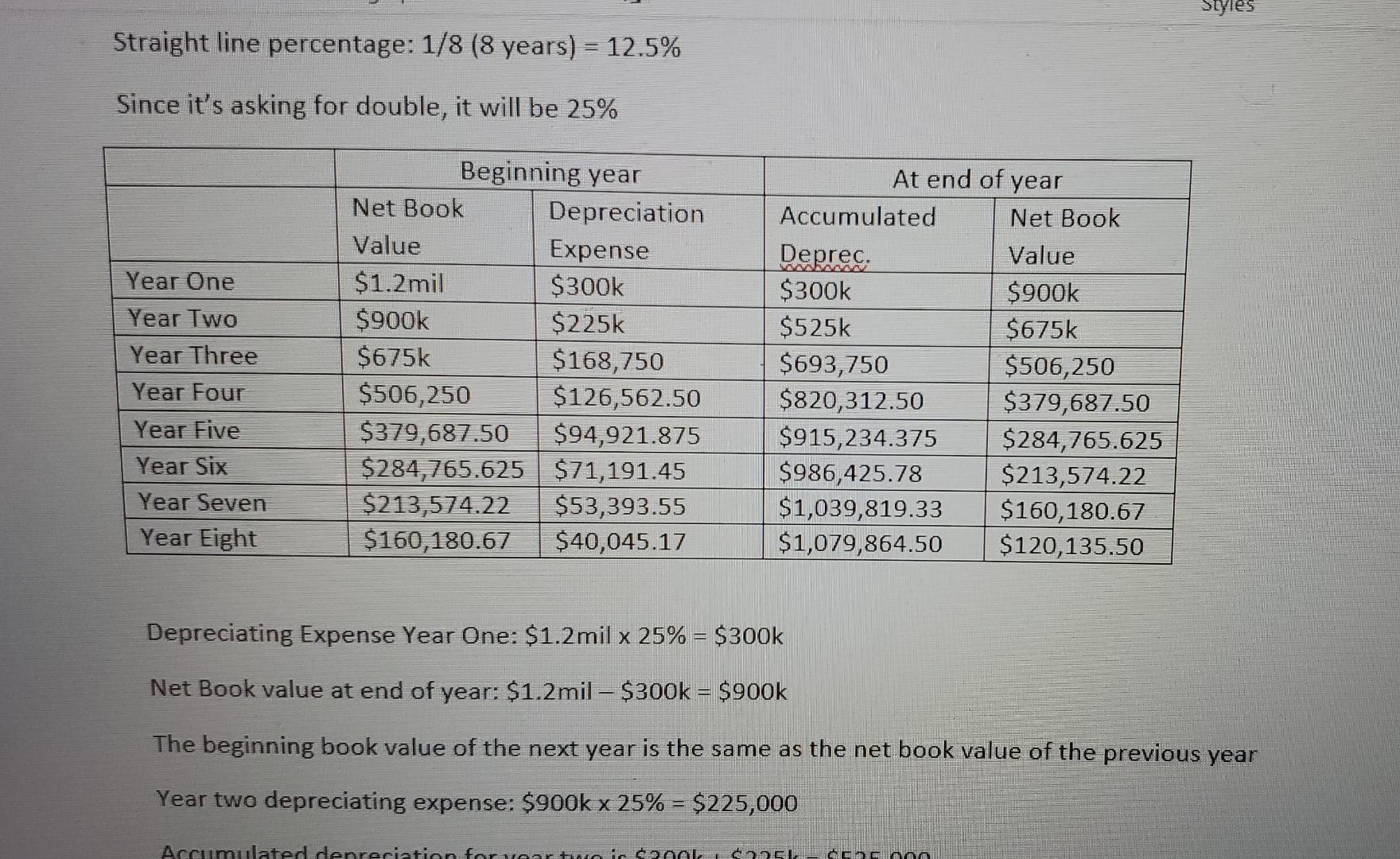

Millco Inc. acquired a machine that cost $1,200,000 early in 2019. The machine is expected to last for elght years, and its estimated salvage value at the end of its life is $180,000. Required: a. Using straight-line depreciation, calculate the depreciation expense to be recognized in the first year of the machine's life and calculate the accumulated depreciation after the fifth year of the machine's life. $ Depreciation expense Accumulated depreciation 127.500 637.500 S b. Using declining-balance depreciation at twice the stralght-line rate, calculate the depreciation expense for the third year of the machine's life. Depreciation expense $ 168,750 c. What will be the net book value of the machine at the end of its eighth year of use before it is disposed of, under each depreciation method? Net book value $ Straight-line depreciation Declining-balance depreciation 180.000 120.136 hs S Styles Straight line percentage: 1/8 (8 years) = 12.5% Since it's asking for double, it will be 25% Year One Year Two Year Three Year Four Year Five Year Six Year Seven Year Eight Beginning year Net Book Depreciation Value Expense $1.2mil $300k $900k $225k $675k $168,750 $506,250 $126,562.50 $379,687.50 $94,921.875 $284,765.625 $71,191.45 $213,574.22 $53,393.55 $160,180.67 $40,045.17 At end of year Accumulated Net Book Deprec. Value $300k $900k $525k $675k $693,750 $506,250 $820,312.50 $379,687.50 $915,234.375 $284,765.625 $986,425.78 $213,574.22 $1,039,819.33 $160,180.67 $1,079,864.50 $120,135.50 Depreciating Expense Year One: $1.2mil x 25% = $300k Net Book value at end of year: $1.2mil - $300k = $900k The beginning book value of the next year is the same as the net book value of the previous year Year two depreciating expense: $900k x 25% = $225,000 Accumulated denreciation for wear todo el Cacao

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts