Question: I need help with these last 4 questions 17. Common stock of PR Co. has an expected return of 12%. The expected market return is

I need help with these last 4 questions

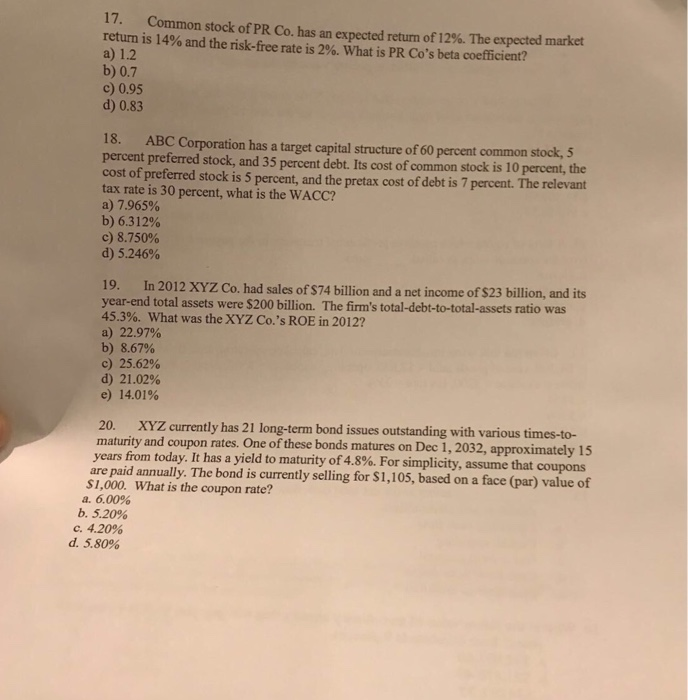

17. Common stock of PR Co. has an expected return of 12%. The expected market return is 14% and the risk-free rate is 290, what is PR Co's beta coefficient? a) 1.2 b) 0.7 c) 0.95 d) 0.83 18. ABC Corporation has a target capital structure of 60 percent common st percent preferred stock, and 35 percent debt. Its cost of common stock is 10 percent, the cost of prefered stock is 5 percent, and the pretax cost of debt is 7 percent. The relevant tax rate is 30 percent, what is the WACC? a) 7.965% b) 631 2% c) 8.750% d) 5.246% ock, 5 19. In 2012 XYZ Co. had sales of s74 billion and a net income of S23 billion, and its year-end total assets were $200 billion. The firm's total-debt-to-total-assets ratio was 45.3%. What was the XYZ Co.'s ROE in 2012? a) 22.97% b) 8.67% c) 25.62% d) 21.02% e) 14.01% 20. XYZ currently has 21 long-term bond issues outstanding with various tim maturity and coupon rates. One of these bonds matures on Dec 1, 2032, approximately 15 years from today. It has a yield to maturity of48%. For simplicity, assume that coupons are paid annually. The bond is currently selling for $1,105, based on a face (par) value of $1,000. What is the coupon rate? a. 6.00% b. 5.20% c. 4.20% d. 5.80%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts