Question: I need help with the given question. I have attached a similar solved question with different values for your reference. 5. Given a lognormal distribution

I need help with the given question. I have attached a similar solved question with different values for your reference.

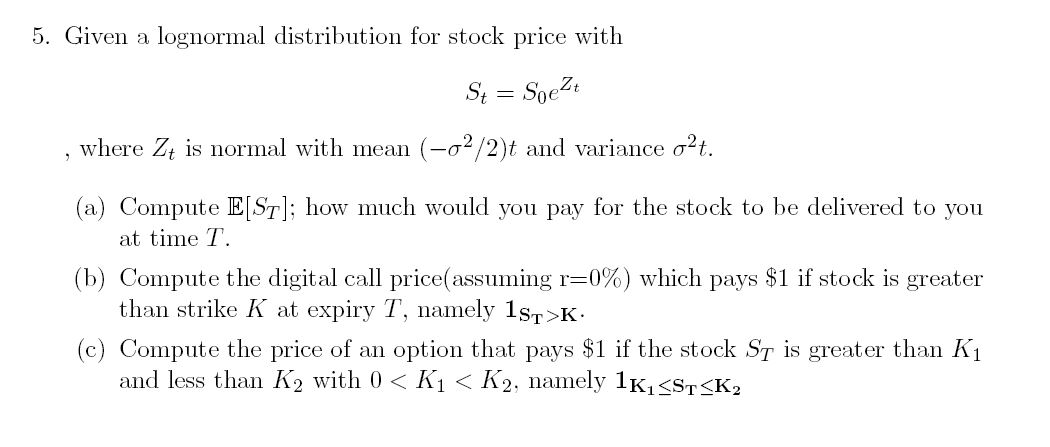

5. Given a lognormal distribution for stock price with St = Soezt , where Zt is normal with mean (r - 02/2)t and variance o't. (a) Compute Efe 'Sr]; how much would you pay for the stock to be delivered to you at time T? taking into account that the moment generating function of a standard normal is etz/2 Efe "'Sr] = erT SoEje(r-62/2)T+ovTN(0,1)] e-IT Soe(r-02/2)TEjeVTN(0,1)] e-rT Soe(r-02/2)T eTo2/2 = So (b) Compute the digital call price which pays $1 if stock is greater than strike K at expiry T, namely e "1ST>K Eels,>K] = e-TP(S(T) > K) P(ST > K) = P (Soe (r - 202 ) T +OVTN(0,1) > K) = P ((r - 302 ) T + OVTN(0, 1) > log5) = POVTN(0, 1) > log 50 - (7 - 202) 1) = P (VIN(0, 1) > & log 5 - (7 - 402) I]) ... = P N(0, 1) > 247 108 5 - (7 - 202) 7]) = P N ( 0, 1 ) K]] - e TE[1ST>k] Let's compute the first part of the expression: e "TE [ST(STK)] = e TE Soe(-202)ToWI1(ST>K)] = Soe-IT V27 = So / In( K / 50 ) - ( 1 -0 2/ 2) VIT 1 - 12 -oVD 2 dx LOVT 108 K + ( " + 202 ) =] ) Putting all together and using what we computed at part b) and using the notation OVTL los " + ( r + 207 ) 7] The price of a call option can be written as : So(di) - Kerrid(di -oVT)\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts