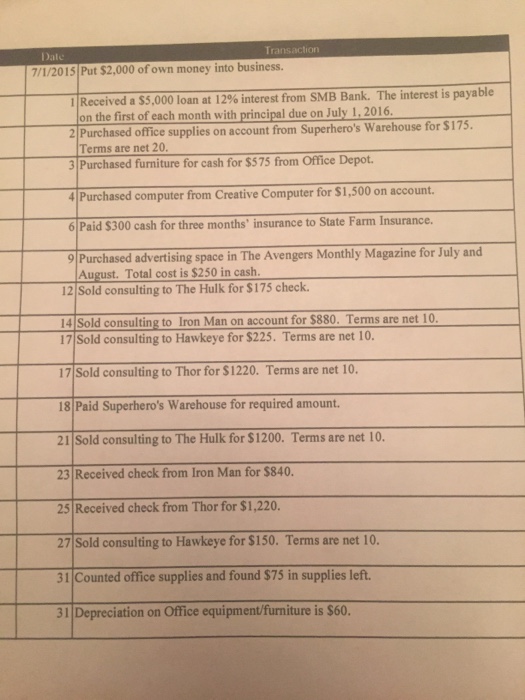

Question: I need help with the journal entries and amounts Put $2,000 of own money into business. Received a $5,000 loan at 12% interest from SMB

Put $2,000 of own money into business. Received a $5,000 loan at 12% interest from SMB Bank. The interest is payable on the first of each month with principal due on July 1. 2016. Purchased office supplies on account from Superhero's Warehouse for $175. Terms are net 20. Purchased furniture for cash for $575 from Office Depot. Purchased computer from Creative Computer for $1,500 on account. Paid $300 cash for three months' insurance to State Farm Insurance. Purchased advertising space in The Avengers Monthly Magazine for July and August. Total cost is $250 in cash. Sold consulting to The Hulk for $175 check. Sold consulting to Iron Man on account for $880. Terms are net 10. Sold consulting to Hawkeye for $225. Terms are net 10. Sold consulting to Thor for $1220. Terms are net 10. Paid Superhero's Warehouse for required amount. Sold consulting to The Hulk for $ 1200. Terms are net 10. Received check from Iron Man for $840. Received check from Thor for $ 1,220. Sold consulting to Hawkeye for $150. Terms are net 10. Counted office supplies and found $75 in supplies left. depreciation on Office equipment/furniture is $60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts