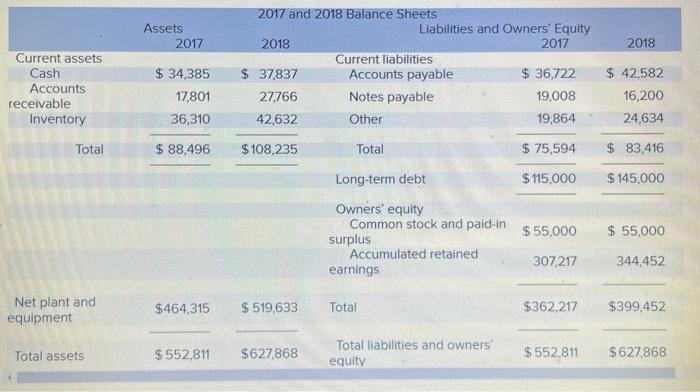

Question: i need help with the total asset turnover Assets 2017 2018 Current assets Cash Accounts receivable Inventory $ 34,385 17,801 36,310 2017 and 2018 Balance

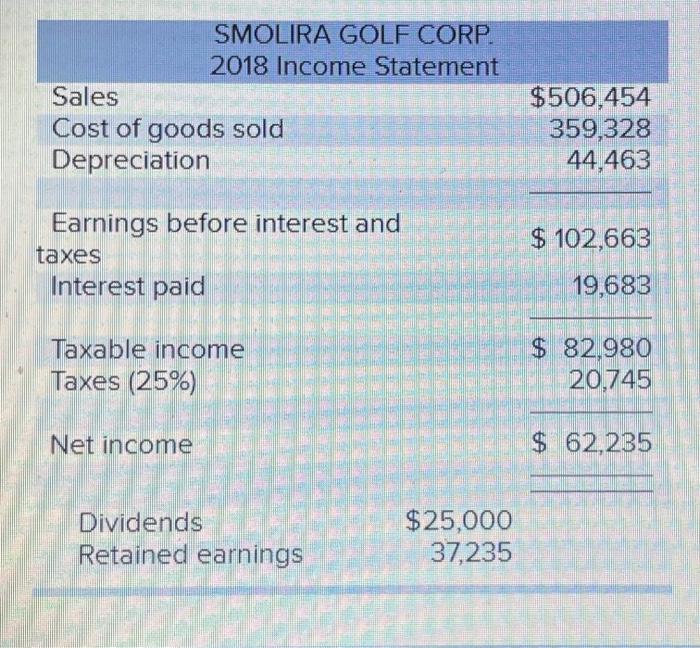

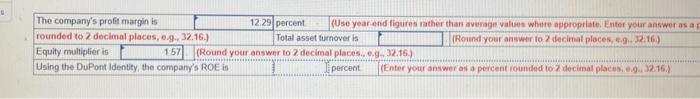

Assets 2017 2018 Current assets Cash Accounts receivable Inventory $ 34,385 17,801 36,310 2017 and 2018 Balance Sheets Liabilities and Owners' Equity 2018 2017 Current liabilities $ 37,837 Accounts payable $ 36,722 27766 Notes payable 19,008 42,632 Other 19,864 $ 42,582 16,200 24,634 Total $ 88,496 $ 108,235 Total $ 75,594 $ 83,416 Long-term debt $ 115,000 $ 145,000 Owners' equity Common stock and paid-in surplus Accumulated retained earnings $ 55,000 $ 55,00 307,217 344,452 Net plant and equipment $464,315 $ 519,633 Total $362.217 $399,452 Total assets $.552,811 $627,868 Total liabilities and owners equity $552,811 $627,868 SMOLIRA GOLF CORP. 2018 Income Statement Sales Cost of goods sold Depreciation $506,454 359,328 44,463 $ 102,663 Earnings before interest and taxes Interest paid 19,683 Taxable income Taxes (25%) $ 82,980 20,745 Net income $ 62,285 Dividends Retained earnings $25,000 37,235 The company's profit marginis 12.29 percent (Use year and figures rather than age values where appropriate Enter your answer as a rounded to 2 decimal places, .g. 32.16.) Total asset turnover is Round your answer to 2 decimal places ... 32.16.) Equity multiplier is 157 (Round your answer to 2 decimal places... 3216.) Using the DuPont identity, the company's ROE is I percent (Enter your answer as a percent rounded to 2 decimal places....12.16)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts