Question: i need help with the question at the bottom. You own a coal mining company and are considering opening a new mine. The mine will

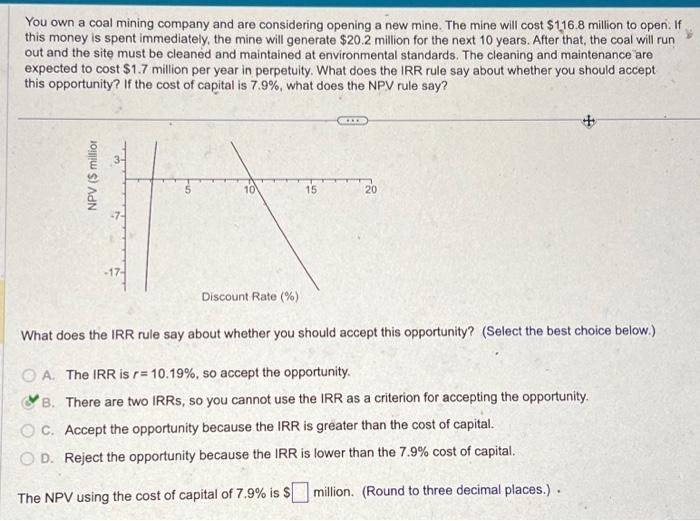

You own a coal mining company and are considering opening a new mine. The mine will cost $116.8 million to open. If this money is spent immediately, the mine will generate $20.2 million for the next 10 years. After that, the coal will run out and the site must be cleaned and maintained at environmental standards. The cleaning and maintenance are expected to cost $1.7 million per year in perpetuity. What does the IRR rule say about whether you should accept this opportunity? If the cost of capital is 7.9%, what does the NPV rule say? What does the IRR rule say about whether you should accept this opportunity? (Select the best choice below.) A. The IRR is r=10.19%, so accept the opportunity. B. There are two IRRs, so you cannot use the IRR as a criterion for accepting the opportunity. C. Accept the opportunity because the IRR is greater than the cost of capital. D. Reject the opportunity because the IRR is lower than the 7.9% cost of capital. The NPV using the cost of capital of 7.9% is $ million. (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts