Question: I need help with the last entry and part c b. Journalize the transactions under the allowance method, assuming that the allowance account had a

I need help with the last entry and part c

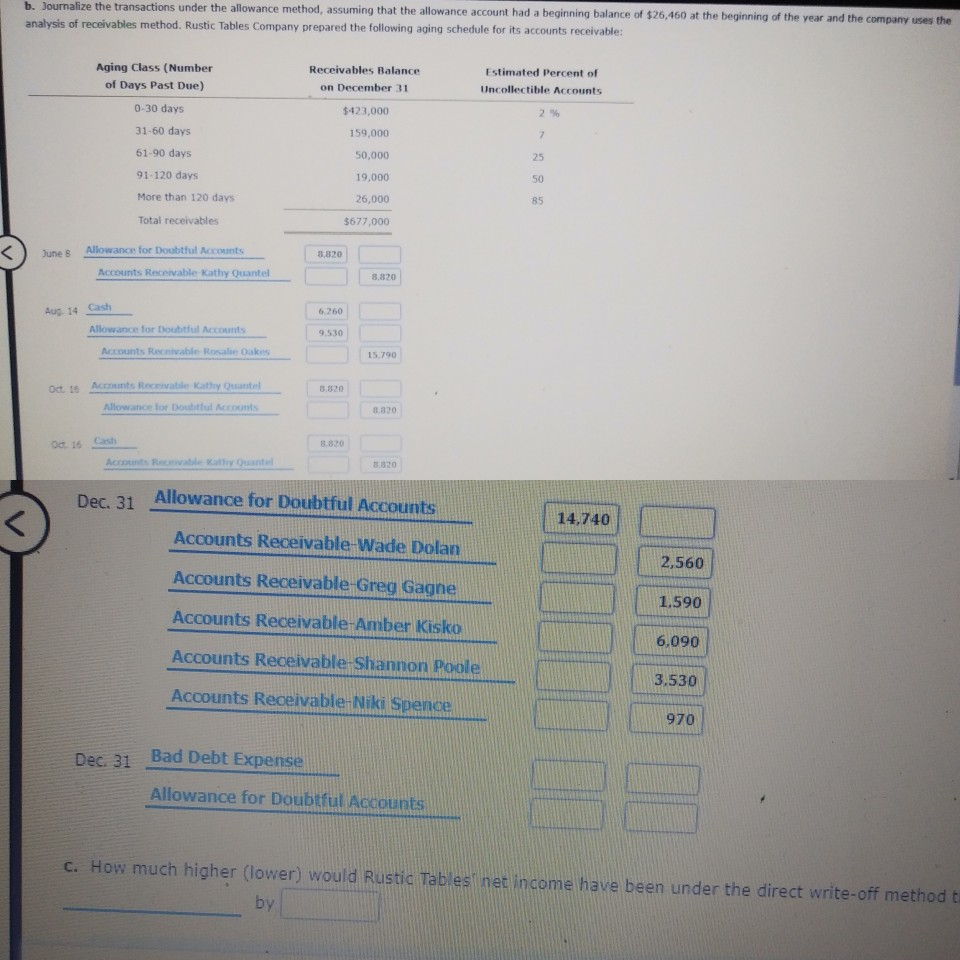

b. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of $26,460 at the beginning of the year and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable: Aging Class (Number of Days Past Due) 0-30 days 31-60 days Receivables Balance on December 31 $423,000 Estimated Percent of Uncollectible Accounts 159,000 7 61-90 days 50,000 25 19,000 50 91-120 days More than 120 days Total receivables 26,000 85 $677,000 June 8 3.820 Allowance for Doubtful Accounts Accounts Receivable Kathy Quantel 8.820 Aug. 14 6.260 Allowance for Doubtful Accounts 9.530 Accounts Receivable Rosalie Cakes 15.790 Oct 16 Accounts Receivable Kathy Dantel 3.820 Allowance for Doubtful Accounts 8.320 Oct 16 1.820 Account Rethy Ouante Dec. 31 Allowance for Doubtful Accounts 14,740 Accounts Receivable-Wade Dolan 2,560 Accounts Receivable-Greg Gagne 1.590 Accounts Receivable-Amber Kisko 6.090 Accounts Receivable-Shannon Poole 3,530 Accounts Receivable-Niki Spence 970 Dec. 31 Bad Debt Expense Allowance for Doubtful Accounts C. How much higher (lower) would Rustic Tables net income have been under the direct write-off method to by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts