Question: I need help with the second question (2nd picture posted) - Thank you Fun Sports makes downhill ski equipment. Assume that Atomic has offered to

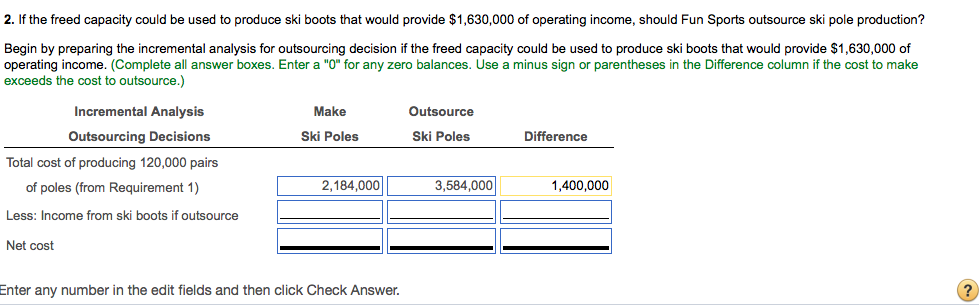

I need help with the second question (2nd picture posted) - Thank you

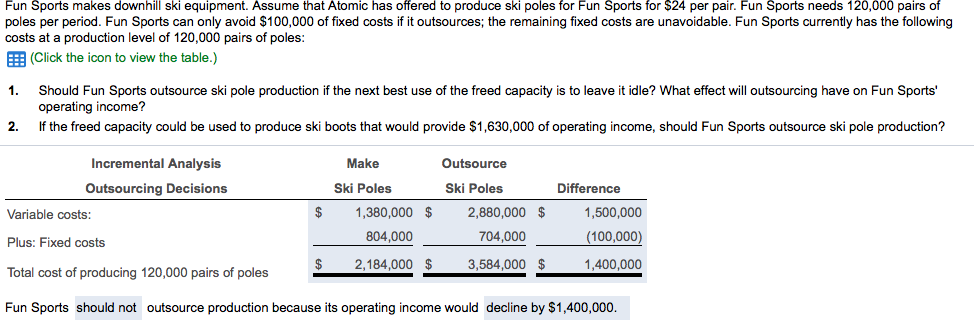

Fun Sports makes downhill ski equipment. Assume that Atomic has offered to produce ski poles for Fun Sports for $24 per pair. Fun Sports needs 120,000 pairs of poles per period. Fun Sports can only avoid $100,000 of fixed costs if it outsources; the remaining fixed costs are unavoidable. Fun Sports currently has the following costs at a production level of 120,000 pairs of poles EEB (Click the icon to view the table.) 1. Should Fun Sports outsource ski pole production if the next best use of the freed capacity is to leave it idle? What effect will outsourcing have on Fun Sports' operating income? If the freed capacity could be used to produce ski boots that would provide $1,630,000 of operating income, should Fun Sports outsource ski pole production? 2. Incremental Analysi Make Outsource Outsourcing Decisions Ski Poles Ski Poles Difference $1,380,000 2,880,000 $ Variable costs Plus: Fixed costs Total cost of producing 120,000 pairs of poles Fun Sports should not outsource production because its operating income would decline by $1,400,000 1,500,000 100,000 1,400,000 804,000 704,000 $2,184,000 3,584,000$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts