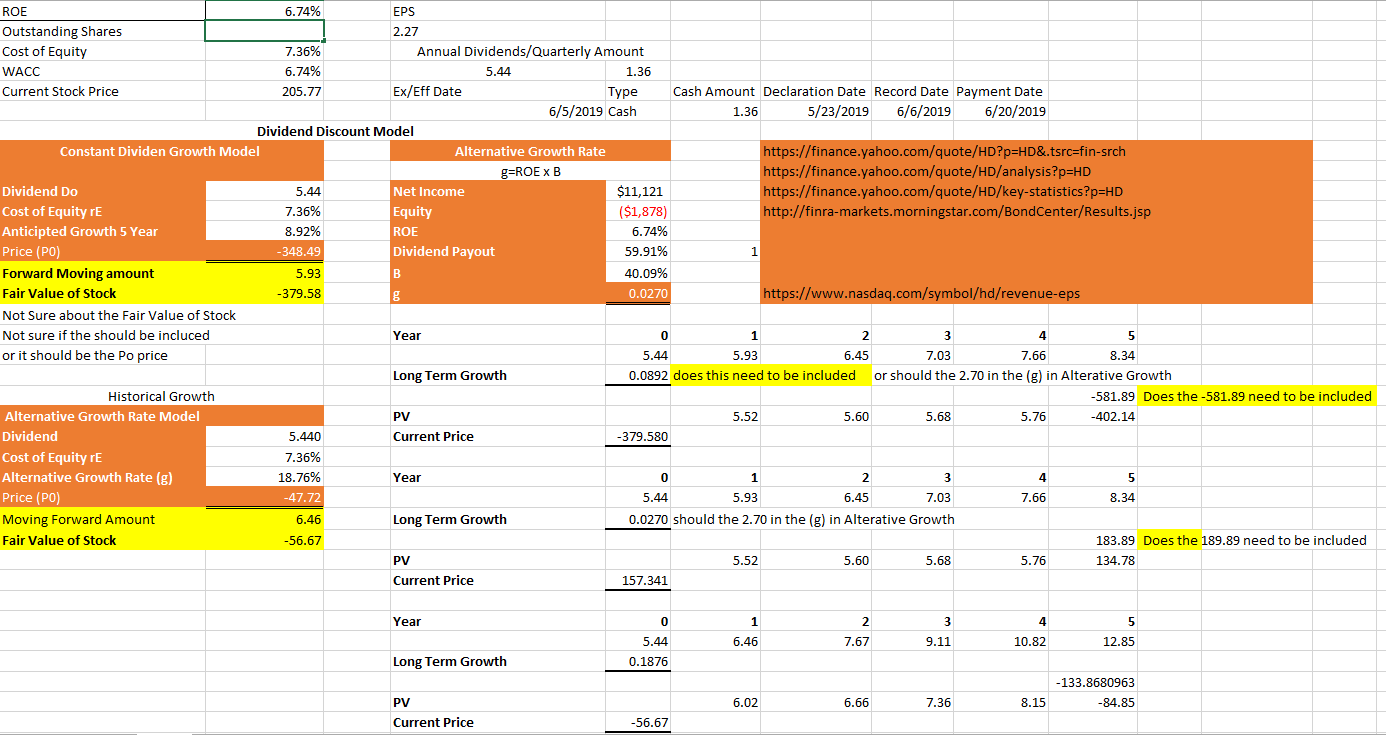

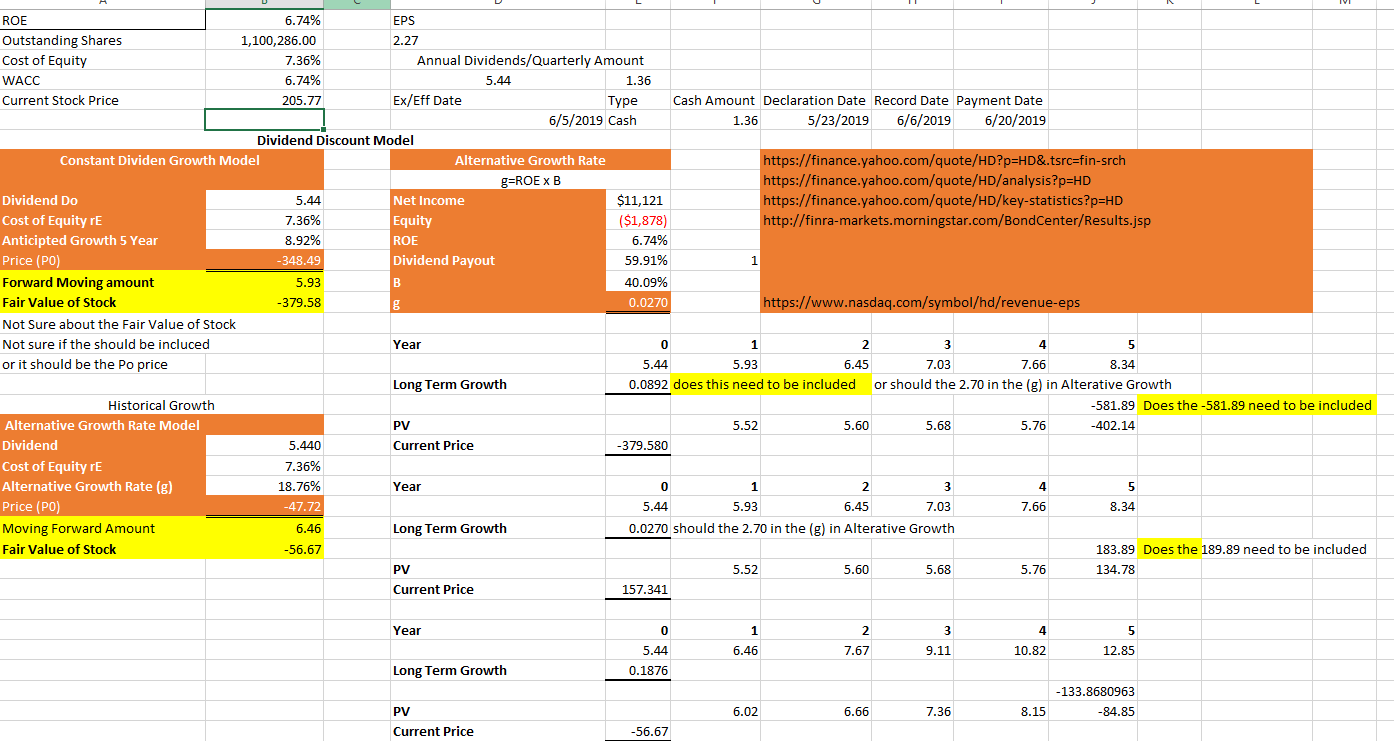

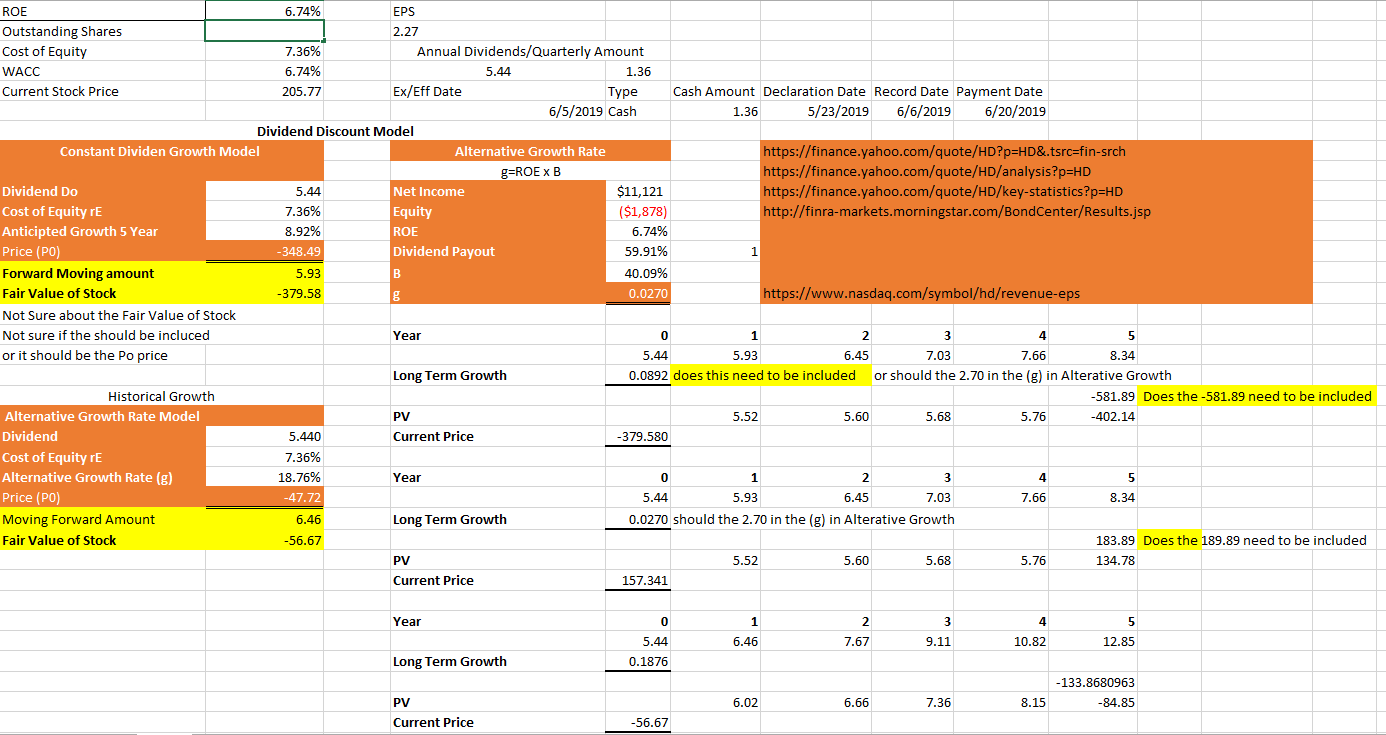

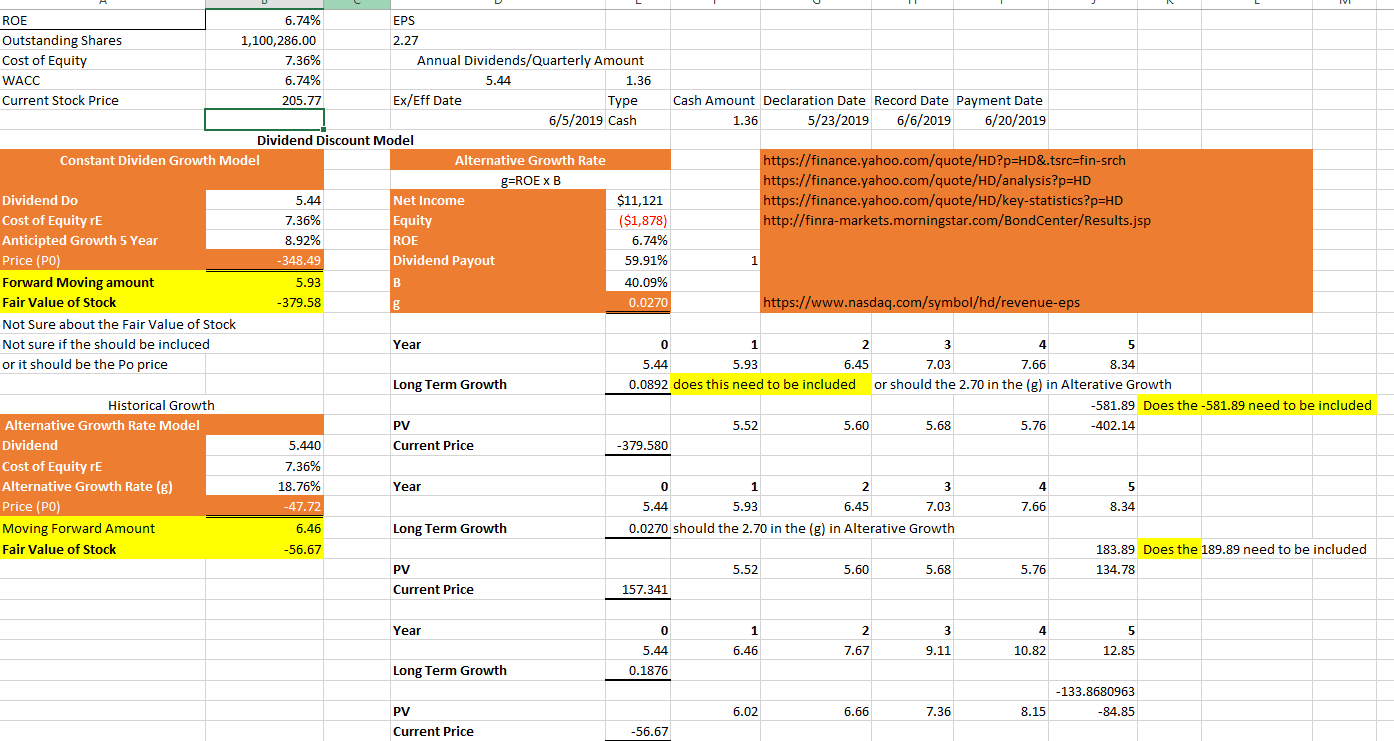

Question: I need Help with the Dividend Discount Model , im not sure where I am going wrong Estimate the firm's stock price using the dividend-discount

I need Help with the Dividend Discount Model , im not sure where I am going wrong

- Estimate the firm's stock price using the dividend-discount model: Use an investment source (some have been provided in the Content area) and find: 1) the current dividend; 2) analyst's estimate growth rate for the next five to ten years; 3) an alternative growth estimate using the firm's historical growth rate or the formula "g=ROE x b".

- Use your estimate of the cost of equity in the WACC for the rE part of your formula: Combine the above information into the dividend-discount model (DDM).

My company is Home Depot

stock price is 205.77

outstanding share 1100286

Current Dividends are 5.44 annually

Cost of Equity is 7.39

my ROE is 6.74

my 5 year growth is 8.92

historical grow is 18.76

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts