Question: i need help with the Quality Sporting Goods coorporation. please use excel and in depth explain all steps and calculations. i only posted the other

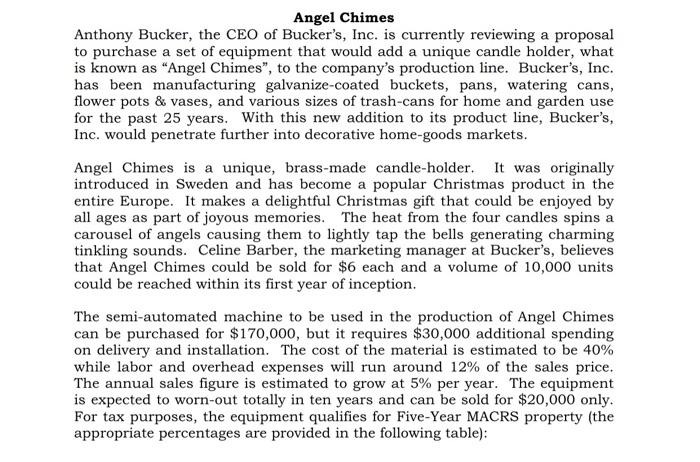

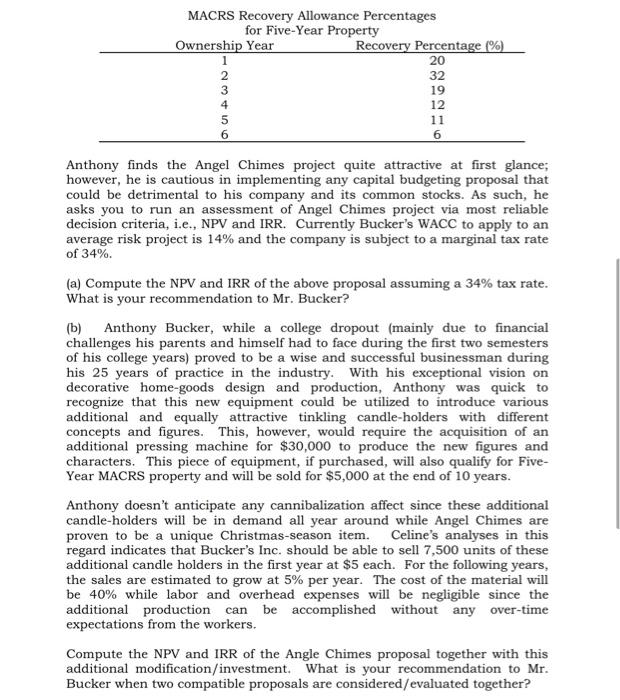

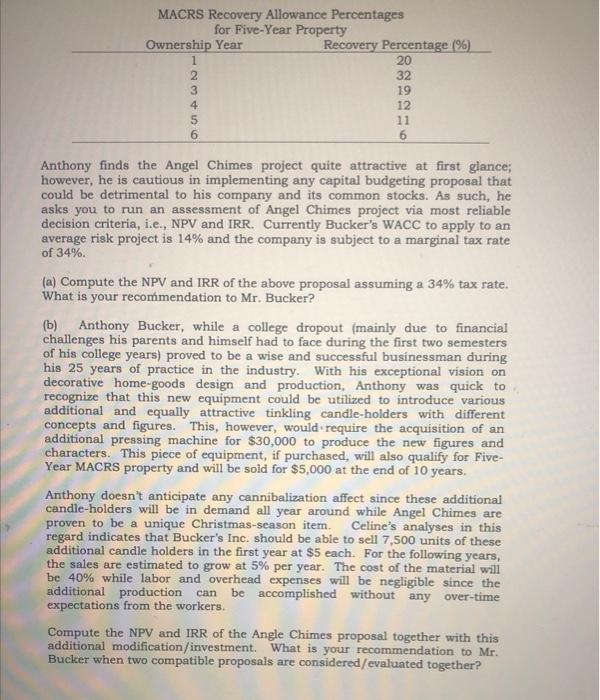

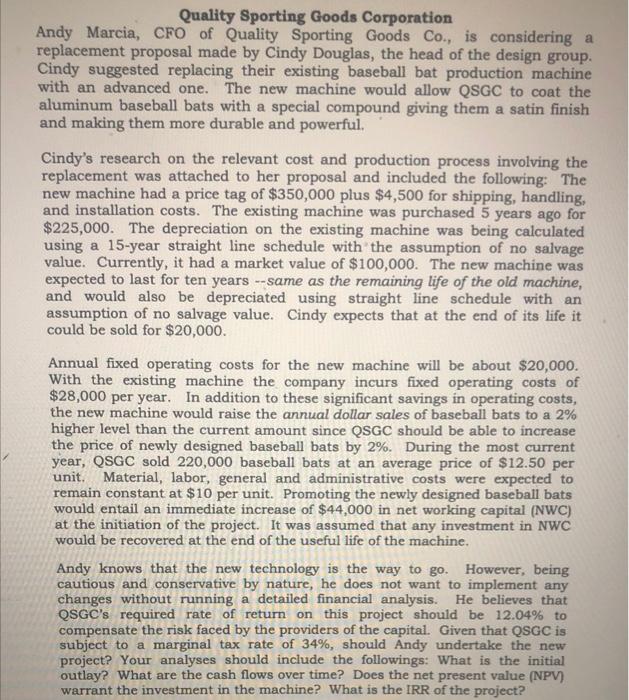

Angel Chimes Anthony Bucker, the CEO of Bucker's, Inc. is currently reviewing a proposal to purchase a set of equipment that would add a unique candle holder, what is known as "Angel Chimes", to the company's production line. Bucker's, Inc. has been manufacturing galvanize-coated buckets, pans, watering cans, flower pots & vases, and various sizes of trash-cans for home and garden use for the past 25 years. With this new addition to its product line, Bucker's, Inc. would penetrate further into decorative home-goods markets. Angel Chimes is a unique, brass-made candle-holder. It was originally introduced in Sweden and has become a popular Christmas product in the entire Europe. It makes a delightful Christmas gift that could be enjoyed by all ages as part of joyous memories. The heat from the four candles spins a carousel of angels causing them to lightly tap the bells generating charming tinkling sounds. Celine Barber, the marketing manager at Bucker's, believes that Angel Chimes could be sold for $6 each and a volume of 10,000 units could be reached within its first year of inception. The semi-automated machine to be used in the production of Angel Chimes can be purchased for $170,000, but it requires $30,000 additional spending on delivery and installation. The cost of the material is estimated to be 40% while labor and overhead expenses will run around 12% of the sales price. The annual sales figure is estimated to grow at 5% per year. The equipment is expected to worn-out totally in ten years and can be sold for $20,000 only. For tax purposes, the equipment qualifies for Five-Year MACRS property (the appropriate percentages are provided in the following table): MACRS Recovery Allowance Percentages for Five-Year Property Ownership Year Recovery Percentage (%) 20 2 32 3 19 4 12 5 11 6 6 Anthony finds the Angel Chimes project quite attractive at first glance; however, he is cautious in implementing any capital budgeting proposal that could be detrimental to his company and its common stocks. As such, he asks you to run an assessment of Angel Chimes project via most reliable decision criteria, i.e., NPV and IRR. Currently Bucker's WACC to apply to an average risk project is 14% and the company is subject to a marginal tax rate of 34%. (a) Compute the NPV and IRR of the above proposal assuming a 34% tax rate. What is your recommendation to Mr. Bucker? (b) Anthony Bucker, while a college dropout (mainly due to financial challenges his parents and himself had to face during the first two semesters of his college years) proved to be a wise and successful businessman during his 25 years of practice in the industry. With his exceptional vision on decorative home-goods design and production, Anthony was quick to recognize that this new equipment could be utilized to introduce various additional and equally attractive tinkling candle holders with different concepts and figures. This, however, would require the acquisition of an additional pressing machine for $30,000 to produce the new figures and characters. This piece of equipment, if purchased, will also qualify for Five- Year MACRS property and will be sold for $5,000 at the end of 10 years. Anthony doesn't anticipate any cannibalization affect since these additional candle holders will be in demand all year around while Angel Chimes are proven to be a unique Christmas-season item. Celine's analyses in this regard indicates that Bucker's Inc. should be able to sell 7,500 units of these additional candle holders in the first year at $5 each. For the following years, the sales are estimated to grow at 5% per year. The cost of the material will be 40% while labor and overhead expenses will be negligible since the additional production can be accomplished without any over-time expectations from the workers. Compute the NPV and IRR of the Angle Chimes proposal together with this additional modification/investment. What is your recommendation to Mr. Bucker when two compatible proposals are considered/evaluated together? Quality Sporting Goods Corporation Andy Marcia, CFO of Quality Sporting Goods Co., is considering a replacement proposal made by Cindy Douglas, the head of the design group. Cindy suggested replacing their existing baseball bat production machine with an advanced one. The new machine would allow QSGC to coat the aluminum baseball bats with a special compound giving them a satin finish and making them more durable and powerful. Cindy's research on the relevant cost and production process involving the replacement was attached to her proposal and included the following: The new machine had a price tag of $350,000 plus $4,500 for shipping, handling, and installation costs. The existing machine was purchased 5 years ago for $225,000. The depreciation on the existing machine was being calculated using a 15-year straight line schedule with the assumption of no salvage value. Currently, it had a market value of $100,000. The new machine was expected to last for ten years -- same as the remaining life of the old machine, and would also be depreciated using straight line schedule with an assumption of no salvage value. Cindy expects that at the end of its life it could be sold for $20,000. Annual fixed operating costs for the new machine will be about $20,000. With the existing machine the company incurs fixed operating costs of $28,000 per year. In addition to these significant savings in operating costs, the new machine would raise the annual dollar sales of baseball bats to a 2% higher level than the current amount since QSGC should be able to increase the price of newly designed baseball bats by 2%. During the most current year, QSGC sold 220,000 baseball bats at an average price of $12.50 per unit. Material, labor, general and administrative costs were expected to remain constant at $10 per unit. Promoting the newly designed baseball bats would entail an immediate increase of $44,000 in net working capital (NWC) at the initiation of the project. It was assumed that any investment in NWC would be recovered at the end of the useful life of the machine. Andy knows that the new technology is the way to go. However, being cautious and conservative by nature, he does not want to implement any changes without running a detailed financial analysis. He believes that QSGC's required rate of return on this project should be 12.04% to compensate the risk faced by the providers of the capital. Given that QSGC is subject to a marginal tax rate of 34%, should Andy undertake the new project? Your analyses should include the followings: What is the initial outlay? What are the cash flows over time? Does the net present value (NPV) warrant the investment in the machine? What is the IRR of the project? Angel Chimes Anthony Bucker, the CEO of Bucker's, Inc. in currently reviewing a proposal to purchase a set of equipment that would add a unique candle holder, what is known as "Angel Chimes", to the company's production line. Bucker's, Inc. has been manufacturing galvanize-coated buckets, pans, watering cans, flower pots & vases, and various sizes of trash-cann for home and garden une for the past 25 years. With this new addition to its product line, Bucker's, Inc. would penetrate further into decorative home-good markets. Angel Chimes is a unique, brass-made candle-holder. It was originally introduced in Sweden and has become a popular Christmas product in the entire Europe. It makes a delightful Christmas gift that could be enjoyed by all ages as part of joyous memories. The heat from the four candies spins a carousel of angels causing them to lightly tap the bella generating charming tinding sounds. Celine Barber, the marketing manager at Buckers, believen that Angel Chimen could be sold for $6 each and a volume of 10,000 units could be reached within its first year of inception. The semi-automated machine to be used in the production of Angel Chimen can be purchased for $170,000, but it requires $30,000 additional spending on delivery and installation. The cost of the material is estimated to be 40% while labor and overhead expenses will run around 12% of the sales price, The annual sales figure is estimated to grow at 5% per year. The equipment is expected to worn-out totally in ten years and can be sold for $20,000 only. For tax purposes, the equipment qualifies for Five Year MACRS property (the appropriate percentages are provided in the following table): MACRS Recovery Allowance Percentages for Five-Year Property Ownership Year Recovery Percentage (%) 1 20 2 32 19 12 5 11 6 3 4 Anthony finds the Angel Chimes project quite attractive at first glance; however, he is cautious in implementing any capital budgeting proposal that could be detrimental to his company and its common stocks. As such, he asks you to run an assessment of Angel Chimes project via most reliable decision criteria, i.e., NPV and IRR. Currently Bucker's WACC to apply to an average risk project is 14% and the company is subject to a marginal tax rate of 34%. (a) Compute the NPV and IRR of the above proposal assuming a 34% tax rate. What is your recommendation to Mr. Bucker? (b) Anthony Bucker, while a college dropout (mainly due to financial challenges his parents and himself had to face during the first two semesters of his college years) proved to be a wise and successful businessman during his 25 years of practice in the industry. With his exceptional vision on decorative home-goods design and production, Anthony was quick to recognize that this new equipment could be utilized to introduce various additional and equally attractive tinkling candle holders with different concepts and figures. This, however, would require the acquisition of an additional pressing machine for $30,000 to produce the new figures and characters. This piece of equipment, if purchased, will also qualify for Five- Year MACRS property and will be sold for $5,000 at the end of 10 years. Anthony doesn't anticipate any cannibalization affect since these additional candle-holders will be in demand all year around while Angel Chimes are proven to be a unique Christmas-season item. Celine's analyses in this regard indicates that Bucker's Inc. should be able to sell 7,500 units of these additional candle holders in the first year at $5 each. For the following years, the sales are estimated to grow at 5% per year. The cost of the material will be 40% while labor and overhead expenses will be negligible since the additional production can be accomplished without any over-time expectations from the workers. Compute the NPV and IRR of the Angle Chimes proposal together with this additional modification/investment. What is your recommendation to Mr. Bucker when two compatible proposals are considered/evaluated together? Quality Sporting Goods Corporation Andy Marcia, CFO of Quality Sporting Goods Co., is considering a replacement proposal made by Cindy Douglas, the head of the design group. Cindy suggested replacing their existing baseball bat production machine with an advanced one. The new machine would allow QSGC to coat the aluminum baseball bats with a special compound giving them a satin finish and making them more durable and powerful. Cindy's research on the relevant cost and production process involving the replacement was attached to her proposal and included the following: The new machine had a price tag of $350,000 plus $4,500 for shipping, handling, and installation costs. The existing machine was purchased 5 years ago for $225,000. The depreciation on the existing machine was being calculated using a 15-year straight line schedule with the assumption of no salvage value. Currently, it had a market value of $100,000. The new machine was expected to last for ten years -- same as the remaining life of the old machine, and would also be depreciated using straight line schedule with an assumption of no salvage value. Cindy expects that at the end of its life it could be sold for $20,000. Annual fixed operating costs for the new machine will be about $20,000. With the existing machine the company incurs fixed operating costs of $28,000 per year. In addition to these significant savings in operating costs, the new machine would raise the annual dollar sales of baseball bats to a 2% higher level than the current amount since QSGC should be able to increase the price of newly designed baseball bats by 2%. During the most current year, QSGC sold 220,000 baseball bats at an average price of $12.50 per unit. Material, labor, general and administrative costs were expected to remain constant at $10 per unit. Promoting the newly designed baseball bats would entail an immediate increase of $44,000 in net working capital (NWC) at the initiation of the project. It was assumed that any investment in NWC would be recovered at the end of the useful life of the machine. Andy knows that the new technology is the way to go. However, being cautious and conservative by nature, he does not want to implement any changes without running a detailed financial analysis. He believes that QSGC's required rate of return on this project should be 12.04% to compensate the risk faced by the providers of the capital. Given that QSGC is subject to a marginal tax rate of 34%, should Andy undertake the new project? Your analyses should include the followings: What is the initial outlay? What are the cash flows over time? Does the net present value (NPV) warrant the investment in the machine? What is the IRR of the project? red at the end othhouse Angel Chimes Anthony Bucker, the CEO of Bucker's, Inc. is currently reviewing a proposal to purchase a set of equipment that would add a unique candle holder, what is known as "Angel Chimes", to the company's production line. Bucker's, Inc. has been manufacturing galvanize-coated buckets, pans, watering cans, flower pots & vases, and various sizes of trash-cans for home and garden use for the past 25 years. With this new addition to its product line, Bucker's, Inc. would penetrate further into decorative home-goods markets. Angel Chimes is a unique, brass-made candle-holder. It was originally introduced in Sweden and has become a popular Christmas product in the entire Europe. It makes a delightful Christmas gift that could be enjoyed by all ages as part of joyous memories. The heat from the four candles spins a carousel of angels causing them to lightly tap the bells generating charming tinkling sounds. Celine Barber, the marketing manager at Bucker's, believes that Angel Chimes could be sold for $6 each and a volume of 10,000 units could be reached within its first year of inception. The semi-automated machine to be used in the production of Angel Chimes can be purchased for $170,000, but it requires $30,000 additional spending on delivery and installation. The cost of the material is estimated to be 40% while labor and overhead expenses will run around 12% of the sales price. The annual sales figure is estimated to grow at 5% per year. The equipment is expected to worn-out totally in ten years and can be sold for $20,000 only. For tax purposes, the equipment qualifies for Five-Year MACRS property (the appropriate percentages are provided in the following table): MACRS Recovery Allowance Percentages for Five-Year Property Ownership Year Recovery Percentage (%) 20 2 32 3 19 4 12 5 11 6 6 Anthony finds the Angel Chimes project quite attractive at first glance; however, he is cautious in implementing any capital budgeting proposal that could be detrimental to his company and its common stocks. As such, he asks you to run an assessment of Angel Chimes project via most reliable decision criteria, i.e., NPV and IRR. Currently Bucker's WACC to apply to an average risk project is 14% and the company is subject to a marginal tax rate of 34%. (a) Compute the NPV and IRR of the above proposal assuming a 34% tax rate. What is your recommendation to Mr. Bucker? (b) Anthony Bucker, while a college dropout (mainly due to financial challenges his parents and himself had to face during the first two semesters of his college years) proved to be a wise and successful businessman during his 25 years of practice in the industry. With his exceptional vision on decorative home-goods design and production, Anthony was quick to recognize that this new equipment could be utilized to introduce various additional and equally attractive tinkling candle holders with different concepts and figures. This, however, would require the acquisition of an additional pressing machine for $30,000 to produce the new figures and characters. This piece of equipment, if purchased, will also qualify for Five- Year MACRS property and will be sold for $5,000 at the end of 10 years. Anthony doesn't anticipate any cannibalization affect since these additional candle holders will be in demand all year around while Angel Chimes are proven to be a unique Christmas-season item. Celine's analyses in this regard indicates that Bucker's Inc. should be able to sell 7,500 units of these additional candle holders in the first year at $5 each. For the following years, the sales are estimated to grow at 5% per year. The cost of the material will be 40% while labor and overhead expenses will be negligible since the additional production can be accomplished without any over-time expectations from the workers. Compute the NPV and IRR of the Angle Chimes proposal together with this additional modification/investment. What is your recommendation to Mr. Bucker when two compatible proposals are considered/evaluated together? Quality Sporting Goods Corporation Andy Marcia, CFO of Quality Sporting Goods Co., is considering a replacement proposal made by Cindy Douglas, the head of the design group. Cindy suggested replacing their existing baseball bat production machine with an advanced one. The new machine would allow QSGC to coat the aluminum baseball bats with a special compound giving them a satin finish and making them more durable and powerful. Cindy's research on the relevant cost and production process involving the replacement was attached to her proposal and included the following: The new machine had a price tag of $350,000 plus $4,500 for shipping, handling, and installation costs. The existing machine was purchased 5 years ago for $225,000. The depreciation on the existing machine was being calculated using a 15-year straight line schedule with the assumption of no salvage value. Currently, it had a market value of $100,000. The new machine was expected to last for ten years -- same as the remaining life of the old machine, and would also be depreciated using straight line schedule with an assumption of no salvage value. Cindy expects that at the end of its life it could be sold for $20,000. Annual fixed operating costs for the new machine will be about $20,000. With the existing machine the company incurs fixed operating costs of $28,000 per year. In addition to these significant savings in operating costs, the new machine would raise the annual dollar sales of baseball bats to a 2% higher level than the current amount since QSGC should be able to increase the price of newly designed baseball bats by 2%. During the most current year, QSGC sold 220,000 baseball bats at an average price of $12.50 per unit. Material, labor, general and administrative costs were expected to remain constant at $10 per unit. Promoting the newly designed baseball bats would entail an immediate increase of $44,000 in net working capital (NWC) at the initiation of the project. It was assumed that any investment in NWC would be recovered at the end of the useful life of the machine. Andy knows that the new technology is the way to go. However, being cautious and conservative by nature, he does not want to implement any changes without running a detailed financial analysis. He believes that QSGC's required rate of return on this project should be 12.04% to compensate the risk faced by the providers of the capital. Given that QSGC is subject to a marginal tax rate of 34%, should Andy undertake the new project? Your analyses should include the followings: What is the initial outlay? What are the cash flows over time? Does the net present value (NPV) warrant the investment in the machine? What is the IRR of the project? Angel Chimes Anthony Bucker, the CEO of Bucker's, Inc. in currently reviewing a proposal to purchase a set of equipment that would add a unique candle holder, what is known as "Angel Chimes", to the company's production line. Bucker's, Inc. has been manufacturing galvanize-coated buckets, pans, watering cans, flower pots & vases, and various sizes of trash-cann for home and garden une for the past 25 years. With this new addition to its product line, Bucker's, Inc. would penetrate further into decorative home-good markets. Angel Chimes is a unique, brass-made candle-holder. It was originally introduced in Sweden and has become a popular Christmas product in the entire Europe. It makes a delightful Christmas gift that could be enjoyed by all ages as part of joyous memories. The heat from the four candies spins a carousel of angels causing them to lightly tap the bella generating charming tinding sounds. Celine Barber, the marketing manager at Buckers, believen that Angel Chimen could be sold for $6 each and a volume of 10,000 units could be reached within its first year of inception. The semi-automated machine to be used in the production of Angel Chimen can be purchased for $170,000, but it requires $30,000 additional spending on delivery and installation. The cost of the material is estimated to be 40% while labor and overhead expenses will run around 12% of the sales price, The annual sales figure is estimated to grow at 5% per year. The equipment is expected to worn-out totally in ten years and can be sold for $20,000 only. For tax purposes, the equipment qualifies for Five Year MACRS property (the appropriate percentages are provided in the following table): MACRS Recovery Allowance Percentages for Five-Year Property Ownership Year Recovery Percentage (%) 1 20 2 32 19 12 5 11 6 3 4 Anthony finds the Angel Chimes project quite attractive at first glance; however, he is cautious in implementing any capital budgeting proposal that could be detrimental to his company and its common stocks. As such, he asks you to run an assessment of Angel Chimes project via most reliable decision criteria, i.e., NPV and IRR. Currently Bucker's WACC to apply to an average risk project is 14% and the company is subject to a marginal tax rate of 34%. (a) Compute the NPV and IRR of the above proposal assuming a 34% tax rate. What is your recommendation to Mr. Bucker? (b) Anthony Bucker, while a college dropout (mainly due to financial challenges his parents and himself had to face during the first two semesters of his college years) proved to be a wise and successful businessman during his 25 years of practice in the industry. With his exceptional vision on decorative home-goods design and production, Anthony was quick to recognize that this new equipment could be utilized to introduce various additional and equally attractive tinkling candle holders with different concepts and figures. This, however, would require the acquisition of an additional pressing machine for $30,000 to produce the new figures and characters. This piece of equipment, if purchased, will also qualify for Five- Year MACRS property and will be sold for $5,000 at the end of 10 years. Anthony doesn't anticipate any cannibalization affect since these additional candle-holders will be in demand all year around while Angel Chimes are proven to be a unique Christmas-season item. Celine's analyses in this regard indicates that Bucker's Inc. should be able to sell 7,500 units of these additional candle holders in the first year at $5 each. For the following years, the sales are estimated to grow at 5% per year. The cost of the material will be 40% while labor and overhead expenses will be negligible since the additional production can be accomplished without any over-time expectations from the workers. Compute the NPV and IRR of the Angle Chimes proposal together with this additional modification/investment. What is your recommendation to Mr. Bucker when two compatible proposals are considered/evaluated together? Quality Sporting Goods Corporation Andy Marcia, CFO of Quality Sporting Goods Co., is considering a replacement proposal made by Cindy Douglas, the head of the design group. Cindy suggested replacing their existing baseball bat production machine with an advanced one. The new machine would allow QSGC to coat the aluminum baseball bats with a special compound giving them a satin finish and making them more durable and powerful. Cindy's research on the relevant cost and production process involving the replacement was attached to her proposal and included the following: The new machine had a price tag of $350,000 plus $4,500 for shipping, handling, and installation costs. The existing machine was purchased 5 years ago for $225,000. The depreciation on the existing machine was being calculated using a 15-year straight line schedule with the assumption of no salvage value. Currently, it had a market value of $100,000. The new machine was expected to last for ten years -- same as the remaining life of the old machine, and would also be depreciated using straight line schedule with an assumption of no salvage value. Cindy expects that at the end of its life it could be sold for $20,000. Annual fixed operating costs for the new machine will be about $20,000. With the existing machine the company incurs fixed operating costs of $28,000 per year. In addition to these significant savings in operating costs, the new machine would raise the annual dollar sales of baseball bats to a 2% higher level than the current amount since QSGC should be able to increase the price of newly designed baseball bats by 2%. During the most current year, QSGC sold 220,000 baseball bats at an average price of $12.50 per unit. Material, labor, general and administrative costs were expected to remain constant at $10 per unit. Promoting the newly designed baseball bats would entail an immediate increase of $44,000 in net working capital (NWC) at the initiation of the project. It was assumed that any investment in NWC would be recovered at the end of the useful life of the machine. Andy knows that the new technology is the way to go. However, being cautious and conservative by nature, he does not want to implement any changes without running a detailed financial analysis. He believes that QSGC's required rate of return on this project should be 12.04% to compensate the risk faced by the providers of the capital. Given that QSGC is subject to a marginal tax rate of 34%, should Andy undertake the new project? Your analyses should include the followings: What is the initial outlay? What are the cash flows over time? Does the net present value (NPV) warrant the investment in the machine? What is the IRR of the project? red at the end othhouse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts