Question: I need help with the question attaced below An endowment economy consists of two types of consumers indexed by i = 1.2. Let [cg-1.9:) be

I need help with the question attaced below

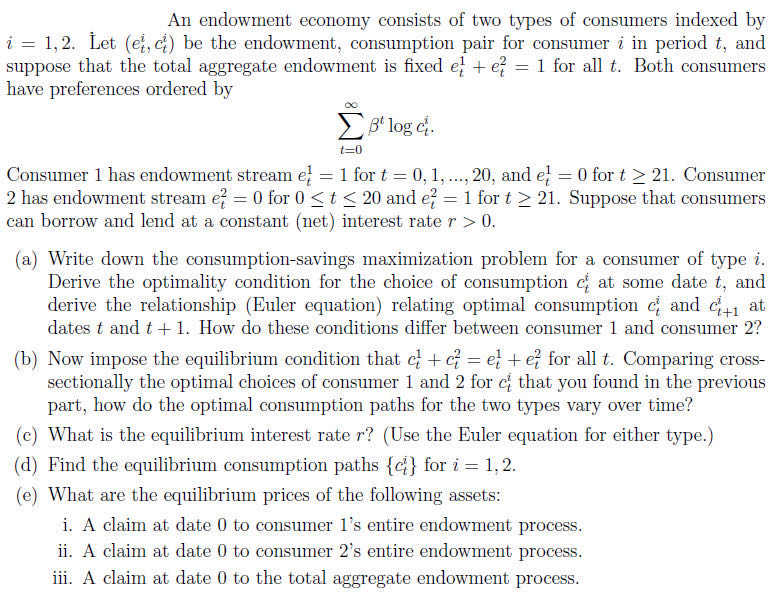

An endowment economy consists of two types of consumers indexed by i = 1.2. Let [cg-1.9:) be the endowment, consumption pair for consumer i in period t1 and suppose that the total aggregate endowment is xed oi + e? : 1 for all t. Both consumers have preferences ordered by Zen-age: H Consumer 1 has endowment stream a} = 1 for t = ii1 1, .... 2i], and ei = IE1 for t :3 21. Consumer 2 has endowment stream e? = [1 for I] 5 t g 2!} and e? = 1 for t E 21. Suppose that consumers can borrow and lend at a constant (net) interest rate r :2:- ID. (a) Write down the consumptionsavings maximization problem for a consumer of type i. Derive the optimality condition for the choice of consumption c: at some date t, and derive the relationship {Euler equation) relating optimal consumption c: and c: +1 at dates t and i + 1. How do these conditions differ between consumer 1 and consumer 2? [13} Now impose the equilibrium condition that c} | cf 2 c} | e? for all t. Comparing cross sectionally the optimal choices of consumer 1 and 2 for c: that you found in the previous part, how do the optimal consumption paths for the two types vary over time? (c) What is the equilibrium interest rate r? (Use the Euler equation for either type.) (d) Find the equilibrium consumption paths {c2} for i = 1, 2. (e) 1F:Flurhat are the equilibrium prices of the following assets: i. A claim at date [1 to consumer 17s entire endowment process. ii. A claim at date [I to consumer as entire endowment process. iii. A claim at date [1 to the total aggregate endowment process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts