Question: I need help with these problems I. Mirana purchased 50 shares of Gold Corporation for $500. During the current year, Gold declared a nontaxable 10%

I need help with these problems

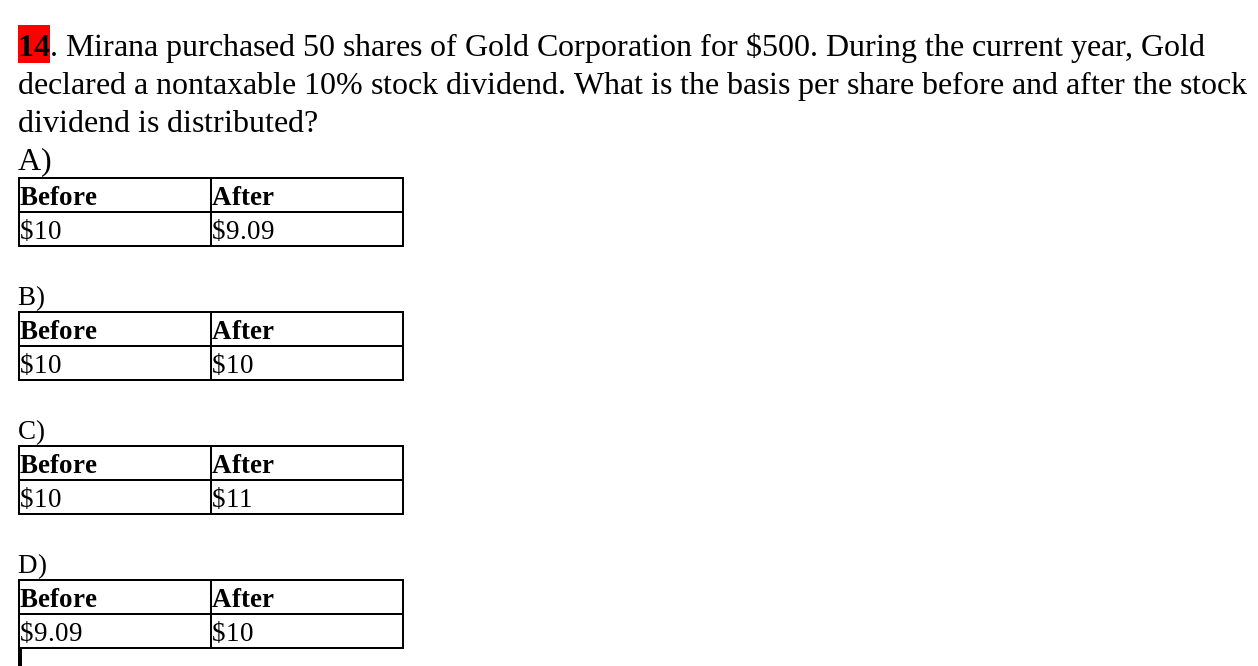

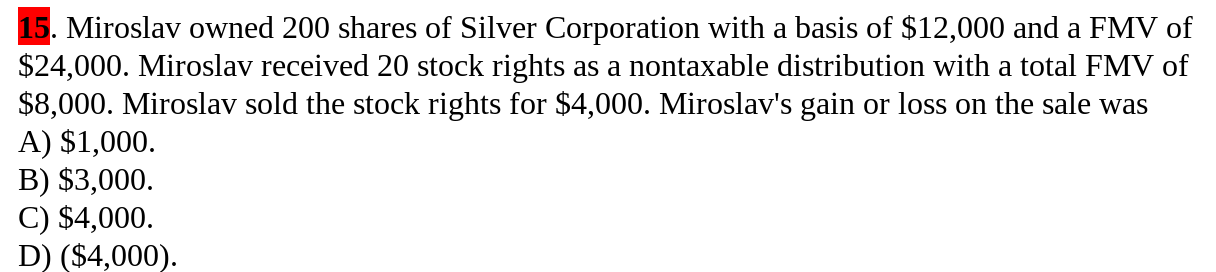

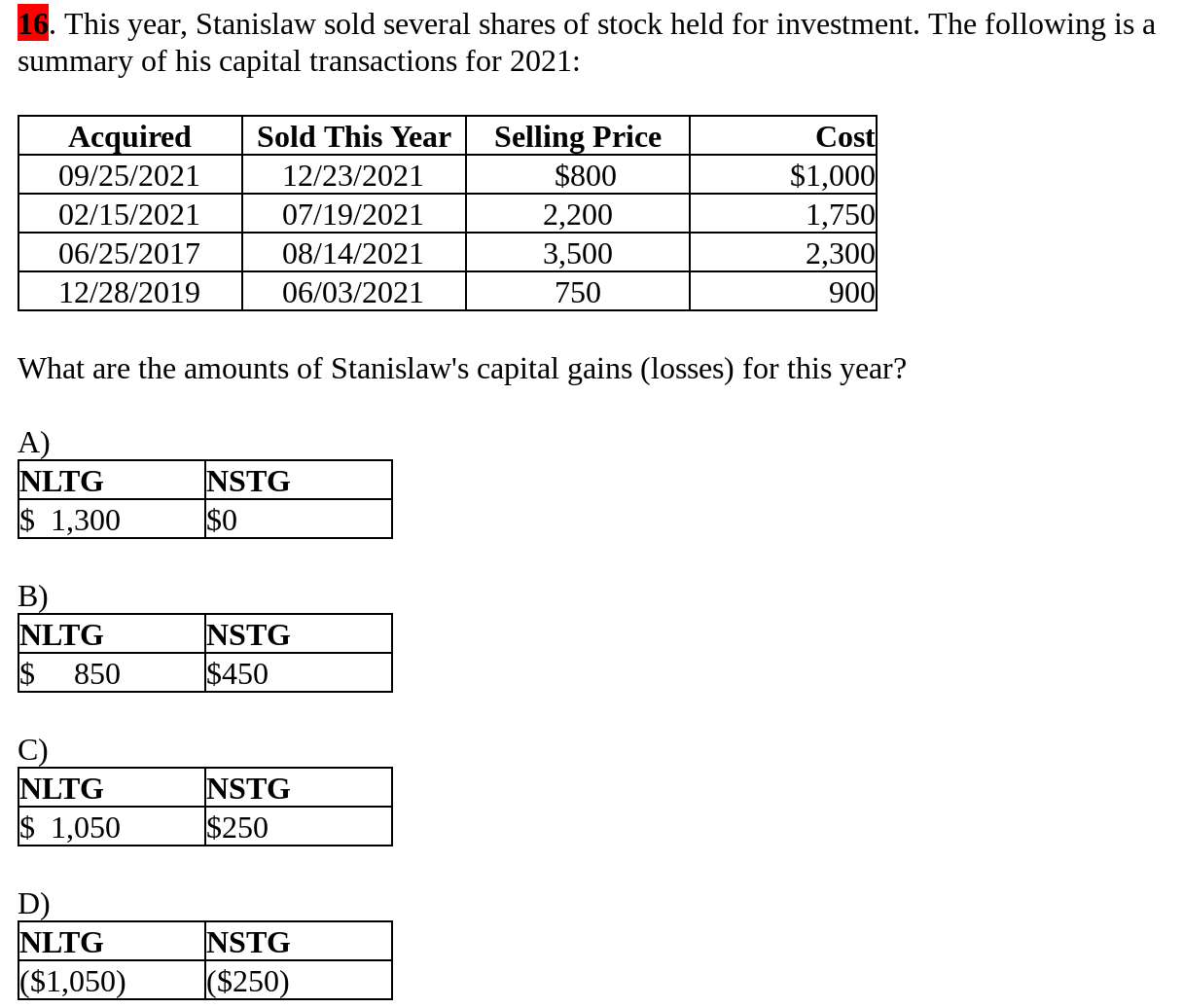

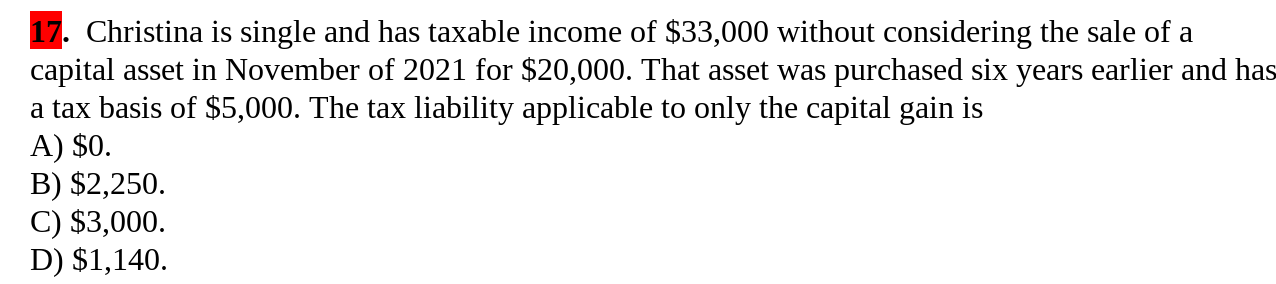

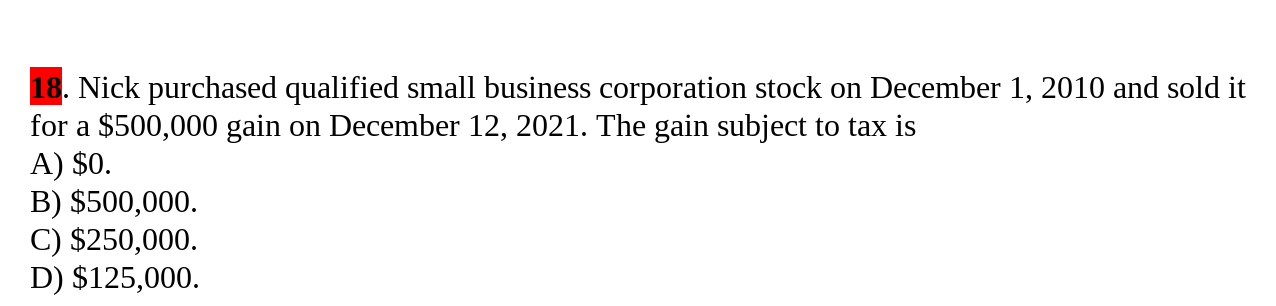

I. Mirana purchased 50 shares of Gold Corporation for $500. During the current year, Gold declared a nontaxable 10% stock dividend. What is the basis per share before and after the stock dividend is distributed? A In_ 15. Miroslav owned 200 shares of Silver Corporation with a basis of $12,000 and a FMV of $24,000. Miroslav received 20 stock rights as a nontaxable distribution with a total FMV of $8,000. Miroslav sold the stock rights for $4,000. Miroslav's gain or loss on the sale was A) $1,000. B) $3,000. C) $4,000. D) ($4,000).I. This year, Stanislaw sold several shares of stock held for investment. The following is a summary of his capital transactions for 2021: Sold This Year M- 09/25/2021 12/23/2021 $800 $1, 000 02/15/2021 07/19/2021 2,200 06/25/2017 08/14/2021 3,500 2,300 12/28/2019 06/03/2021-m What are the amounts of Stanislaw's capital gains (losses) for this year? C $ 1,050 $250 I. Christina is single and has taxable income of $33,000 without considering the sale of a capital asset in November of 2021 for $20,000. That asset was purchased six years earlier and has a tax basis of $5,000. The tax liability applicable to only the capital gain is A) $0. B) $2,250. C) $3,000. D) $1,140. I. Nick purchased qualified small business corporation stock on December 1, 2010 and sold it for a $500,000 gain on December 12, 2021. The gain subject to taxis A) $0. B) $500,000. C) $250,000. D) $125,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts