Question: I need help with the problem below. Thanks in advance! Problem4 Alex, Barnes, Caleb and Davis have the following partnership business: Assets Cash $55,000 Current

I need help with the problem below. Thanks in advance!

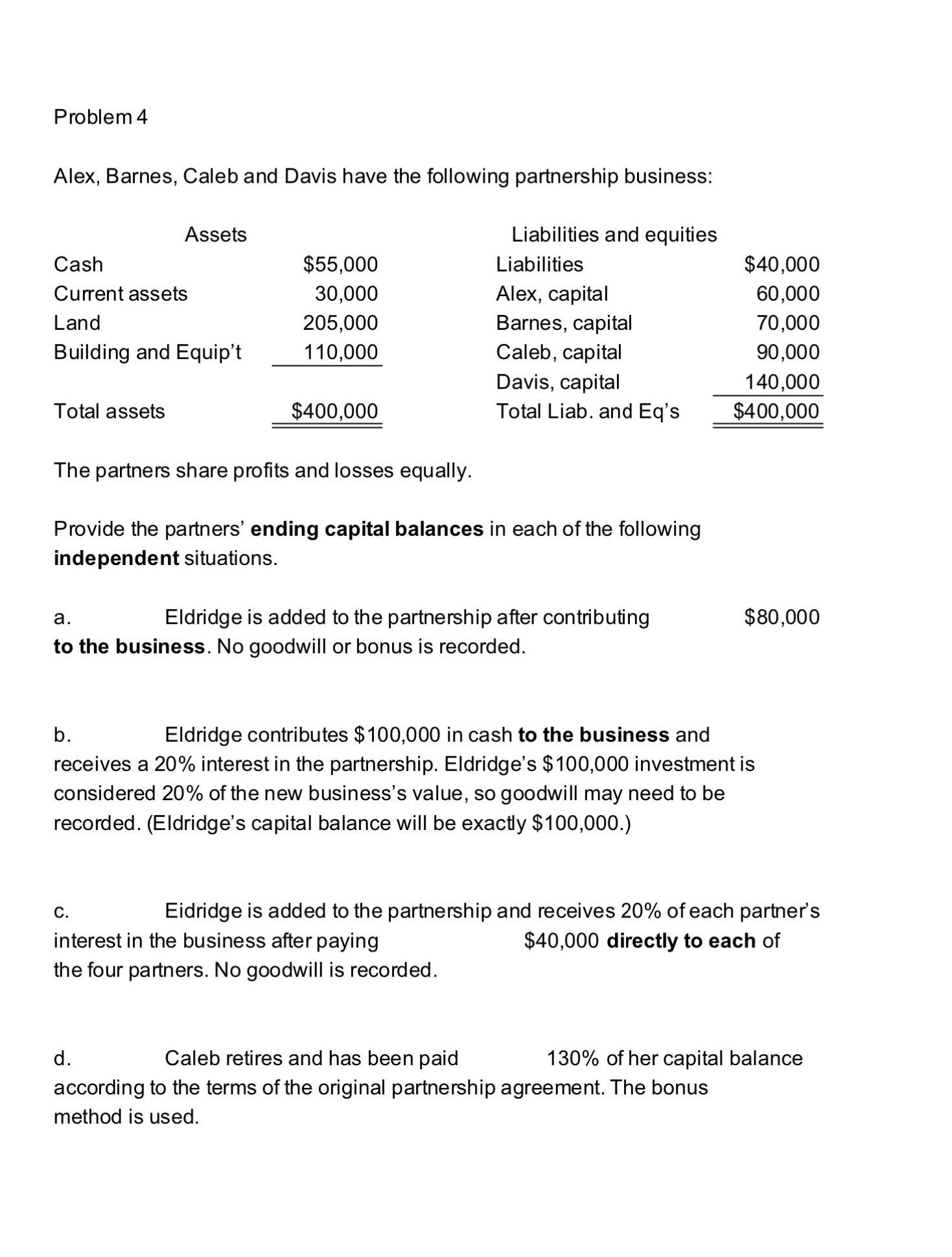

Problem4 Alex, Barnes, Caleb and Davis have the following partnership business: Assets Cash $55,000 Current assets 30,000 Land 205,000 Building and Equip't 110,000 Total assets $400,000 The partners share prots and losses equally. Liabilities and equities Liabilities $40,000 Alex, capital 60,000 Barnes, capital 70,000 Caleb, capital 90,000 Davis, capital 140,000 Total Liab. and Eq's $400,000 Provide the partners' ending capital balances in each of the following independent situations. a. Eldridge is added to the partnership after contributing $80,000 to the business. No goodwill or bonus is recorded. b. Eldridge contributes $100,000 in cash to the business and receives a 20% interest in the partnership. Eldridge's $100,000 investment is considered 20% ofthe new business's value. so goodwill may need to be recorded. (Eldridge's capital balance will be exactly $100,000.) 0. Eldridge is added to the partnership and receives 20% of each partner's interest in the business after paying the four partners. No goodwill is recorded. d. Caleb retires and has been paid $40,000 directly to each of 130% of her capital balance according to the terms of the original partnership agreement. The bonus method is used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts