Question: I need help with the following problem. (answer to problem one pictured below). In problem 1, suppose that the sample information is available in the

I need help with the following problem. (answer to problem one pictured below).

In problem 1, suppose that the sample information is available in the form of a random sample of consumers. For a sample of size one,

a. Find the posterior distribution if the one person sampled will purchase the item, and find the value of this sample information;

b. Find the posterior distribution if the one person sampled will not purchase the item and find the value of this sample information;

c. find the expected value of sample information.

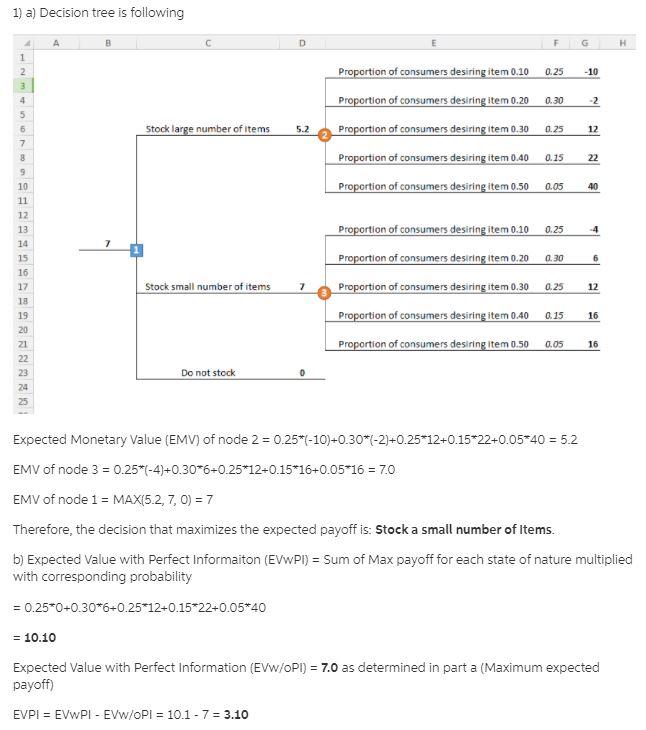

1) a) Decision tree is following D G H 1 2 Proportion of consumers desiring item 0.10 0.25 - 10 0.30 -2 5 Stock large number of items 5.2 0.25 12 7 8 Proportion of consumers desiring item 0.20 Proportion of consumers desiring item 0.30 Proportion of consumers desiring item 0.40 Proportion of consumers desiring item 0.50 0.15 22 0.05 40 0.25 -4 0.30 6 Proportion of consumers desiring item 0.10 Proportion of consumers desiring item 0.20 Proportion of consumers desiring item 0.30 Proportion of consumers desiring item 0.40 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Stock small number of items 0.25 12 0.15 16 Proportion of consumers desiring item 0.50 0.05 16 Do not stock Expected Monetary Value (EMV) of node 2 = 0.25*(-10)+0.30*(-2)+0.25*12+0.15*22+0.05*40 = 5.2 EMV of node 3 = 0.25*(-4)+0.30*6+0.25*12+0.15*16+0.05*16 = 7.0 EMV of node 1 = MAX(5.2, 7,0) = 7 Therefore, the decision that maximizes the expected payoff is: Stock a small number of Items b) Expected Value with Perfect Informaiton (EVWPI) = Sum of Max payoff for each state of nature multiplied with corresponding probability = 0.25*0+0.30*6+0.25*12+0.15*22+0.05*40 = 10.10 Expected Value with Perfect Information (EVW/OPI) = 7.0 as determined in part a (Maximum expected payoff) EVPL = EVWPI - EVW/OPI = 10.1 - 7 = 3.10 1) a) Decision tree is following D G H 1 2 Proportion of consumers desiring item 0.10 0.25 - 10 0.30 -2 5 Stock large number of items 5.2 0.25 12 7 8 Proportion of consumers desiring item 0.20 Proportion of consumers desiring item 0.30 Proportion of consumers desiring item 0.40 Proportion of consumers desiring item 0.50 0.15 22 0.05 40 0.25 -4 0.30 6 Proportion of consumers desiring item 0.10 Proportion of consumers desiring item 0.20 Proportion of consumers desiring item 0.30 Proportion of consumers desiring item 0.40 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Stock small number of items 0.25 12 0.15 16 Proportion of consumers desiring item 0.50 0.05 16 Do not stock Expected Monetary Value (EMV) of node 2 = 0.25*(-10)+0.30*(-2)+0.25*12+0.15*22+0.05*40 = 5.2 EMV of node 3 = 0.25*(-4)+0.30*6+0.25*12+0.15*16+0.05*16 = 7.0 EMV of node 1 = MAX(5.2, 7,0) = 7 Therefore, the decision that maximizes the expected payoff is: Stock a small number of Items b) Expected Value with Perfect Informaiton (EVWPI) = Sum of Max payoff for each state of nature multiplied with corresponding probability = 0.25*0+0.30*6+0.25*12+0.15*22+0.05*40 = 10.10 Expected Value with Perfect Information (EVW/OPI) = 7.0 as determined in part a (Maximum expected payoff) EVPL = EVWPI - EVW/OPI = 10.1 - 7 = 3.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts