Question: I need help with the following items- Current Attempt in Progress Ivanhoe Co. sells Christmas angels. Ivanhoe determines that at the end of December, it

I need help with the following items-

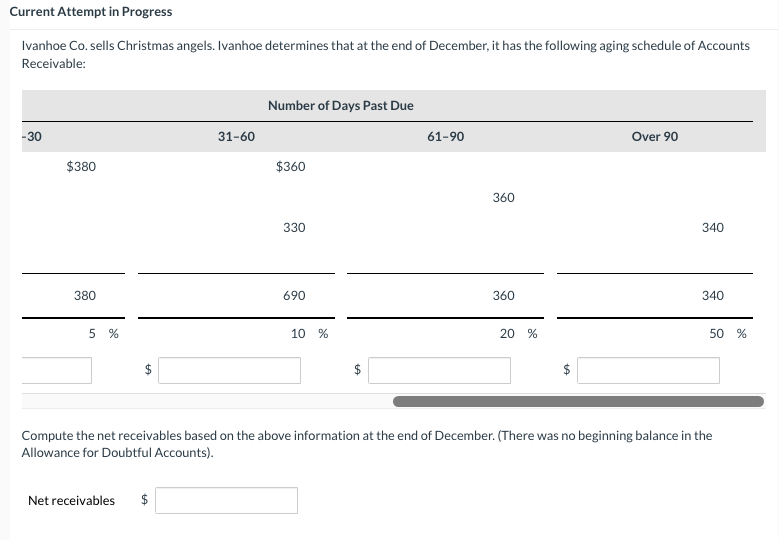

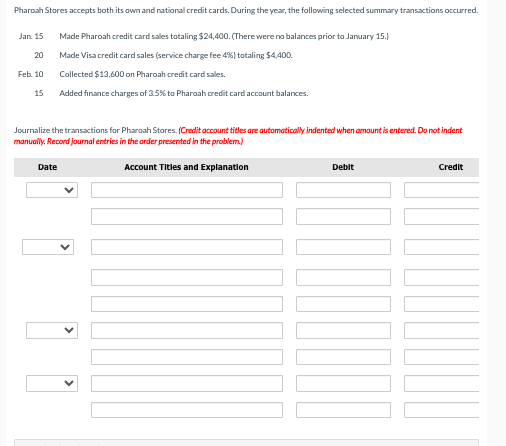

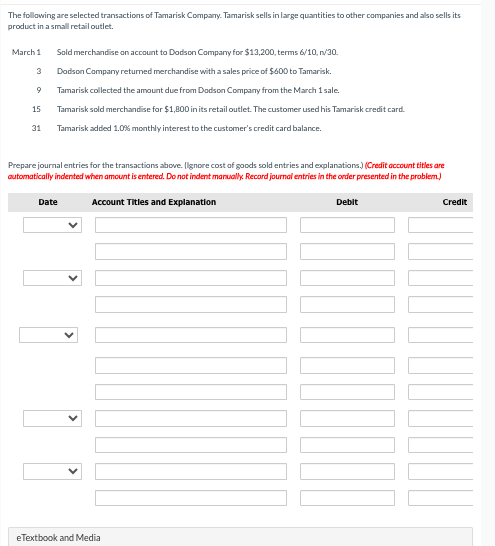

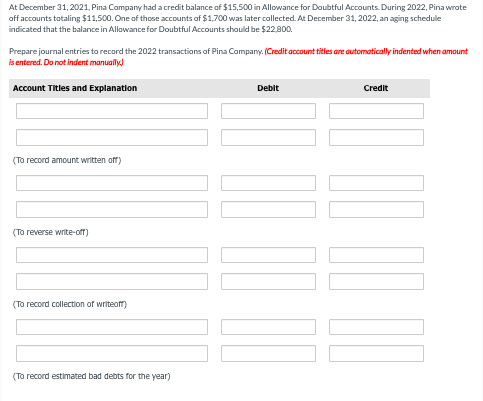

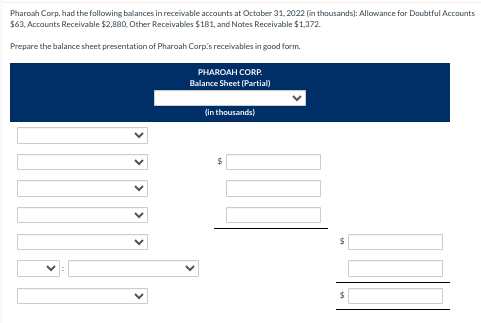

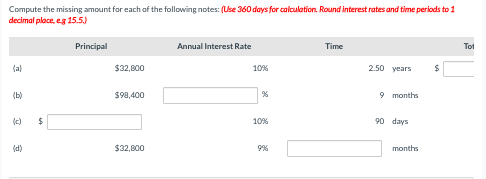

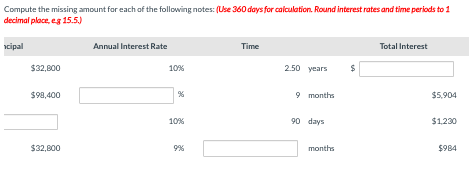

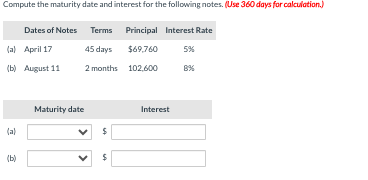

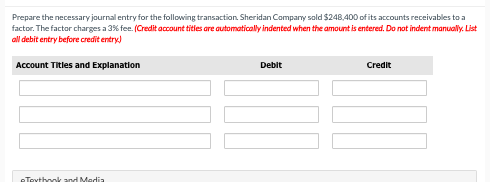

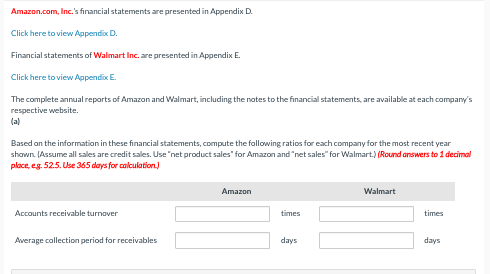

Current Attempt in Progress Ivanhoe Co. sells Christmas angels. Ivanhoe determines that at the end of December, it has the following aging schedule of Accounts Receivable: Number of Days Past Due -30 31-60 61-90 Over 90 $380 $360 360 330 340 380 690 360 340 % 10 % 20 % 50 % $ $ Compute the net receivables based on the above information at the end of December. (There was no beginning balance in the Allowance for Doubtful Accounts). Net receivables $Pharoah Stores accepts both its own and national credit cards. During the year, the following selected summary transactions occurred. Jan. 15 Made Pharoah credit card sales totaling $24,400. (There were no balances prior to January 15.) 20 Made Visa credit card sales (service charge fee 4%) totaling $4,400. Feb. 10 Collected $13,400 on Pharoah credit card sales. 15 Added finance charges of 3.5%% to Pharoah credit card account balances. Journalize the transactions for Pharoah Stores. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit CreditThe following are selected transactions of Tamarisk Company. Tamarisk sells in large quantities to other companies and also sells its product in a small retail outlet. March 1 Sold merchandise on account to Dodson Company for $13,200, terms /10, n/30. 3 Dodson Company returned merchandise with a sales price of $400 to Tamarisk. 9 Tamarisk collected the amount due from Dodson Company from the March 1 sale. 15 Tamarisk sold merchandise for $1,800 in its retail outlet. The customer used his Tamarisk credit card. 31 Tamarisk added 1.0% monthly interest to the customer's credit card balance. Prepare journal entries for the transactions above. (Ignore cost of goods sold entries and explanations.) (Credit account titles are automatically indented when amount is entered. Do not indent manually Record journal entries in the order presented in the problem ] Date Account Titles and Explanation Debit Credit v v eTextbook and MediaAt December 31, 2021, Pina Company had a credit balance of $15,500 in Allowance for Doubtful Accounts. During 2022, Pina wrote off accounts totaling $11,500. One of those accounts of $1,700 was later collected. At December 31, 2022, an aging schedule indicated that the balance in Allowance for Doubtful Accounts should be $22,800. Prepare journal entries to record the 2022 transactions of Pina Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record amount written off) (To reverse write-off) (To record collection of writeoff) (To record estimated bad debts for the year)Pharoah Corp. had the following balances in receivable accounts at October 31, 2022 [in thousands]: Allowance for Doubtful Accounts $63, Accounts Receivable $2,880, Other Receivables $181, and Notes Receivable $1,372. Prepare the balance sheet presentation of Pharoah Corp's receivables in good form. PHAROAH CORP. Balance Sheet [Partial) (in thousands) V VCompute the missing amount for each of the following notes: (Use 360 days for calculation. Round interest rates and time periods to 1 decimal place, e g 15.5.) Principal Annual Interest Rate Time Tol (al $32,800 1075 2.50 years $98,400 9 months 1075 90 days (P) $32,800 975 monthsCompute the missing amount for each of the following notes: (Use 360 days for calculation. Round interest rates and time periods to 1 decimal place, ex 15.5.) icipal Annual Interest Rate Time Total Interest $32,800 2.50 years $98,400 95 9 months $5.904 90 days $1,220 $32,800 months $984Compute the maturity date and interest for the following notes. (Use 360 days for calculation.) Dates of Notes Terms Principal Interest Rate (a) April 17 45 days $49 760 (by August 11 2 months 102800 Maturity date Interest lal InPrepare the necessary journal entry for the following transaction Sheridan Company sold $248,400 of its accounts receivables to a factor. The factor charges a 3%% fee. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entry before credit entry) Account Titles and Explanation Debit CreditAmazon.com, Inc.'s financial statements are presented in Appendix D. Click here to view Appendix D. Financial statements of Walmart Inc. are presented in Appendix E. Click here to view Appendix E. The complete annual reports of Amazon and Walmart, including the notes to the financial statements, are available at each company's respective website. (al Based on the information in these financial statements, compute the following ratios for each company for the most recent year shown [Assume all sales are credit sales. Use "net product sales" for Amazon and "net sales"for Walmart.) (Round answers to 1 decimal place, eg. 52.5. Use 365 days for calculation ] Amazon Walmart Accounts receivable turnover times times Average collection period for receivables days days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts