Question: I need help with the whole problem with an Explanation and Solution Please Chapter 24-Homework Saved Help Save & Exit Submit Check my work Required

I need help with the whole problem with an Explanation and Solution Please

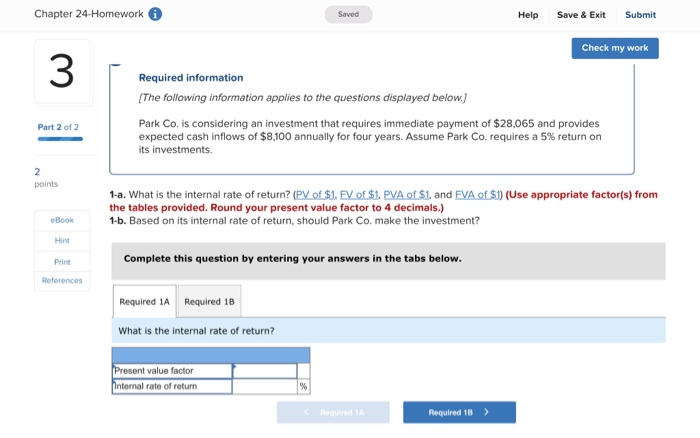

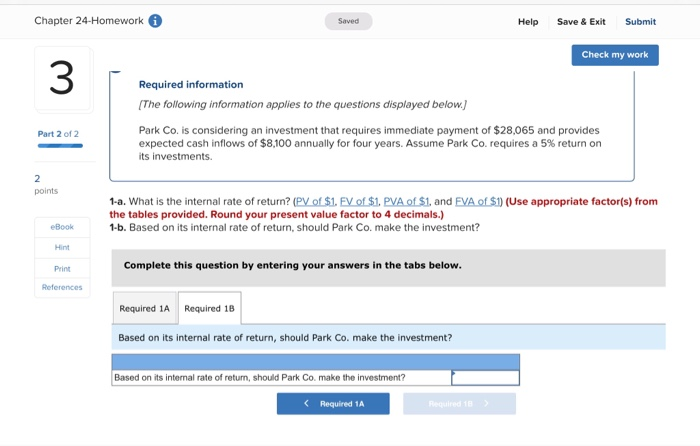

I need help with the whole problem with an Explanation and Solution PleaseChapter 24-Homework Saved Help Save & Exit Submit Check my work Required information (The following information applies to the questions displayed below. Part 2 of 2 Park Co. is considering an investment that requires immediate payment of $28,065 and provides expected cash inflows of $8,100 annually for four years. Assume Park Co. requires a 5% return on its investments. points 1-a. What is the internal rate of return? (PV of $1. FV of $1. PVA of $1, and FVA of $1 (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) 1-b. Based on its internal rate of return, should Park Co. make the investment? eBook Hint Print Complete this question by entering your answers in the tabs below. References Required 1A Required 18 What is the internal rate of return? Present value factor Internal rate of return Required 10 > Chapter 24-Homework i Saved Help Save & Exit Submit Check my work Required information (The following information applies to the questions displayed below.) Part 2 of 2 Park Co. is considering an investment that requires immediate payment of $28,065 and provides expected cash inflows of $8,100 annually for four years. Assume Park Co. requires a 5% return on its investments points 1-a. What is the internal rate of return? (PV of $1. FV of $1. PVA of $1, and FVA of $1 (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) 1-b. Based on its internal rate of return, should Park Co. make the investment? eBook Hint Print Complete this question by entering your answers in the tabs below. References Required 1A Required 1B Based on its internal rate of return, should Park Co. make the investment? Based on its internal rate of return, should Park Co. make the investment?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts