Question: I need help with the last three E, F, G. Please help Expense Control Ratios Wages and salaries/Net Sales = $52/$600= 0.0866 Overhead expenses/Net Sales

I need help with the last three E, F, G. Please help

- Expense Control Ratios

Wages and salaries/Net Sales = $52/$600= 0.0866

Overhead expenses/Net Sales =

29/600= 0.0483

Depreciation expenseset sales =

12/600= 0.02

Interest expenseet sales =

28/600=0.0466

Cost of goods sold/ net sale =

445/600=.7416

Taxes/ net sales=

1/600= 0.0016

Selling, admin., and other expenses/ net sales = 28/600 = 0.0466

- Operating Efficiency: Measure of a Business Firms Performance Effectiveness

Inventory turnover ratio=

COGS/Invent. =

445/128= 3.467

Net sales/ Total assets = 600/ 725=0.8275

Net sales / fixed assets = 600/286= 2.097

Net sales/ accounts receivable= 600/155= 3.8709

Average = (155) / (600/360)= 85.87 collection period

- Marketability of the Customers Product or Service

GPM= 600-445/600=0.2583

NPM= 5/600=0.0083

- Coverage Ratios: Measuring the Adequacy of Earnings

Interest coverage = 34/28= 1.214

Coverage of principal and interest payments =

34/ 28+51/(1-.35)= 31.93%

- Liquidity indicators for business customers

Current Ratio =

- Profitability indicators for business customers

- The Financial leverage factor:

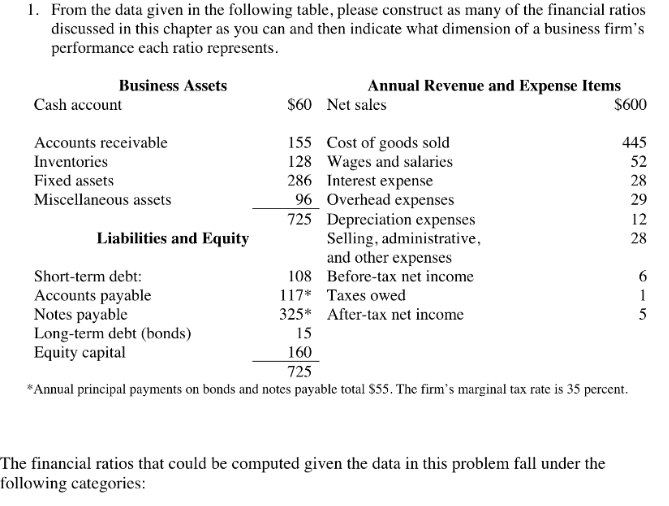

1. From the data given in the following table, please construct as many of the financial ratios discussed in this chapter as you can and then indicate what dimension of a business firm's performance each ratio represents. Business Assets Cash account $60 Annual Revenue and Expense Items Net sales $600 Accounts receivable 155 Cost of goods sold Inventories 128 Wages and salaries Fixed assets 286 Interest expense Miscellaneous assets 96 Overhead expenses 725 Depreciation expenses Liabilities and Equity Selling, administrative, and other expenses Short-term debt: 108 Before-tax net income Accounts payable 117* Taxes owed Notes payable 325* After-tax net income Long-term debt (bonds) Equity capital 160 725 *Annual principal payments on bonds and notes payable total $55. The firm's marginal tax rate is 35 percent. 15 The financial ratios that could be computed given the data in this problem fall under the following categories

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts