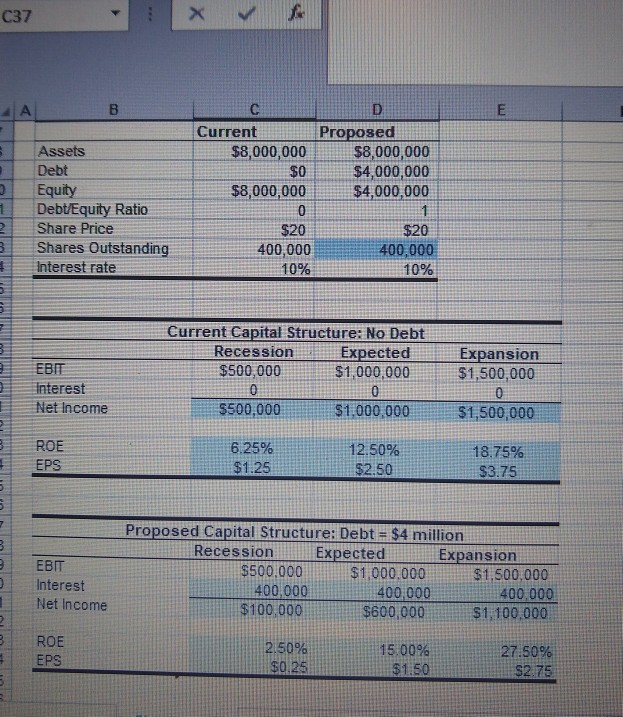

Question: I need help with the formula for the break even EBIT. thank you!! C37 Current $8,000,000 Proposed $8,000,000 $4,000,000 $4,000,000 $8,000,000 Assets Debt Equity Debt

I need help with the formula for the break even EBIT. thank you!!

C37 Current $8,000,000 Proposed $8,000,000 $4,000,000 $4,000,000 $8,000,000 Assets Debt Equity Debt Equity Ratio Share Price Shares Outstanding Interest rate $20 $20 400,000 10% 400,000 10% Current Capital Structure: No Debt Recession Expected $500,000 $1,000,000 Expansion $1,500,000 EBIT Interest Net Income $500,000 $1,000,000 $1,500,000 ROE EPS 6.25% $1.25 12.50% $2.50 18.75% $3.75 Interest Net Income Proposed Capital Structure: Debt = $4 million Recession . Expected Expansion $500,000 $1,000,000 $1,500,000 400.000 400,000 400.000 $100,000 $600,000 $1,100,000 ROE EPS 2.50% $0.25 15.00% $1.50 27.50% $2.75 C37 Current $8,000,000 Proposed $8,000,000 $4,000,000 $4,000,000 $8,000,000 Assets Debt Equity Debt Equity Ratio Share Price Shares Outstanding Interest rate $20 $20 400,000 10% 400,000 10% Current Capital Structure: No Debt Recession Expected $500,000 $1,000,000 Expansion $1,500,000 EBIT Interest Net Income $500,000 $1,000,000 $1,500,000 ROE EPS 6.25% $1.25 12.50% $2.50 18.75% $3.75 Interest Net Income Proposed Capital Structure: Debt = $4 million Recession . Expected Expansion $500,000 $1,000,000 $1,500,000 400.000 400,000 400.000 $100,000 $600,000 $1,100,000 ROE EPS 2.50% $0.25 15.00% $1.50 27.50% $2.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts