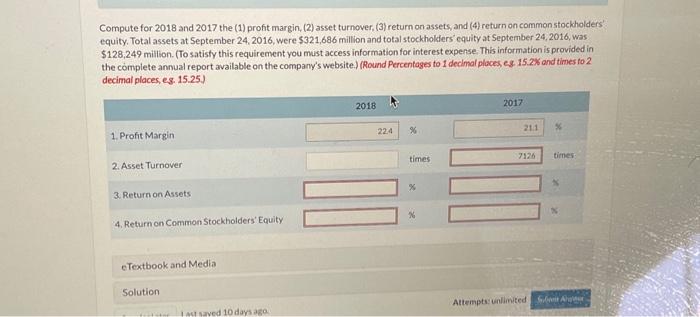

Question: i need help with the first pic i dont understand it out of the rest thnks its a project due next week Compute for 2018

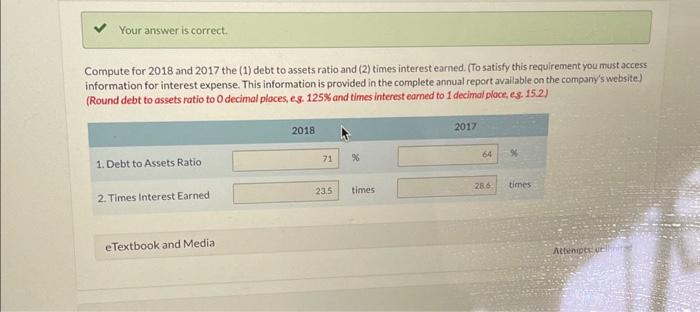

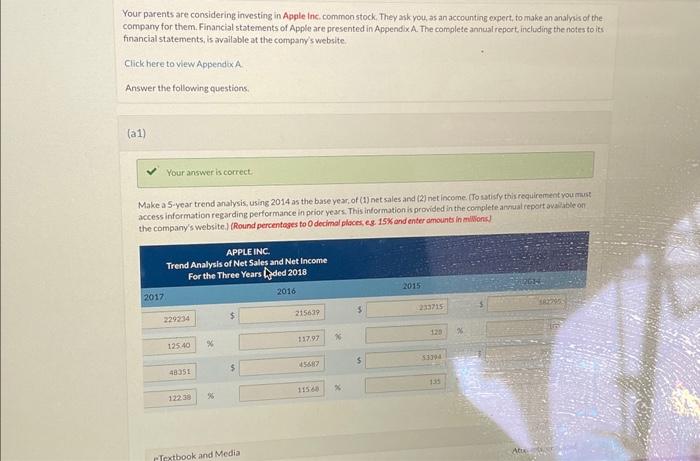

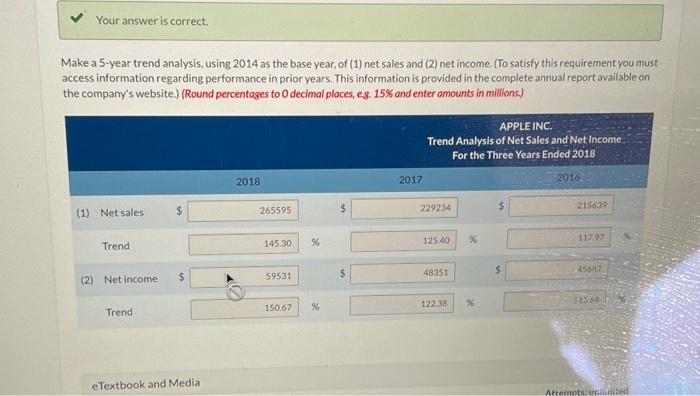

Compute for 2018 and 2017 the (1) profit margin, (2) asset turnover, (3) return onassets, and (4) return on common stockholders' equity. Total assets at September 24, 2016, were $321,686 million and total stockholders' cquity at September 24, 2016, was $128,249 million. (To satisfy this requirement you must access information for interest expense. This information is provided in the complete annual report available on the company's website.) (Round Percentages to 1 declmal places, es. 15.2% ond times fo 2 decimal places, es. 15.25. Your answer is correct. Compute for 2018 and 2017 the (1) debt to assets ratio and (2) times interest earned. (To satisfy this requirement you must access information for interest expense. This information is provided in the complete annual report available on the company's website). (Round debt to assets ratio to 0 decimal ploces, es. 125% and times interest earned to 1 decimal ploce, es. 15.2) Your parents are considering investing in Apple inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for them. Financial statements of Apple are presented in Appendo. A. The complete annual report including the notes to its financial statements, is available at the company's website. Click here to view Appendoc A Answer the following questions. (a1) Your answer is correct Make a 5 -year trend analysis, using 2014 as the base year, of (1) net sales and (2) net income. (To uatisfy this roqulrement voumart access information regarding performance in prior years. This information is provided in the complefe aryual report avasible on the company's website.) (Round percentoges to 0 decimal places, eg. 15% and enter dmounts in miWons) Your answer is correct. Make a 5-year trend analysis, using 2014 as the base year, of (1) net sales and (2) net income. (To satisfy this requirement you must access information regarding performance in prior years. This information is provided in the complete annual report avaliable on the company's website) (Round percentages to 0 decimal ploces, es. 15% and enter amounts in millions.) Compute for 2018 and 2017 the (1) profit margin, (2) asset turnover, (3) return onassets, and (4) return on common stockholders' equity. Total assets at September 24, 2016, were $321,686 million and total stockholders' cquity at September 24, 2016, was $128,249 million. (To satisfy this requirement you must access information for interest expense. This information is provided in the complete annual report available on the company's website.) (Round Percentages to 1 declmal places, es. 15.2% ond times fo 2 decimal places, es. 15.25. Your answer is correct. Compute for 2018 and 2017 the (1) debt to assets ratio and (2) times interest earned. (To satisfy this requirement you must access information for interest expense. This information is provided in the complete annual report available on the company's website). (Round debt to assets ratio to 0 decimal ploces, es. 125% and times interest earned to 1 decimal ploce, es. 15.2) Your parents are considering investing in Apple inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for them. Financial statements of Apple are presented in Appendo. A. The complete annual report including the notes to its financial statements, is available at the company's website. Click here to view Appendoc A Answer the following questions. (a1) Your answer is correct Make a 5 -year trend analysis, using 2014 as the base year, of (1) net sales and (2) net income. (To uatisfy this roqulrement voumart access information regarding performance in prior years. This information is provided in the complefe aryual report avasible on the company's website.) (Round percentoges to 0 decimal places, eg. 15% and enter dmounts in miWons) Your answer is correct. Make a 5-year trend analysis, using 2014 as the base year, of (1) net sales and (2) net income. (To satisfy this requirement you must access information regarding performance in prior years. This information is provided in the complete annual report avaliable on the company's website) (Round percentages to 0 decimal ploces, es. 15% and enter amounts in millions.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts