Question: I need help with the finding the return on assets and return on equity for this year and last year. Required information ( The following

I need help with the finding the return on assets and return on equity for this year and last year. Required information

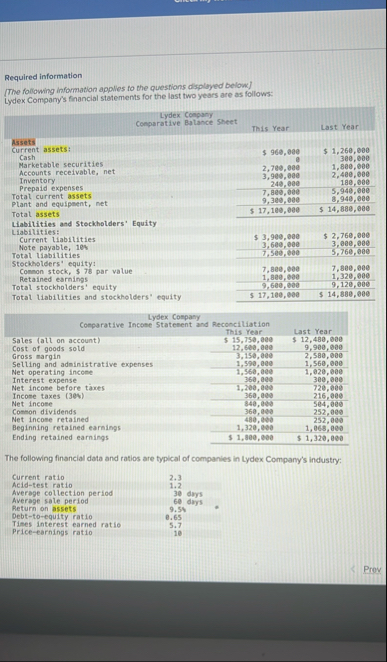

The following information applies to the questions displayed below

Lydex Company's financial statements for the last two years are as follows:

tableLydex Company Conparative Balance Stacet,This Year,Last YearAssetsCurrent assets:,$ $ CasheeMarketable securitiesaae,eeeeAccounts receivable, net,eInventoryePrepaid expenses,eeeeeTotal current assets,eeTotal assets,$ $ Liabilities and Stockholders' EquityLiabilities:$ $ Current liabilities,eeeTotal liabilities,Stockholders equity:,,eeeCommon stock, $ par value,eTotal stockholders' equity,Total liabilities and stockholders equity,$ e$

tabletableLysex CompanyComparative Income Statement and ReconciliationThis Year,Last YearSales all on account$ $ Cost of goods sold,Gross margin,edSelling and administrative expenses,Net operating income,edInterest expense,eNet income before taxes,Income taxes Net incose,edCommon dividends,Net income retained,deeBeginning retained earnings,Ending retained earnings,$ $

The following financial data and ratios are typical of companies in Lydex Company's industry:

tableCurrent ratio,Acidtest ratio,Average collection period, daysAverage sale period, daysReturn on assets,Debttoequity ratio,Tises interest earned ratio,Priceearnings ratio,

Prov

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock