Question: i need help with the general journal,and items 2-11. also needed is a statement of stockholders equity Sassafras Sis, Inc Chart of Accounts Balance Sheet

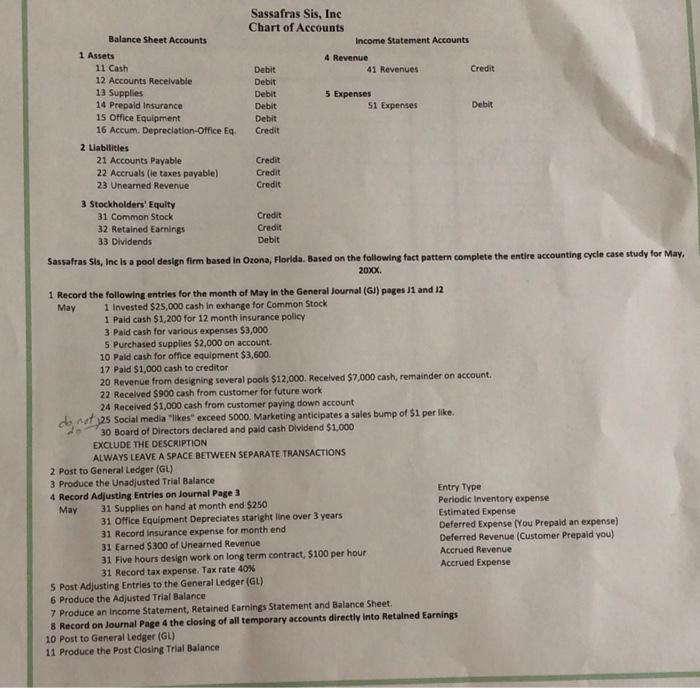

Sassafras Sis, Inc Chart of Accounts Balance Sheet Accounts Income Statement Accounts 1 Assets 4 Revenue 11 Cash Debit 41 Revenues Credit 12 Accounts Receivable Debit 13 Supplies Debit 5 Expenses 14 Prepaid Insurance Debit S1 Expenses Debit 15 Office Equipment Debit 16 Accum. Depreciation Office Eq Credit 2 Liabilities 21 Accounts Payable Credit 22 Accruals (le taxes payable) Credit 23 Unearned Revenue Credit 3 Stockholders' Equity 31 Common Stock Credit 32 Retained Earnings Credit 33 Dividends Debit Sassafras Sis, Inc is a pool design firm based in Ozona, Florida. Based on the following fact pattern complete the entire accounting cycle case study for May, 20xx 1 Record the following entries for the month of May in the General Journal (GJ) pages 1 and 12 May 1 Invested $25,000 cash in exhange for Common Stock 1 Paid cash $1,200 for 12 month Insurance policy 3 Paid cash for various expenses $3,000 5 Purchased supplies $2,000 on account. 10 Pald cash for office equipment $3,600. 17 Paid $1,000 cash to creditor 20 Revenue from designing several pools $12,000. Received $7,000 cash, remainder on account. 22 Received $900 cash from customer for future work 24 Received $1,000 cash from customer paying down account 25 Social media "likes" exceed 5000. Marketing anticipates a sales bump of $1 per like. 30 Board of Directors declared and paid cash Dividend $1,000 EXCLUDE THE DESCRIPTION ALWAYS LEAVE A SPACE BETWEEN SEPARATE TRANSACTIONS 2 Post to General Ledger (GL) 3 Produce the Unadjusted Trial Balance 4 Record Adjusting Entries on Journal Page 3 Entry Type May 31 Supplies on hand at month end $250 Periodic Inventory expense 31 Office Equipment Depreciates staright line over 3 years Estimated Expense 31 Record Insurance expense for month end Deferred Expense (You Prepaid an expense) 31 Earned $300 of Unearned Revenue Deferred Revenue (Customer Prepaid you) 31 Five hours design work on long term contract, $100 per hour Accrued Revenue 31 Record tax expense. Tax rate 40% Accrued Expense 5 Post Adjusting Entries to the General Ledger (GL) 6 Produce the Adjusted Trial Balance 7 Produce an Income Statement, Retained Earnings Statement and Balance Sheet 8 Record on Journal Page 4 the closing of all temporary accounts directly into Retained Earnings 10 Post to General Ledger (GL) 11 Produce the Post Closing Trial Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts