Question: I need help with the Spreadsheet Exercise question. Problems 2-1 2-2 Assume an investor in the 15 percent tax bracket. What taxable equivalent yield must

I need help with the "Spreadsheet Exercise" question.

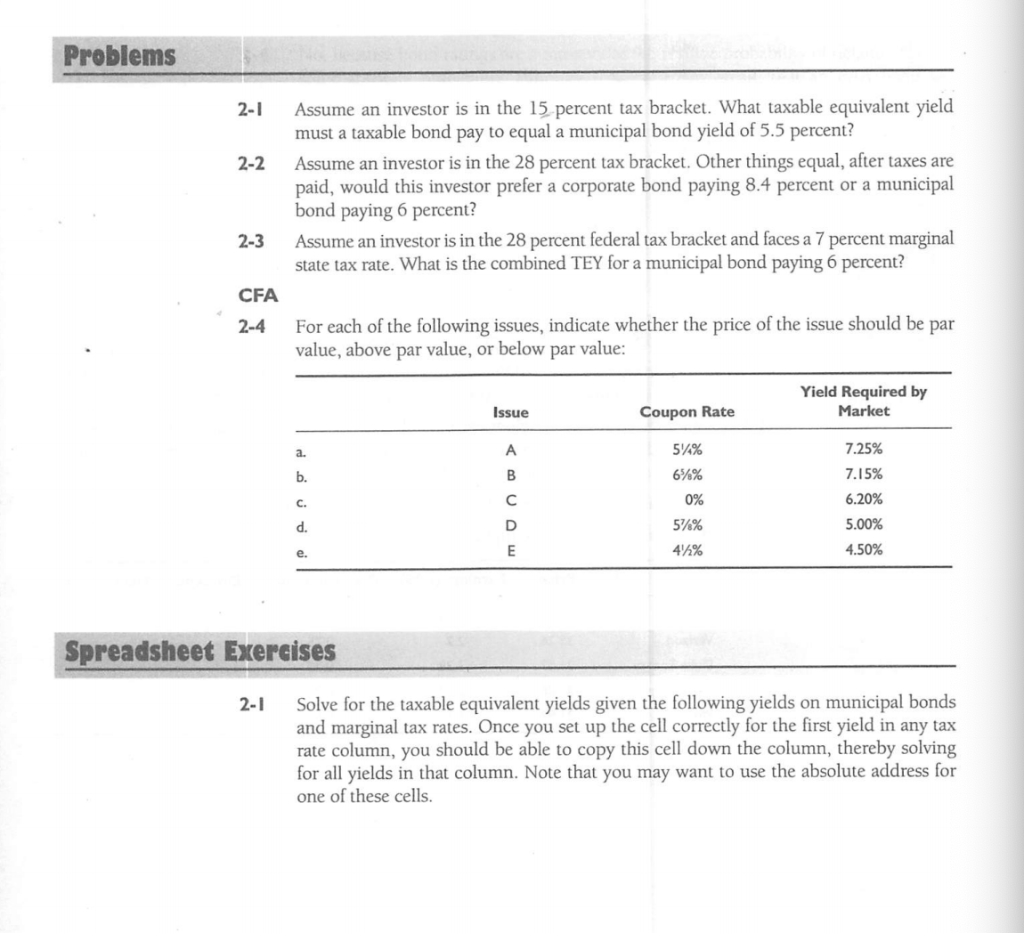

Problems 2-1 2-2 Assume an investor in the 15 percent tax bracket. What taxable equivalent yield must a taxable bond pay to equal a municipal bond yield of 5.5 percent? Assume an investor is in the 28 percent tax bracket. Other things equal, after taxes are paid, would this investor prefer a corporate bond paying 8.4 percent or a municipal bond paying 6 percent? Assume an investor is in the 28 percent federal tax bracket and faces a 7 percent marginal state tax rate. What is the combined TEY for a municipal bond paying 6 percent? 2-3 CFA 2-4 For each of the following issues, indicate whether the price of the issue should be par value, above par value, or below par value: Yield Required by Market Issue Coupon Rate a. A 5/% 6%% b. B 7.25% 7.15% 6.20% c. 0% d. D 5%% 5.00% 4.50% e. E 47% Spreadsheet Exercises 2-1 Solve for the taxable equivalent yields given the following yields on municipal bonds and marginal tax rates. Once you set up the cell correctly for the first yield in any tax rate column, you should be able to copy this cell down the column, thereby solving for all yields in that column. Note that you may want to use the absolute address for one of these cells. Problems 2-1 2-2 Assume an investor in the 15 percent tax bracket. What taxable equivalent yield must a taxable bond pay to equal a municipal bond yield of 5.5 percent? Assume an investor is in the 28 percent tax bracket. Other things equal, after taxes are paid, would this investor prefer a corporate bond paying 8.4 percent or a municipal bond paying 6 percent? Assume an investor is in the 28 percent federal tax bracket and faces a 7 percent marginal state tax rate. What is the combined TEY for a municipal bond paying 6 percent? 2-3 CFA 2-4 For each of the following issues, indicate whether the price of the issue should be par value, above par value, or below par value: Yield Required by Market Issue Coupon Rate a. A 5/% 6%% b. B 7.25% 7.15% 6.20% c. 0% d. D 5%% 5.00% 4.50% e. E 47% Spreadsheet Exercises 2-1 Solve for the taxable equivalent yields given the following yields on municipal bonds and marginal tax rates. Once you set up the cell correctly for the first yield in any tax rate column, you should be able to copy this cell down the column, thereby solving for all yields in that column. Note that you may want to use the absolute address for one of these cells

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts