Question: I need help with the following: Task 1 - Asset register and depreciation schedule Merinda Homewares purchased one capital asset during the 2023 financial year*.

I need help with the following:

Task 1 - Asset register and depreciation schedule

Merinda Homewares purchased one capital asset during the 2023 financial year*. This was the purchase of new office equipmentfor $44,000 (incl. GST) on 31 December 2022.

The office equipment has an expected life span of 4 years. According to the ATO the depreciation rate of this equipment is 50%.

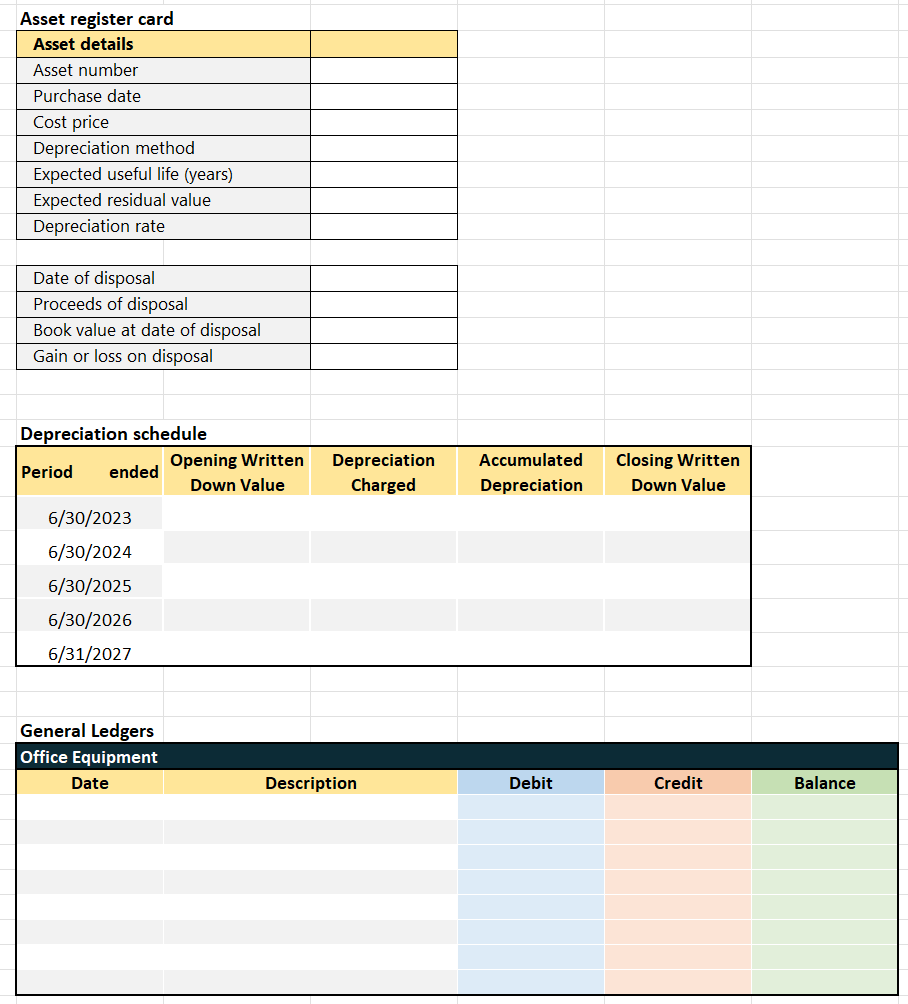

Using the Asset Register and Depreciation Schedule,complete the following tasks:

- Prepare the Asset Register card for the new purchase.

- Provide an Asset Number for the new purchase.

- Refer to section 13 of Merindah Homewares Policy & Procedures. Type the correct method in the "Depreciation Method" for the office equipment on the asset register card.

- Using the depreciation schedule in the spreadsheet, calculate depreciation expense from the 2023 to 2027 financial year (5 financial years in total).

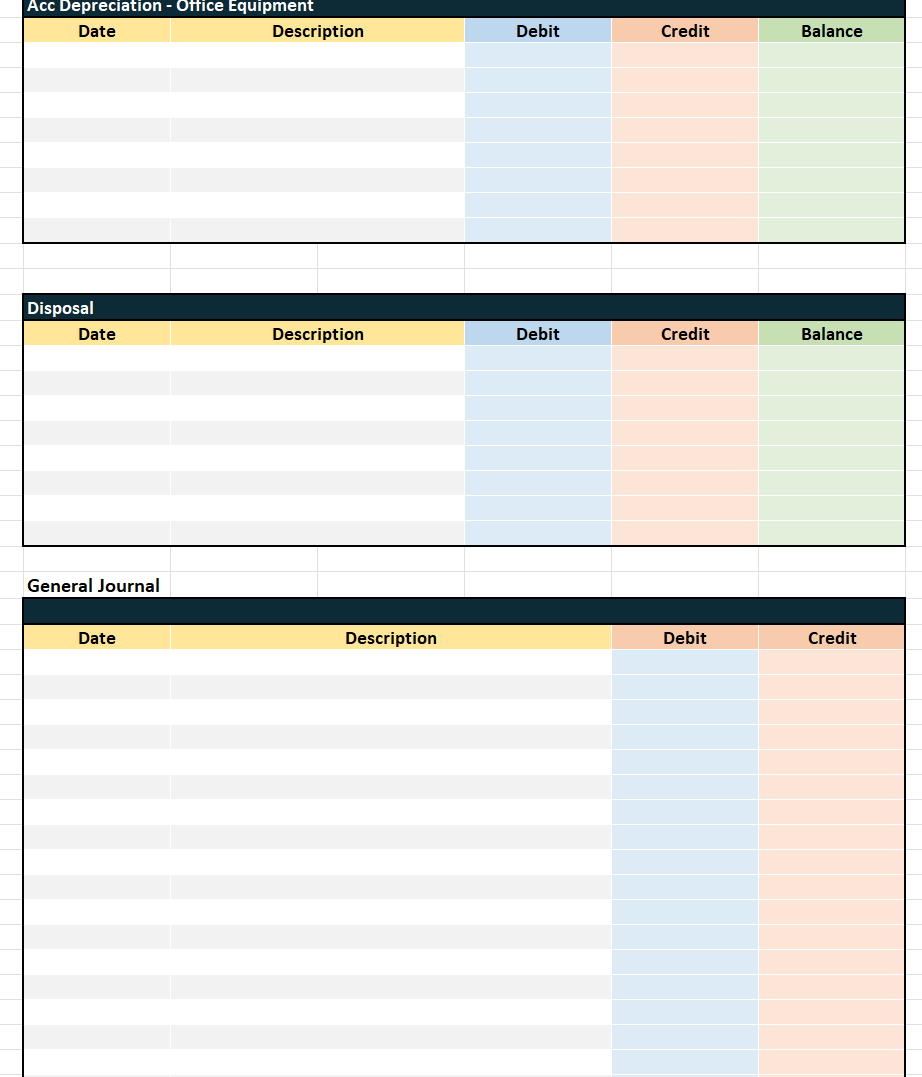

- Prepare journal entries to record the purchase and depreciation of office equipment for the following:

- 2023 Financial Year

- 2024 Financial Year

- 2025 Financial Year until the date of Sale (as per part 5 below)

- Entries should be recorded in the General Journal section of the spreadsheet.

- Prepare journal entries to record the sale of the office equipment on 31 December 2024 for $19,800 cash (inclusive of GST). These entries must also be recorded in the General Journal section of the spreadsheet.

- Complete the disposal details in the asset register card.

The templates are shown in the image below:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts