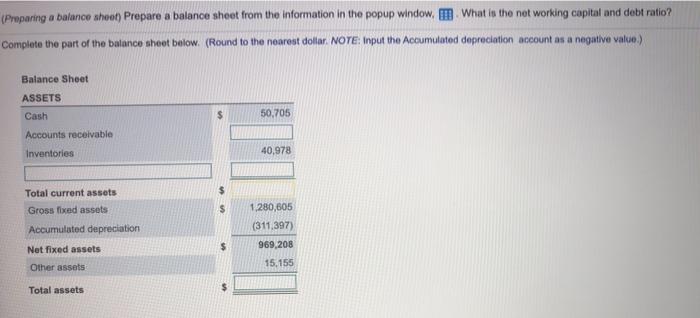

Question: i need help with the missing boxes (Preparing a balance shoot) Prepare a balance sheet from the information in the popup window. What is the

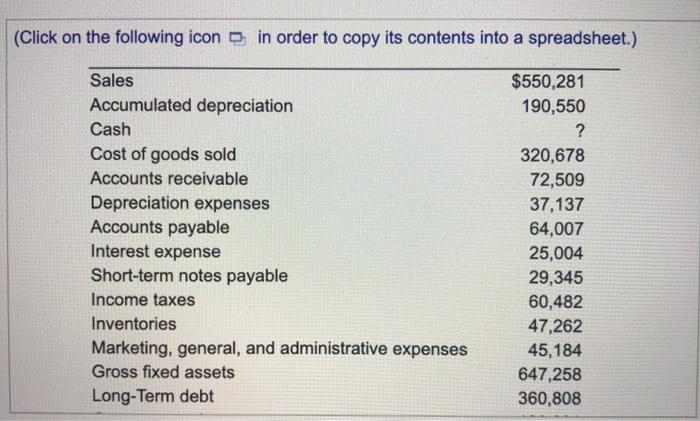

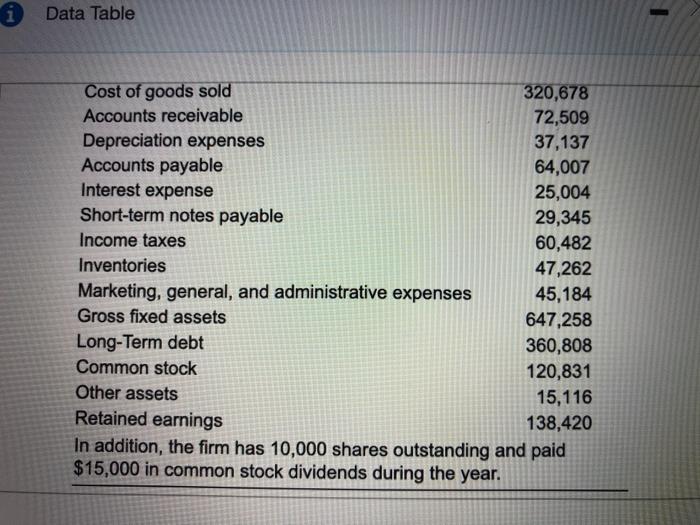

(Preparing a balance shoot) Prepare a balance sheet from the information in the popup window. What is the not working capital and debt ratio? Complete the part of the balance sheet below. (Round to the nearest dollar. NOTE: Input the Accumulated depreciation account as a negative value) Balance Sheet ASSETS Cash 50,705 Accounts receivable Inventories 40,978 Total current assets Gross fixed assets Accumulated depreciation 1.280,605 Net fixed assets Other assets (311.397) 969,208 15,155 Total assets (Click on the following icon in order to copy its contents into a spreadsheet.) Sales Accumulated depreciation Cash Cost of goods sold Accounts receivable Depreciation expenses Accounts payable Interest expense Short-term notes payable Income taxes Inventories Marketing, general, and administrative expenses Gross fixed assets Long-Term debt $550,281 190,550 ? 320,678 72,509 37,137 64,007 25,004 29,345 60,482 47,262 45,184 647,258 360,808 1 Data Table Cost of goods sold 320,678 Accounts receivable 72,509 Depreciation expenses 37,137 Accounts payable 64,007 Interest expense 25,004 Short-term notes payable 29,345 Income taxes 60,482 Inventories 47,262 Marketing, general, and administrative expenses 45,184 Gross fixed assets 647,258 Long-Term debt 360,808 Common stock 120,831 Other assets 15,116 Retained earnings 138,420 In addition, the firm has 10,000 shares outstanding and paid $15,000 in common stock dividends during the year. (Preparing a balance shoot) Prepare a balance sheet from the information in the popup window. What is the not working capital and debt ratio? Complete the part of the balance sheet below. (Round to the nearest dollar. NOTE: Input the Accumulated depreciation account as a negative value) Balance Sheet ASSETS Cash 50,705 Accounts receivable Inventories 40,978 Total current assets Gross fixed assets Accumulated depreciation 1.280,605 Net fixed assets Other assets (311.397) 969,208 15,155 Total assets (Click on the following icon in order to copy its contents into a spreadsheet.) Sales Accumulated depreciation Cash Cost of goods sold Accounts receivable Depreciation expenses Accounts payable Interest expense Short-term notes payable Income taxes Inventories Marketing, general, and administrative expenses Gross fixed assets Long-Term debt $550,281 190,550 ? 320,678 72,509 37,137 64,007 25,004 29,345 60,482 47,262 45,184 647,258 360,808 1 Data Table Cost of goods sold 320,678 Accounts receivable 72,509 Depreciation expenses 37,137 Accounts payable 64,007 Interest expense 25,004 Short-term notes payable 29,345 Income taxes 60,482 Inventories 47,262 Marketing, general, and administrative expenses 45,184 Gross fixed assets 647,258 Long-Term debt 360,808 Common stock 120,831 Other assets 15,116 Retained earnings 138,420 In addition, the firm has 10,000 shares outstanding and paid $15,000 in common stock dividends during the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts