Question: i need help with the following multiple choice question (20-26) 20. The Eckland Company would like to determine its Cost of Goods Sold for the

i need help with the following multiple choice question (20-26)

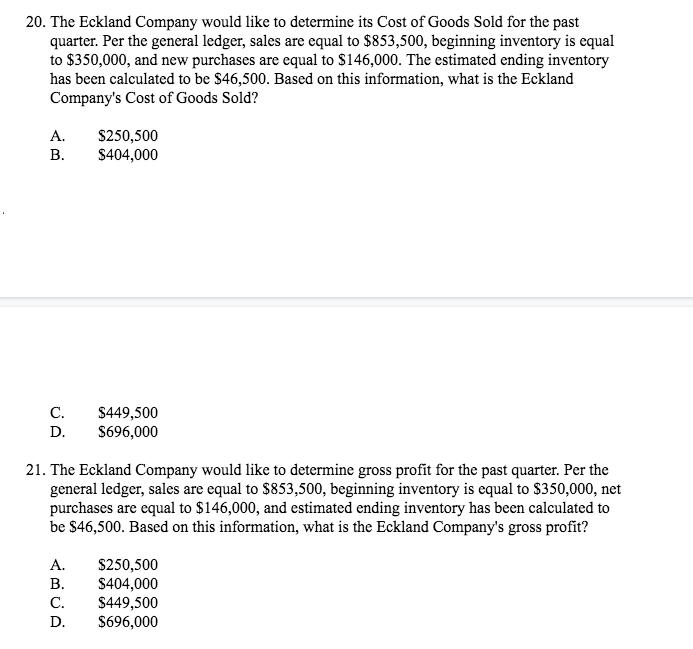

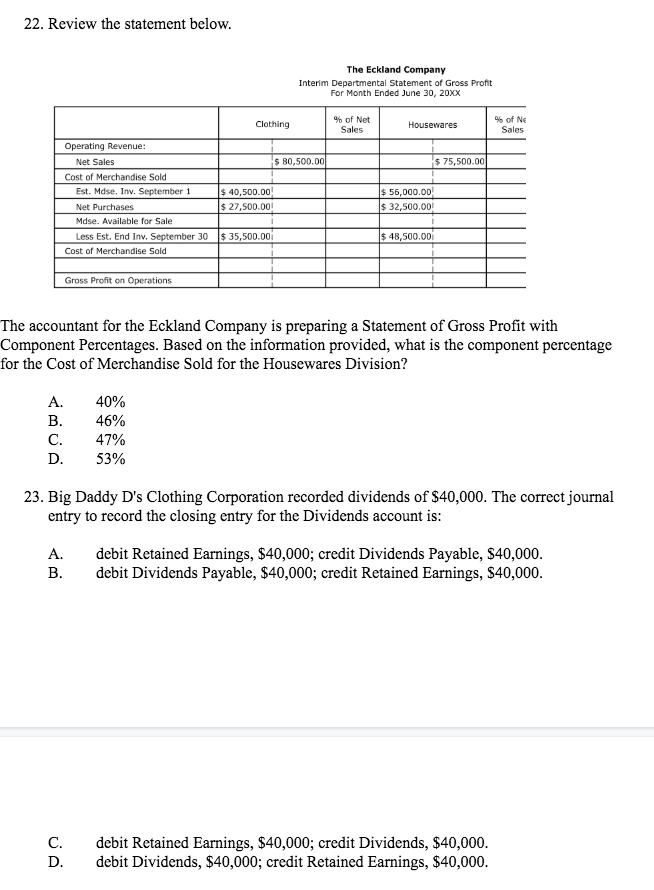

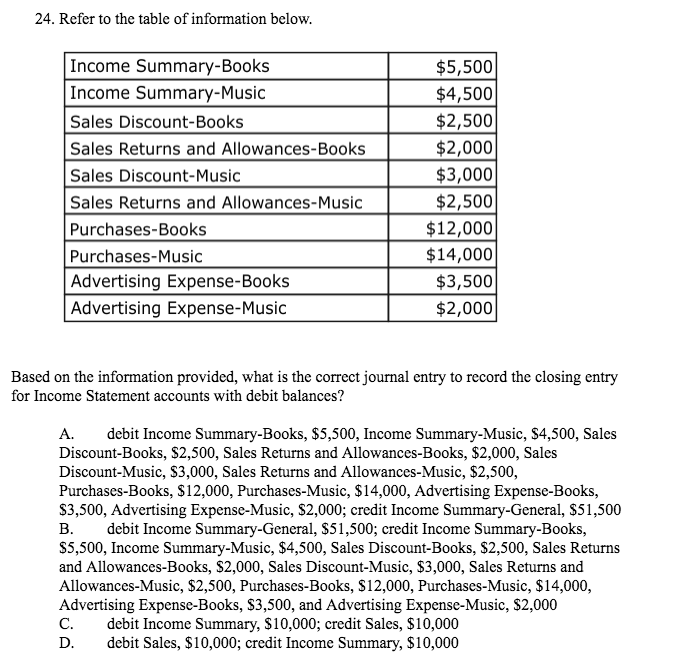

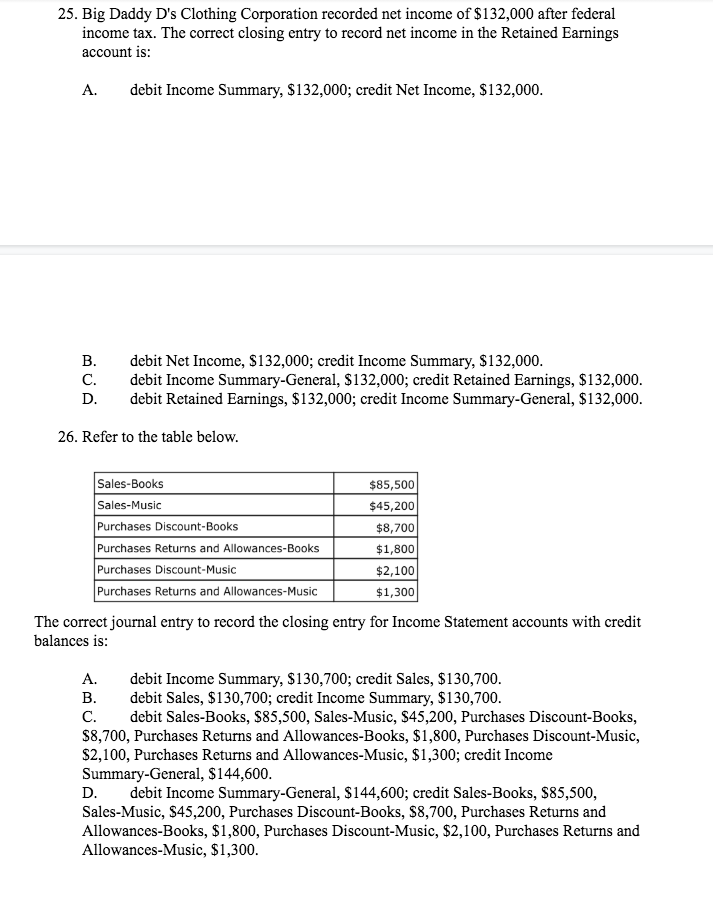

20. The Eckland Company would like to determine its Cost of Goods Sold for the past quarter. Per the general ledger, sales are equal to $853,500, beginning inventory is equal to $350,000, and new purchases are equal to $146,000. The estimated ending inventory has been calculated to be $46,500. Based on this information, what is the Eckland Company's Cost of Goods Sold? A. $250,500 B. $404,000 C. $449,500 D. $696,000 21. The Eckland Company would like to determine gross profit for the past quarter. Per the general ledger, sales are equal to $853,500, beginning inventory is equal to $350,000, net purchases are equal to $146,000, and estimated ending inventory has been calculated to be $46,500. Based on this information, what is the Eckland Company's gross profit? A. $250,500 B. $404,000 C. $449,500 D. $696,00022. Review the statement below. The Eckland Company Interim Departmental Statement of Gross Profit For Month Ended June 30, 20XX Clothing to of Net % of NE Sales Housewares Sales Operating Revenue: Net Sales $ 80,500.DO $ 75,500.00 Cost of Merchandise Sold Est. Mdse. Inv. September 1 $ 40,500.00 $ 56,000.00 Net Purchases $ 27,500.00 $ 32,500.001 Mdse. Available for Sale Less Est. End Inv. September 30 $ 35,500.00 $ 48,500.00 Cost of Merchandise Sold Gross Profit on Operations The accountant for the Eckland Company is preparing a Statement of Gross Profit with Component Percentages. Based on the information provided, what is the component percentage for the Cost of Merchandise Sold for the Housewares Division? A. 40% B. 46% C. 47% D. 53% 23. Big Daddy D's Clothing Corporation recorded dividends of $40,000. The correct journal entry to record the closing entry for the Dividends account is: A. debit Retained Earnings, $40,000; credit Dividends Payable, $40,000. B. debit Dividends Payable, $40,000; credit Retained Earnings, $40,000. C. D. debit Retained Earnings, $40,000; credit Dividends, $40,000. debit Dividends, $40,000; credit Retained Earnings, $40,000.24. Refer to the table of information below. Income Summary-Books $5,500 Income Summary-Music $4,500 Sales Discount-Books $2,500 Sales Returns and Allowances-Books $2,000 Sales Discount-Music $3,000 Sales Returns and Allowances-Music $2,500 Purchases-Books $12,000 Purchases-Music $14,000 Advertising Expense-Books $3,500 Advertising Expense-Music $2,000 Based on the information provided, what is the correct journal entry to record the closing entry for Income Statement accounts with debit balances? A. debit Income Summary-Books, $5,500, Income Summary-Music, $4,500, Sales Discount-Books, $2,500, Sales Returns and Allowances-Books, $2,000, Sales Discount-Music, $3,000, Sales Returns and Allowances-Music, $2,500, Purchases-Books, $12,000, Purchases-Music, $14,000, Advertising Expense-Books, $3,500, Advertising Expense-Music, $2,000; credit Income Summary-General, $51,500 B. debit Income Summary-General, $51,500; credit Income Summary-Books, $5,500, Income Summary-Music, $4,500, Sales Discount-Books, $2,500, Sales Returns and Allowances-Books, $2,000, Sales Discount-Music, $3,000, Sales Returns and Allowances-Music, $2,500, Purchases-Books, $12,000, Purchases-Music, $14,000, Advertising Expense-Books, $3,500, and Advertising Expense-Music, $2,000 C. debit Income Summary, $10,000; credit Sales, $10,000 D. debit Sales, $10,000; credit Income Summary, $10,00025. Big Daddy D's Clothing Corporation recorded net income of $132,000 after federal income tax. The correct closing entry to record net income in the Retained Earnings account is: A. debit Income Summary, $132,000; credit Net Income, $132,000. B. debit Net Income, $132,000; credit Income Summary, $132,000. C. D. debit Income Summary-General, $132,000; credit Retained Earnings, $132,000. debit Retained Earnings, $132,000; credit Income Summary-General, $132,000 26. Refer to the table below. Sales-Books $85,500 Sales-Music $45,200 Purchases Discount-Books $8,700 Purchases Returns and Allowances-Books $1,800 Purchases Discount-Music $2,100 Purchases Returns and Allowances-Music $1,300 The correct journal entry to record the closing entry for Income Statement accounts with credit balances is: A. debit Income Summary, $130,700; credit Sales, $130,700. B. C. debit Sales, $130,700; credit Income Summary, $130,700. debit Sales-Books, $85,500, Sales-Music, $45,200, Purchases Discount-Books, $8,700, Purchases Returns and Allowances-Books, $1,800, Purchases Discount-Music, $2,100, Purchases Returns and Allowances-Music, $1,300; credit Income Summary-General, $144,600. D. debit Income Summary-General, $144,600; credit Sales-Books, $85,500, Sales-Music, $45,200, Purchases Discount-Books, $8,700, Purchases Returns and Allowances-Books, $1,800, Purchases Discount-Music, $2,100, Purchases Returns and Allowances-Music, $1,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts