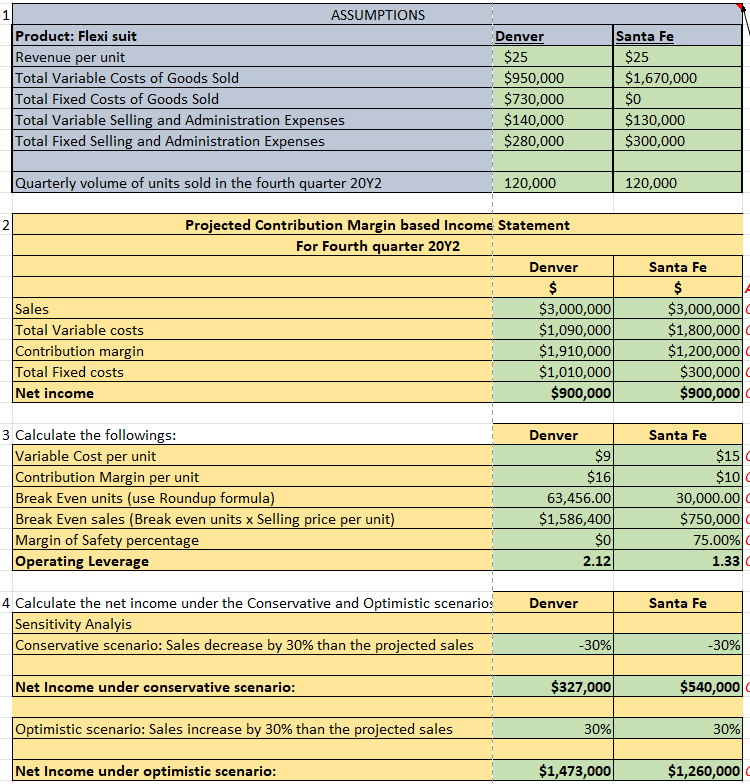

Question: I NEED HELP WITH THE LAST SECTION OF THIS PROBLEM ( PLEASE GIVE FULL FORMULAS AND EXPLINATIONS) begin{tabular}{|l|c|r|} hline multicolumn{2}{|c|}{ Projected Contribution Margin based Income

I NEED HELP WITH THE LAST SECTION OF THIS PROBLEM ( PLEASE GIVE FULL FORMULAS AND EXPLINATIONS)

I NEED HELP WITH THE LAST SECTION OF THIS PROBLEM ( PLEASE GIVE FULL FORMULAS AND EXPLINATIONS)

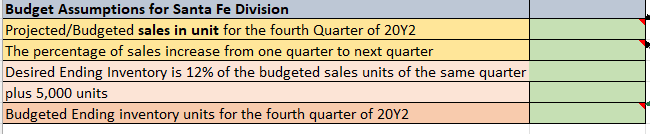

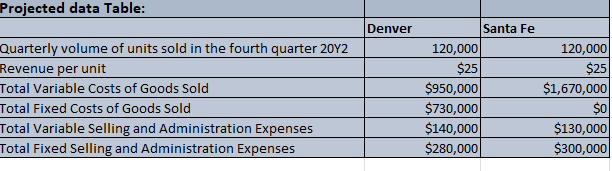

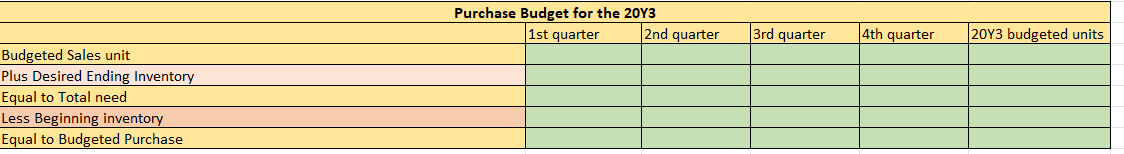

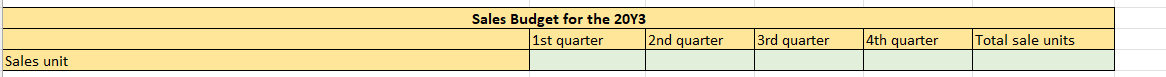

\begin{tabular}{|l|c|r|} \hline \multicolumn{2}{|c|}{ Projected Contribution Margin based Income Statement } \\ \hline \multicolumn{1}{|c|}{ For Fourth quarter 20Y2 } & \multicolumn{2}{|c|}{} \\ \hline & Denver & \multicolumn{2}{|c|}{ Santa Fe } \\ \hline Sales & $ & $ \\ \hline Total Variable costs & $3,000,000 & $3,000,000 \\ \hline Contribution margin & $1,090,000 & $1,800,000 \\ \hline Total Fixed costs & $1,910,000 & $1,200,000 \\ \hline Net income & $1,010,000 & $300,000 \\ \hline \end{tabular} 3 Calculate the followings: Variable Cost per unit Contribution Margin per unit Break Even units (use Roundup formula) Break Even sales (Break even units x Selling price per unit) Margin of Safety percentage Operating Leverage \begin{tabular}{|l|r|r|} \hline Optimistic scenario: Sales increase by 30% than the projected sales & 30% & 30% \\ \hline Net Income under optimistic scenario: & & \\ \hline \end{tabular} Budget Assumptions for Santa Fe Division Projected/Budgeted sales in unit for the fourth Quarter of 20Y2 The percentage of sales increase from one quarter to next quarter Desired Ending Inventory is 12% of the budgeted sales units of the same quarter plus 5,000 units Budgeted Ending inventory units for the fourth quarter of 20Y2 Projected data Table: \begin{tabular}{|l|r|r|} \hline & Denver & \multicolumn{1}{|l|}{ Santa Fe } \\ \hline Quarterly volume of units sold in the fourth quarter 20Y2 & 120,000 & 120,000 \\ \hline Revenue per unit & $25 & $25 \\ \hline Total Variable Costs of Goods Sold & $950,000 & $1,670,000 \\ \hline Total Fixed Costs of Goods Sold & $730,000 & $0 \\ \hline Total Variable Selling and Administration Expenses & $140,000 & $130,000 \\ \hline Total Fixed Selling and Administration Expenses & $280,000 & $300,000 \\ \hline \end{tabular} Purchase Budget for the 20Y3 Sales Budget for the 20Y3 \begin{tabular}{|l|c|r|} \hline \multicolumn{2}{|c|}{ Projected Contribution Margin based Income Statement } \\ \hline \multicolumn{1}{|c|}{ For Fourth quarter 20Y2 } & \multicolumn{2}{|c|}{} \\ \hline & Denver & \multicolumn{2}{|c|}{ Santa Fe } \\ \hline Sales & $ & $ \\ \hline Total Variable costs & $3,000,000 & $3,000,000 \\ \hline Contribution margin & $1,090,000 & $1,800,000 \\ \hline Total Fixed costs & $1,910,000 & $1,200,000 \\ \hline Net income & $1,010,000 & $300,000 \\ \hline \end{tabular} 3 Calculate the followings: Variable Cost per unit Contribution Margin per unit Break Even units (use Roundup formula) Break Even sales (Break even units x Selling price per unit) Margin of Safety percentage Operating Leverage \begin{tabular}{|l|r|r|} \hline Optimistic scenario: Sales increase by 30% than the projected sales & 30% & 30% \\ \hline Net Income under optimistic scenario: & & \\ \hline \end{tabular} Budget Assumptions for Santa Fe Division Projected/Budgeted sales in unit for the fourth Quarter of 20Y2 The percentage of sales increase from one quarter to next quarter Desired Ending Inventory is 12% of the budgeted sales units of the same quarter plus 5,000 units Budgeted Ending inventory units for the fourth quarter of 20Y2 Projected data Table: \begin{tabular}{|l|r|r|} \hline & Denver & \multicolumn{1}{|l|}{ Santa Fe } \\ \hline Quarterly volume of units sold in the fourth quarter 20Y2 & 120,000 & 120,000 \\ \hline Revenue per unit & $25 & $25 \\ \hline Total Variable Costs of Goods Sold & $950,000 & $1,670,000 \\ \hline Total Fixed Costs of Goods Sold & $730,000 & $0 \\ \hline Total Variable Selling and Administration Expenses & $140,000 & $130,000 \\ \hline Total Fixed Selling and Administration Expenses & $280,000 & $300,000 \\ \hline \end{tabular} Purchase Budget for the 20Y3 Sales Budget for the 20Y3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts