Question: I need help with the numbers for A & D for part A. I need the whole thing for part B. Alex and Bess have

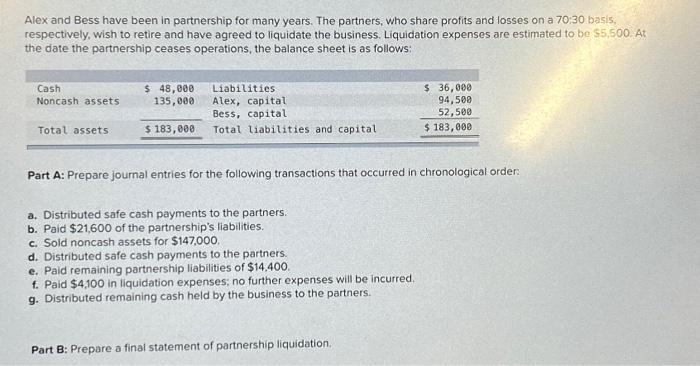

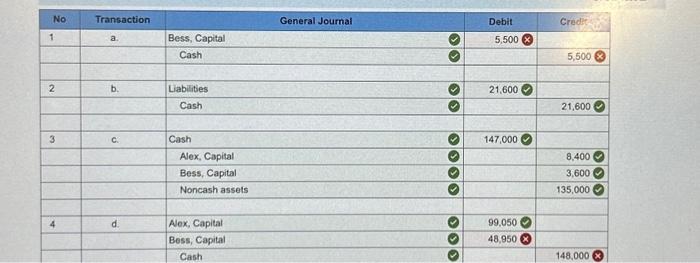

Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a \\( 70: 30 \\) basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be \\( \\$ 5,500 \\). At the date the partnership ceases operations, the balance sheet is as follows: Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid \\( \\$ 21,600 \\) of the partnership's liabilities. c. Sold noncash assets for \\( \\$ 147,000 \\). d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of \\( \\$ 14.400 \\). f. Paid \\( \\$ 4,100 \\) in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners. Part B: Prepare a final statement of partnership liquidation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts