Question: I need help with the formulas. Please show Excel formulas. Vaughan Company makes AMAZING SUPER DUPER Widgets. Management is now preparing detailed budgets for the

I need help with the formulas. Please show Excel formulas.

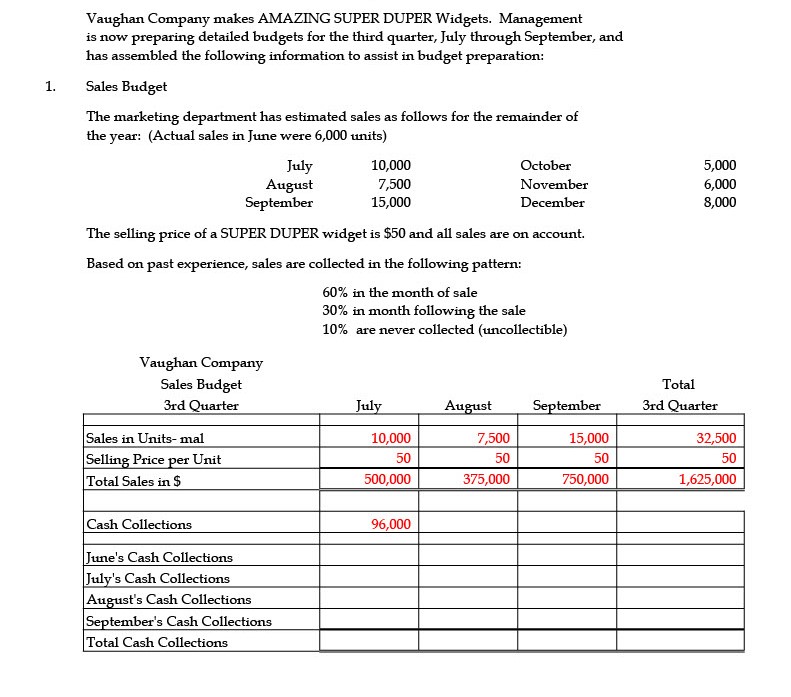

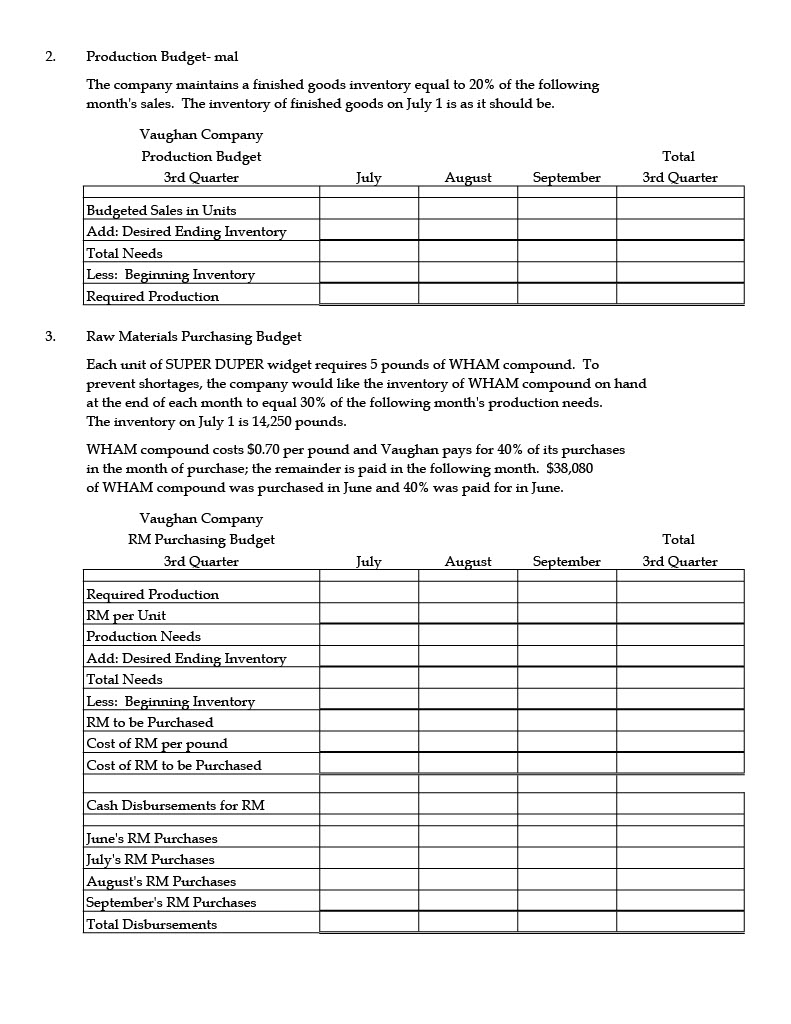

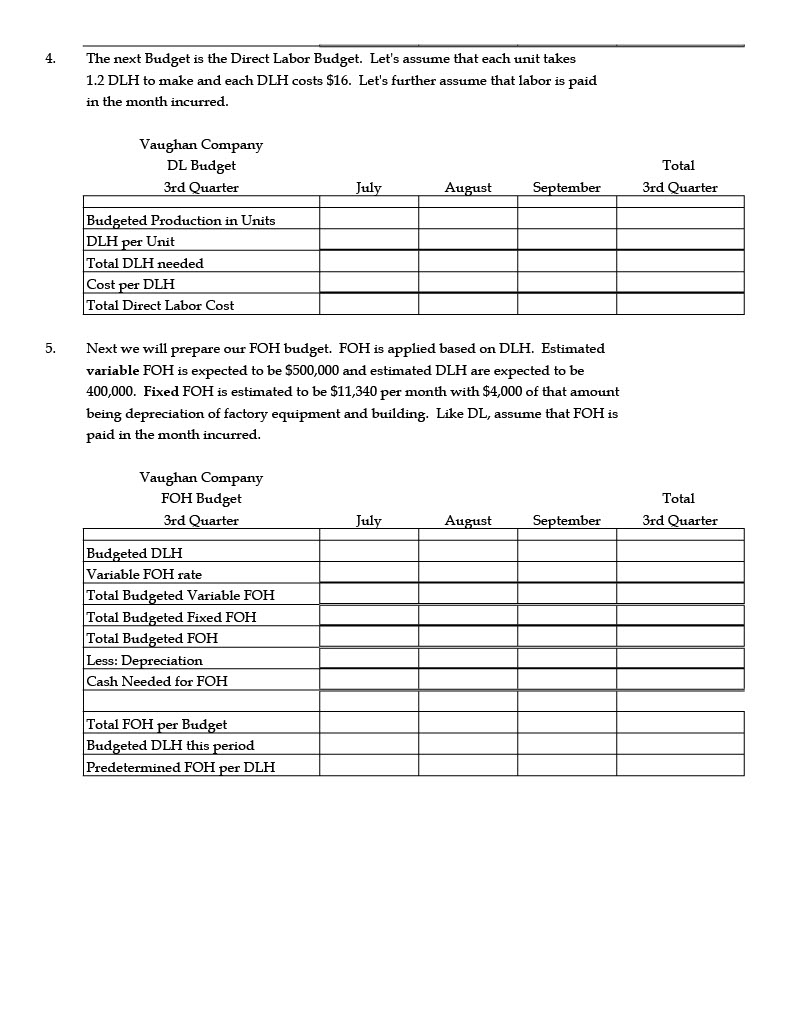

Vaughan Company makes AMAZING SUPER DUPER Widgets. Management is now preparing detailed budgets for the third quarter, July through September, and has assembled the following information to assist in budget preparation: Sales Budget The marketing department has estimated sales as follows for the remainder of the year: (Actual sales in June were 6,000 units) The selling price of a SUPER DUPER widget is $50 and all sales are on account. Based on past experience, sales are collected in the following pattern: 60% in the month of sale 30% in month following the sale 10% are never collected (uncollectible) Vaughan Company Production Budget-mal The company maintains a finished goods inventory equal to 20% of the following month's sales. The inventory of finished goods on July 1 is as it should be. Vaughan Company Denduntion Rudmat Raw Materials Purchasing Budget Each unit of SUPER DUPER widget requires 5 pounds of WHAM compound. To prevent shortages, the company would like the inventory of WHAM compound on hand at the end of each month to equal 30% of the following month's production needs. The inventory on July 1 is 14,250 pounds. WHAM compound costs $0.70 per pound and Vaughan pays for 40% of its purchases in the month of purchase; the remainder is paid in the following month. $38,080 of WHAM compound was purchased in June and 40% was paid for in June. Vaughan Companv 4. The next Budget is the Direct Labor Budget. Let's assume that each unit takes 1.2 DLH to make and each DLH costs \$16. Let's further assume that labor is paid in the month incurred. Vaughan Company 5. Next we will prepare our FOH budget. FOH is applied based on DLH. Estimated variable FOH is expected to be $500,000 and estimated DLH are expected to be 400,000 . Fixed FOH is estimated to be $11,340 per month with $4,000 of that amount being depreciation of factory equipment and building. Like DL, assume that FOH is paid in the month incurred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts