Question: I need help with the part M, N, and O. excel spreadsheet to show all work. Problem 1 (45 marks) You have done your research

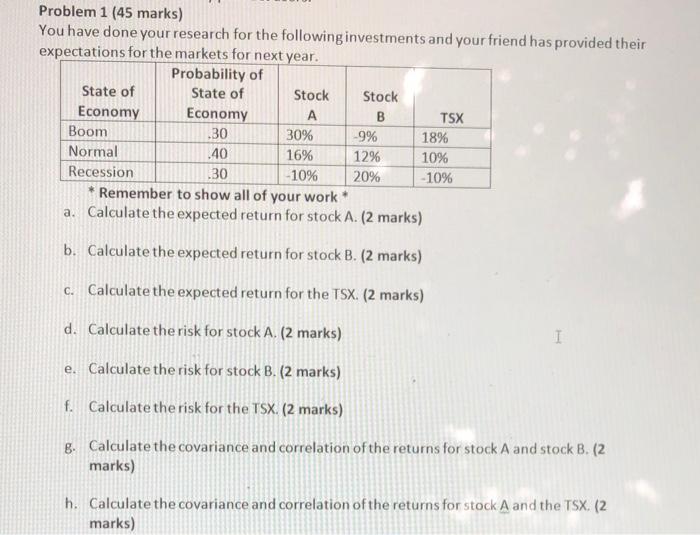

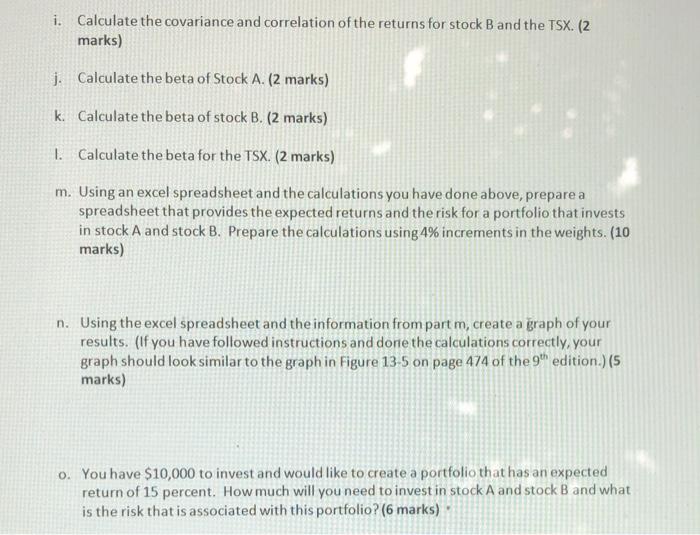

Problem 1 (45 marks) You have done your research for the following investments and your friend has provided their expectations for the markets for next year. Probability of State of State of Stock Stock Economy Economy A B TSX Boom .30 30% -9% 18% Normal .40 16% 12% 10% Recession .30 -10% 20% -10% Remember to show all of your work a. Calculate the expected return for stock A. (2 marks) b. Calculate the expected return for stock B. (2 marks) C. Calculate the expected return for the TSX. (2 marks) d. Calculate the risk for stock A. (2 marks) I e. Calculate the risk for stock B. (2 marks) f. Calculate the risk for the TSX. (2 marks) g. Calculate the covariance and correlation of the returns for stock A and stock B. (2 marks) h. Calculate the covariance and correlation of the returns for stock A and the TSX. (2 marks) i. Calculate the covariance and correlation of the returns for stock B and the TSX. (2 marks) j. Calculate the beta of Stock A. (2 marks) k. Calculate the beta of stock B. (2 marks) 1. Calculate the beta for the TSX. (2 marks) m. Using an excel spreadsheet and the calculations you have done above, prepare a spreadsheet that provides the expected returns and the risk for a portfolio that invests in stock A and stock B. Prepare the calculations using 4% increments in the weights. (10 marks) n. Using the excel spreadsheet and the information from part m, create a graph of your results. (If you have followed instructions and done the calculations correctly, your graph should look similar to the graph in Figure 13-5 on page 474 of the 9th edition.) (5 marks) o. You have $10,000 to invest and would like to create a portfolio that has an expected return of 15 percent. How much will you need to invest in stock A and stock B and what is the risk that is associated with this portfolio? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts