Question: I need help with the time weighted return and leverage question Year 2021 2020 2019 2018 2017 2016 2015 Closing Price 37.54 23.68 28.98 32.15

I need help with the time weighted return and leverage question

I need help with the time weighted return and leverage question

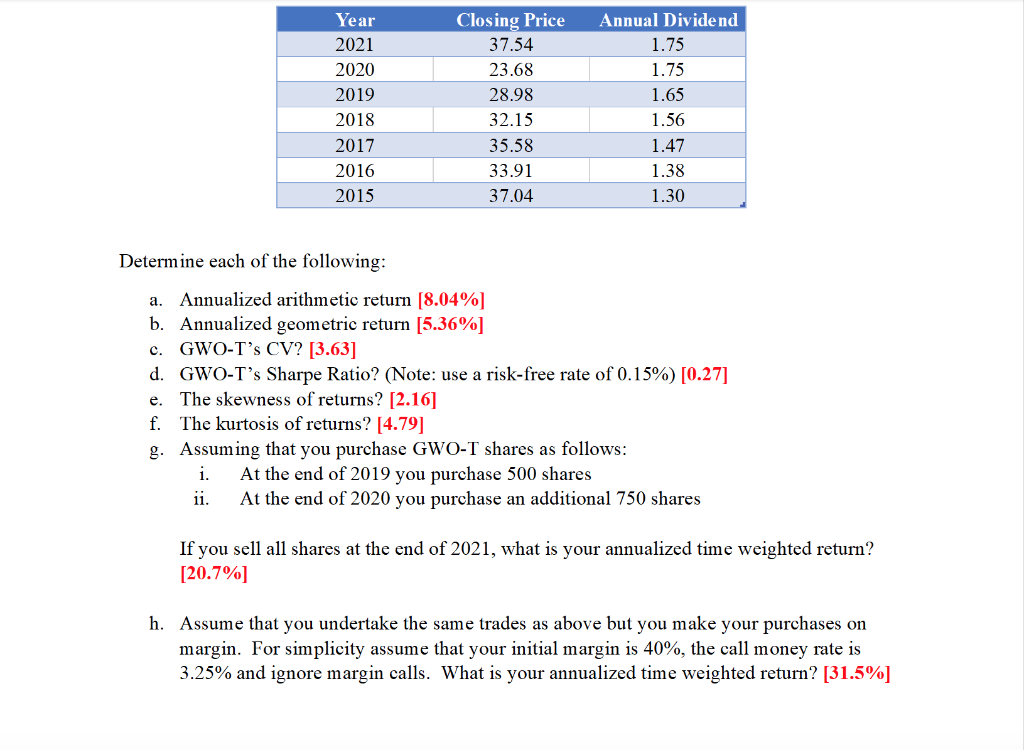

Year 2021 2020 2019 2018 2017 2016 2015 Closing Price 37.54 23.68 28.98 32.15 35.58 33.91 37.04 Annual Dividend 1.75 1.75 1.65 1.56 1.47 1.38 1.30 Determine each of the following: a. Annualized arithmetic return (8.04%] b. Annualized geometric return [5.36%] c. GWO-T's CV? [3.63] d. GWO-T's Sharpe Ratio? (Note: use a risk-free rate of 0.15%) [0.27] e. The skewness of returns? [2.16] f. The kurtosis of returns? [4.79] g. Assuming that you purchase GWO-T shares as follows: i. At the end of 2019 you purchase 500 shares ii. At the end of 2020 you purchase an additional 750 shares If you sell all shares at the end of 2021, what is your annualized time weighted return? [20.7%) h. Assume that you undertake the same trades as above but you make your purchases on margin. For simplicity assume that your initial margin is 40%, the call money rate is 3.25% and ignore margin calls. What is your annualized time weighted return? [31.5%] Year 2021 2020 2019 2018 2017 2016 2015 Closing Price 37.54 23.68 28.98 32.15 35.58 33.91 37.04 Annual Dividend 1.75 1.75 1.65 1.56 1.47 1.38 1.30 Determine each of the following: a. Annualized arithmetic return (8.04%] b. Annualized geometric return [5.36%] c. GWO-T's CV? [3.63] d. GWO-T's Sharpe Ratio? (Note: use a risk-free rate of 0.15%) [0.27] e. The skewness of returns? [2.16] f. The kurtosis of returns? [4.79] g. Assuming that you purchase GWO-T shares as follows: i. At the end of 2019 you purchase 500 shares ii. At the end of 2020 you purchase an additional 750 shares If you sell all shares at the end of 2021, what is your annualized time weighted return? [20.7%) h. Assume that you undertake the same trades as above but you make your purchases on margin. For simplicity assume that your initial margin is 40%, the call money rate is 3.25% and ignore margin calls. What is your annualized time weighted return? [31.5%]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts