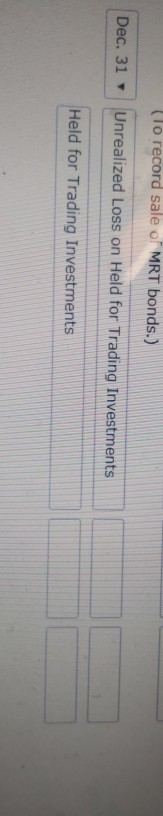

Question: I need help with the journal entry for dec 31. thanks (lo record sale of MRT bonds.) Dec. 31 Unrealized Loss on Held for Trading

I need help with the journal entry for dec 31.

thanks

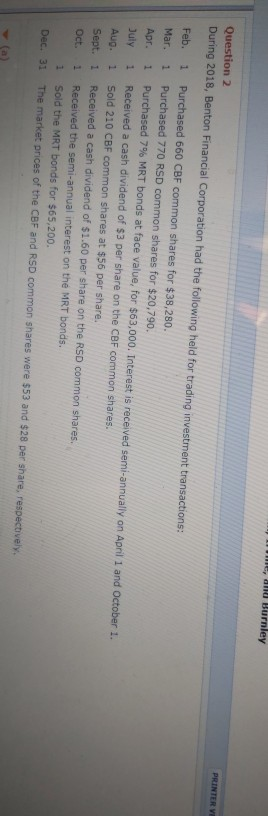

(lo record sale of MRT bonds.) Dec. 31 Unrealized Loss on Held for Trading Investments Held for Trading Investments - and Burnley Question 2 During 2018, Benton Financial Corporation had the following held for trading investment transactions: PRINTER VE Feb. 1 Mar. 1 Apr. 1 July 1 Aug. 1 Sept. 1 Oct. 1 1 Dec.31 Purchased 660 CBF common shares for $38,280. Purchased 770 RSD common shares for $20,790. Purchased 7% MRT bonds at face value, for $63,000. Interest is received semi-annually on April 1 and October 1. Received a cash dividend of $3 per share on the CBF common shares. Sold 210 CBF common shares at $56 per share. Received a cash dividend of $1.60 per share on the RSD common shares. Received the semi-annual interest on the MRT bonds. Sold the MRT bonds for $65,200. The market prices of the CBF and RSD common shares were $53 and $28 per share, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts