Question: I need help with the required for this question, thanks in advance! AP 1-5 Residency after Departure from Canada Mr. Valmont has been employed on

I need help with the required for this question, thanks in advance!

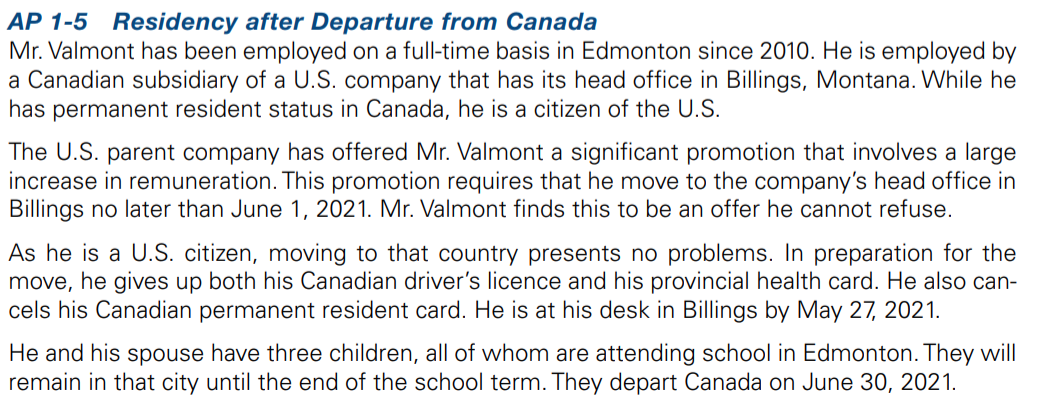

AP 1-5 Residency after Departure from Canada Mr. Valmont has been employed on a full-time basis in Edmonton since 2010. He is employed by a Canadian subsidiary of a U.S. company that has its head office in Billings, Montana. While he has permanent resident status in Canada, he is a citizen of the U.S. The U.S. parent company has offered Mr. Valmont a significant promotion that involves a large increase in remuneration. This promotion requires that he move to the company's head office in Billings no later than June 1, 2021. Mr. Valmont finds this to be an offer he cannot refuse. As he is a U.S. citizen, moving to that country presents no problems. In preparation for the move, he gives up both his Canadian driver's licence and his provincial health card. He also can- cels his Canadian permanent resident card. He is at his desk in Billings by May 27, 2021. He and his spouse have three children, all of whom are attending school in Edmonton. They will remain in that city until the end of the school term. They depart Canada on June 30, 2021. Mr. Valmont and his spouse have canceled all of their club memberships and closed their bank- ing accounts. While they have listed their residence with an Edmonton real estate agent, it remains on the market at December 31, 2021. The real estate agent has indicated that, given the unique nature of the property, it could take up to a year to find a buyer. Required: For purposes of assessing Canadian income taxes, determine when Mr. Valmont ceased to be a Canadian resident and the portion of his annual income that would be assessed for Canadian taxes. Explain your conclusions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts