Question: I need help with these 2 questions. I will give a thumbs up if both are answered. Please help 24 A share of Microsoft common

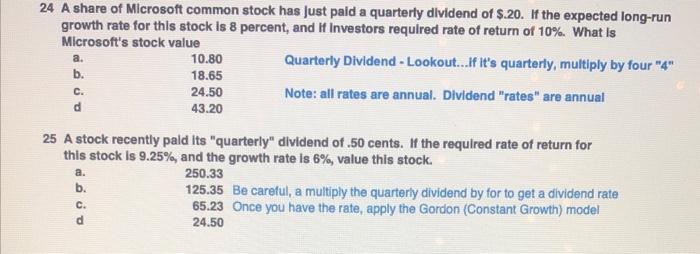

24 A share of Microsoft common stock has just paid a quarterly dividend of $.20. If the expected long-run growth rate for this stock is 8 percent, and if Investors required rate of return of 10%. What is Microsoft's stock value Quarterly Dividend - Lookout...If it's quarterly, multiply by four "4" Note: all rates are annual. Dividend "rates" are annual a. b. C. d 25 A stock recently paid its "quarterly" dividend of .50 cents. If the required rate of return for this stock is 9.25%, and the growth rate is 6%, value this stock. a. b. 10.80 18.65 24.50 43.20 C. d 250.33 125.35 Be careful, a multiply the quarterly dividend by for to get a dividend rate 65.23 Once you have the rate, apply the Gordon (Constant Growth) model 24.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts